Written by

Cranfield, UK, August 2023 – It’s safe to say that Philips has had a rough ride in recent years, following the recall of several solutions within its Respiratory and Sleep business. Not only did the company lose share within a market it was most dominant, but it also faced significant remuneration to remedy the situation. However, Philips isn’t alone in facing pressure to guarantee the safety of the ventilators manufactured, with many vendors also seeing product recalls in recent years. In this insight, Signify Research assesses the changing dynamics in the competitive environment within the Ventilator market.

Philips continues to feel the heat

Philips announced the recall notification/field safety notice of several of its Philips Respironics sleep and respiratory care products on June 14, 2021. The recall was issued due to possible risks to users related to the polyester-based polyurethane (PE-PUR) sound abatement foam used in specific CPAP, BiPAP and ventilator devices. Following the notice, Philips has invested heavily to remediate the affected devices. It has since provided a complete set of laboratory results for the CPAP/BiPAP sleep therapy devices under the recall. However, it is continuing to assess its ventilator solutions that were also affected. Despite the Trilogy ventilator passing its VOC testing (ISO 18562-3), it failed on the ISO 10993 genotoxicity testing under laboratory conditions. In its most recent financials, Philips stated that the restructuring and remediation costs affecting their Connected Care segment accounted for EUR 95 million in Q2 2023. Philips has noted that it will be ‚ÄòTaking the learnings of Respironics recall to raise patient safety and quality to the highest standards across Philips.’ This is a clear sign it understands the implication the recall has had on its brand reputation. It is subsequently taking significant efforts to remedy the situation, and improve its research and development activities to improve safety across all of its solutions.

Philips is not alone in the recall saga

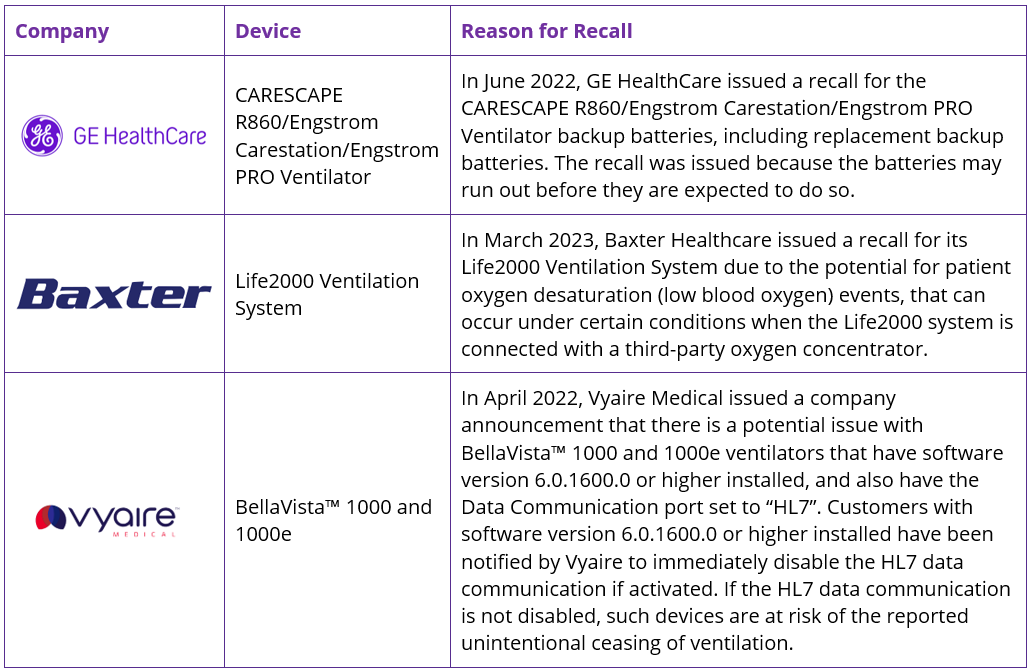

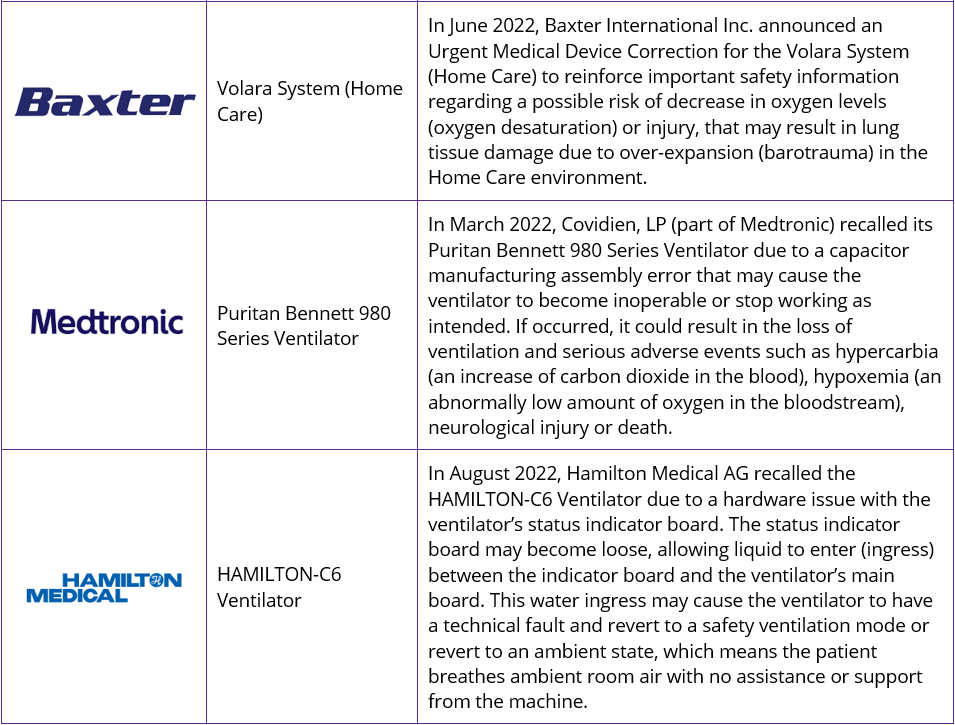

With patient safety of top priority, the need to ensure products are of the highest quality is paramount. Ventilators offer life-saving treatment and can not afford to be of sub-standard quality. The growing use of digital solutions also brings with it additional risk factors, with software solutions now also facing increasing stringent regulations. Alongside Philips, several of the leading ventilator companies have also seen product recalls in recent years, with battery issues, oxygen desaturation, in addition to software and hardware issues being the cause. Some recent recalls include:

How has the Ventilator market shaped up?

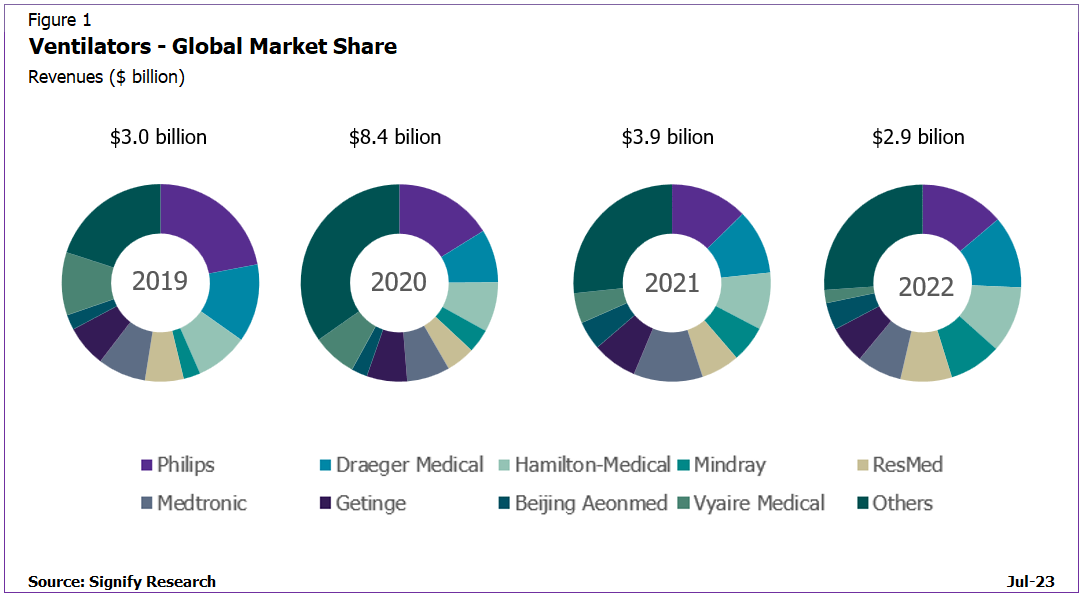

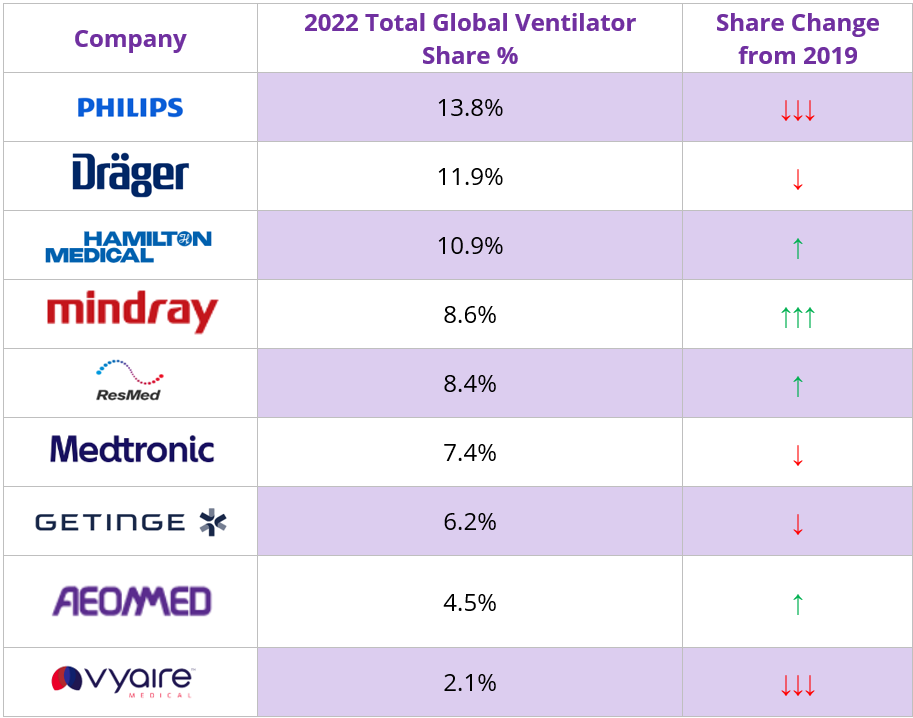

Signify Research recently updated its market analysis on the ventilator market and assessed the market share of the leading vendors across the ventilator product segments. Despite the recalls, the dominance of the ventilator manufacturers has remained relatively steady over the last two years, with a few product-specific variations to Signify’s 2021 report edition. However, changes in vendor market share from pre-pandemic levels have been a little more significant as illustrated below.

Philips remained the global market leader for ventilators in 2022, with greatest share on a regional perspective in North America. Despite the recalls it faced, Philips gained share of the overall ventilator market in 2022 due to its dominance in the faster growing Home Care ventilator market, despite losing share in the specific markets it is active within, and in contrast to the trend since 2019. Draeger was ranked second overall in 2022; it was ranked second in the High-End Critical Care and first in the Neonatal ventilator markets. Hamilton Medical continues to lead the EEMEA and Mature Asia Pacific regions, enabling it to be ranked third overall on a global basis. It regained its leading position of the Transport & Emergency Care ventilator market in 2022. Mindray was ranked fourth in 2022; its largest market shares were in the Emerging Asia Pacific and EEMEA regions. The vendor has a comprehensive portfolio across the clinical care market mainly offering lower price point solutions.

What does the future hold?

With increasing focus on regulations to support the improvement in patient safety and subsequent care provision, recalls are unlikely to fade. The FDA isn’t the only regulatory authority that is cracking down on manufacturers to ensure optimum quality of healthcare devices. The movement from European Medical Devices Directive (MDD) (93/42/EEC) to the Medical Devices Regulation (MDR) ((EU) 2017/745) occurred in May 2021. The MDR applies to all manufacturers that sell medical devices to countries within the European Union. The strict regulatory controls have resulted in additional technical information that will be required to support the launch of new products. Additional resource will also be required to ensure devices are monitored throughout their lifetime. Although the aim is to improve the standard of care provided, it is also expected it will stifle newer entrants or smaller vendors that are unable to keep up with the ongoing surveillance costs. As such, the medical device markets will remain dominated by those vendors that can afford to invest in the necessary R&D and supporting regulatory processes.

As for the likes of Philips, it has previously done a stellar job at focusing on educating and training its installed base, with many of its clients true to their brand. The industry recognises the efforts that they have made historically to ensure their users are maximising their solutions to their full capabilities. Over the last two decades Philips has increased interest in non-invasive ventilation through additional support and training, in addition to technological developments to both devices and associated non-invasive masks, to improve patient compliance and outcomes. That said, it needs to continue to prove itself as a reliable vendor that has learnt from its mistakes to ensure its mainstay in the market. Many new vendors have entered the stand-alone non-invasive ventilator market, trying to compete for a piece of the increasing pie. A segment that Philips was historically most dominant within. However, the industry is expected to keep a beaded eye on the newer solutions from Getinge, Nihon Kohden, Mindray and Draeger as they maximise on Philips current shortfall.

Related Research

Signify Research has recently published its “Ventilators – World – 2023” report, which builds on our 2021 edition of the report. The report provides a data-centric and global outlook of the market. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors to provide a balanced and objective view of the market.

About Kelly Patrick

Kelly joined Signify Research in 2020 as a Principal Analyst. She has over 15 years’ experience covering a range of healthcare technology research at IHS Markit/Omdia. Kelly’s core focus has been on the clinical care sector, including patient monitoring, diagnostic cardiology, respiratory care, and infusion and associated IT solutions. Kelly holds a BSc degree with honours in Pharmacology from the University of Leeds.

About the Clinical Care Team

The clinical care team provides market intelligence and detailed insights on the clinical care equipment and IT markets. Our areas of coverage include patient monitoring, diagnostic cardiology, infusion pumps, ventilators, anaesthesia and high-acuity IT. Our reports provide a data-centric and global outlook of each market with granular country-level insights. Our research process blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net