Written by

- The last two weeks have seen two key announcements relating to major telehealth platform vendors making a push into the direct-to-consumer market.

- On January 5th, InTouch Health announced that it had entered into an agreement to acquire TruClinic, an on-demand telehealth platform supplier.

- On January 8th, Philips signed a strategic partnership with American Well to support both companies’ initiatives to deliver virtual care solutions around the world.

- For both InTouch Health and Philips it marked a strategic shift towards adding to their already established enterprise telehealth businesses with a more aggressive focus on the direct-to-consumer market.

- However, the drivers and strategies for both are quite different. Here’s the Signify View on both developments.

InTouch Health – a jump into direct-to-consumer or just a step?

InTouch Health has historically supplied telehealth hardware and platforms primarily aimed at US enterprise settings and over recent years it has established itself as a leading vendor in this sector. It has done this by expanding its business both by investing heavily in its platform offering, as it attempts to scale its software business over hardware, and broadening the range of care settings it serves (e.g. community settings, acute settings and post-acute settings). Via the acquisition of telehealth service providers C30 Medical Corporation and AcuteCare Telemedicine (ACT), 2017 saw InTouch Health further expand its capabilities to include physician support services.

However, historically it has not been a significant player in the direct-to-consumer telehealth market, a segment serviced extensively by companies such as Teladoc, American Well and DoctorOnDemand. The TruClinic acquisition broadens InTouch Health’s offering. TruClinic had developed a platform aimed primarily at clinics, and more recently enterprise-scale networks, that could be used for provider-patient telehealth video consultations (and to a lesser extent provider-provider video consultations).

The alignment between the two companies in terms of the platform approach and the acuity levels they address (TruClinic addressing only slightly lower acuity levels, with some cross over) makes the acquisition a logical move for InTouch Health and positions it well to address the direct-to-consumer market. However, TruClinic is a relatively small player in this sector (estimated revenues of between $5 and $10 million in 2017) and so it initially won’t drive a particularly large change in overall revenues for InTouch Health. However, as mentioned earlier, InTouch Health is strategically pushing to increase the share of its business driven by platforms and all of TruClinic’s business is driven by its platform and associated support services, so the acquisition will support the overall strategic direction of InTouch Health.

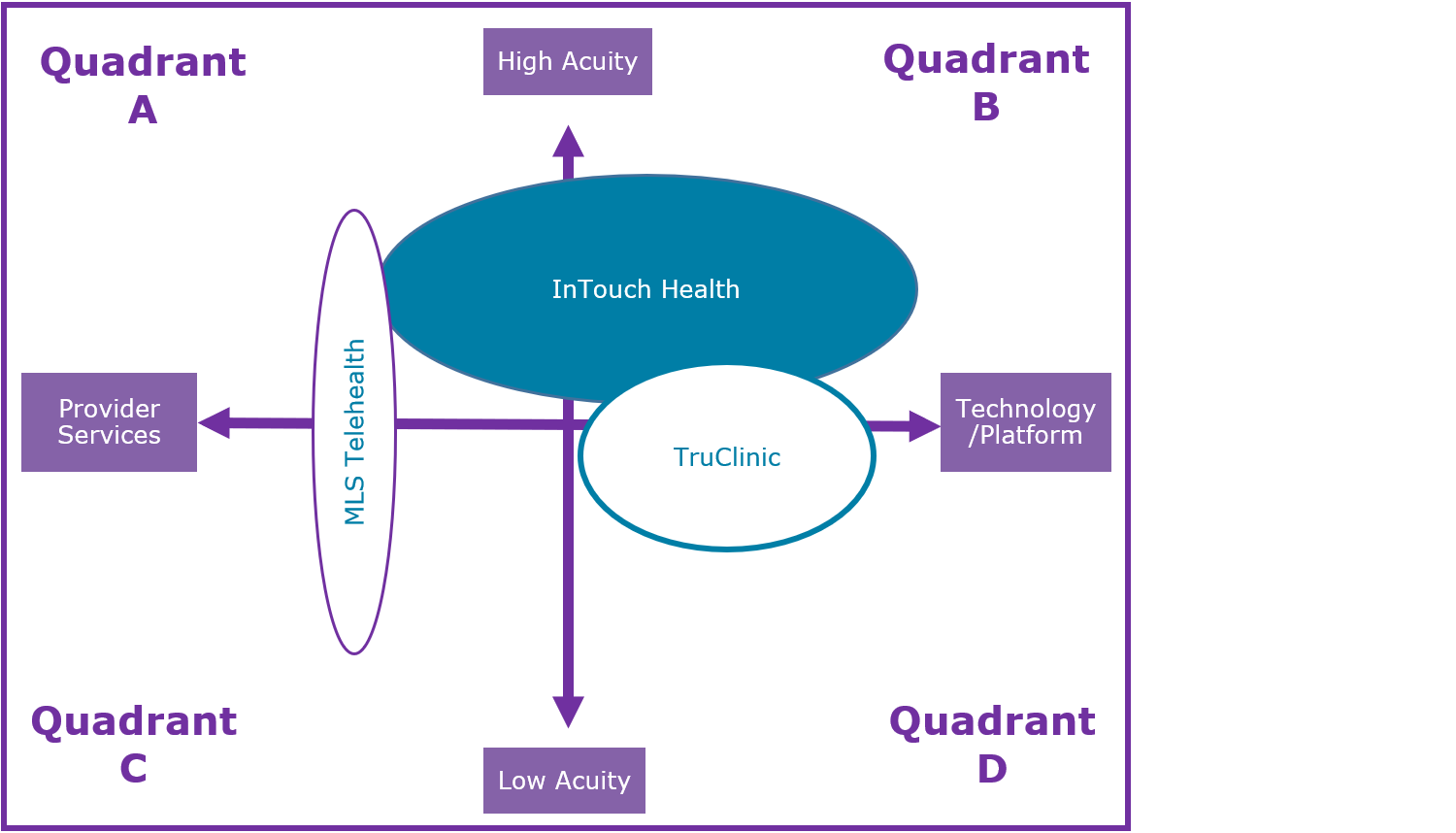

The diagram below shows pre-acquisition where InTouch Health and TruClinic sat in terms of the range and types of services that are offered to the telehealth market. The diagram segments the market into:

Quadrant A – High-acuity service provision

Quadrant B – High-acuity technology provision

Quadrant C – Low-acuity service provision

Quadrant D – Low-acuity technology provision

InTouch Health was very much focused on high-acuity technology provision (Quadrant B). Its 2017 acquisitions allowed it to also address high-acuity service provision (Quadrant A). The acquisition of TruClinic means that it will now also address lower acuity markets in terms of its technology. TruClinic had also historically partnered with MLS Telehealth to support its customers with physician support services. It’s not yet clear whether this relationship will continue. Despite InTouch Health having this capability internally, maintaining a relationship MLS Telehealth will support the company when addressing specific clinical needs and varying capacity demands. And despite it increasingly bringing physician support services in-house, InTouch Health has continued to use external services where needed. Therefore, it is expected that the relationship will continue.

Philips and American Well strategic partnership

The partnership between Philips and American Well bears a number of similarities to the InTouch Health and TruClinic acquisition, although both companies operate at a higher level in terms of scale. Philips has a strong enterprise-level telehealth business supporting telehealth provision in areas such as tele-ICU, provider-to-provider video conferencing, surgical/medical support and remote patient monitoring. American Well provides both a platform for providers to develop their own direct-to-patient telehealth services and, through AmWell, it also offers physician support services directly to consumers. Its partnership with Samsung also means that its apps are pre-installed on all Samsung Android smartphones sold in the US.

For Philips the partnership allows the company to take advantage of the well established American Well brand, the distribution of the American Well app and underlying technology, and its uptake within the US consumer telehealth market. Initially Philips will be using this to support the deployment of its uGrow parenting app, but it’s expected to leverage the relationship across a broader range of products and services relatively quickly. Philips will also have access to the American Well Exchange. This is a platform operated by American Well that allows payers, providers and in the case of Philips, technology providers, to exchange services with each other.

The overwhelming majority of American Well’s business is in North America. Philips’ telehealth business, while dominated by North America, is much more international in composition. American Well had started to look internationally to develop its business, setting up an office in Tel Aviv and ensuring its platform supports services in a multitude of languages; it is expected that it will use its new relationship with Philips to further support its international expansion.

The two companies do brush up against each other in terms of competition in a number of areas and it will be interesting to see how they work together (or otherwise) when this occurs. While American Well operates typically at lower acuity levels to Philips, its platform and services are used to some extent in higher acuity applications such as some ICU applications, care transition, emergency room and remote patient management applications. It’s still not clear how the partnership will operate when this occurs, although it has been stated that it will extend to the integration of American Well’s telehealth visit applications into Philips other clinical systems, and the Philips Healthsuite Digital Platform (HSDP) suggesting the partnership will go beyond consumer focused applications.

About the Report

The information presented in this insight sets the scene for Signify Research’s upcoming market report “Acute, Community and Home Telehealth“. This report will present the market for telehealth platforms, hardware and services and will include projections and market sizings for more than 20 countries.

The report is available as a stand-alone product, but it is also a component of Signify Research’s newly launched “Population Health Management and Telehealth Service”. This is a year-round service that provides ongoing data, insights, and analysis on the global population heath management and telehealth markets. The service includes four market reports delivered over a 12-month period, regular updates of key market metrics, competitive environment and market share analysis by product type and region and quarterly analyst briefings to each subscriber firm.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

To find out more:

E: Alex.Green@signifyresearch.net , T: +44 (0) 1234 436 150

www.signifyresearch.net