Written by

Cranfield, UK, 15th January 2024 – While the spotlight in 2023 shone on developments around Generative Artificial Intelligence (AI), away from the limelight a quiet revolution in AI was taking place, which promises to transform the way we diagnose, manage, and treat cardiovascular diseases, the world’s leading cause of death. Signify Research has just released a deep-dive qualitative analysis of developments around the use of AI to analyse and interpret electrocardiograms (ECGs), one of the world’s most ubiquitous diagnostic tests for cardiac disease.

Since 2017, a plethora of AI-based algorithms for interpreting ECGs have been approved by the FDA in the US, ranging from the detection and diagnosis of arrythmias, to more recent advances in the diagnoses of structural and ischemic diseases. A small yet thriving vendor landscape is emerging, forging productive links with academia, health systems, Life Science companies, and large MedTech players.

The cardiac field has also attracted the attention of venture capital (VC) funding, albeit to a lesser extent than the more developed field of AI in Medical Imaging. Inevitably, given its fledgling status, regulation and reimbursement is still playing catch-up, though 2023 saw some important developments in this regard.

An Overnight Sensation (a century in the making)

Efforts to measure the electrical activity of the heart had been well underway since the late 19th Century, though it was the Dutch physiologist Willem Einthoven, improving on these prior developments, who created what we recognise as the ECG. By 1909 ECGs were being used to diagnose cases of arrhythmia; by 1910 to diagnose indicators of a heart attack.

By the 1960s, advances in technology and medical research led to the emergence of automated ECG interpretation (AEI), based on physician-developed rules of classification. More advanced algorithms followed in the 1980s and 1990s, applying nascent machine learning techniques to large ECG datasets. Many of the algorithms developed at this time are still in use today.

Despite undoubted progress, ECG interpretation remains highly time-consuming and, particularly where non-specialists are involved, prone to inaccurate and inconsistent diagnoses. These existing challenges will be further exacerbated by ongoing demographic pressures, rising shortages of cardiologists, and a deluge of new ECG data from medical and non-medical grade consumer wearables.

Low Hanging Fruit

Where AI in Diagnostic Cardiology ECG has been adopted thus far, it has predominantly focused on the detection and diagnosis of arrythmias, particularly Atrial Fibrillation (AFib), the most prevalent form of arrythmia Given that the majority of AFib cases are paroxysmal or asymptomatic, using AI to detect arrythmias particularly lends itself to the analysis of ECG signals from 1-6 lead ambulatory ECG devices, such as long-term Holter monitors, ECG patches and, increasingly, single-lead consumer wearables.

The benefits of quicker and more accurate diagnosis of arrythmias will be particularly felt in ambulatory care settings, where non-specialists are more than likely to be reading and interpreting ECG signals. In the case of Implantable Cardiac Monitors (ICMs), AI-based algorithms have been developed to filter out the large number of false positive signals generated over the lifetime of an ICM, helping to reduce both clinical burden and patient anxiety.

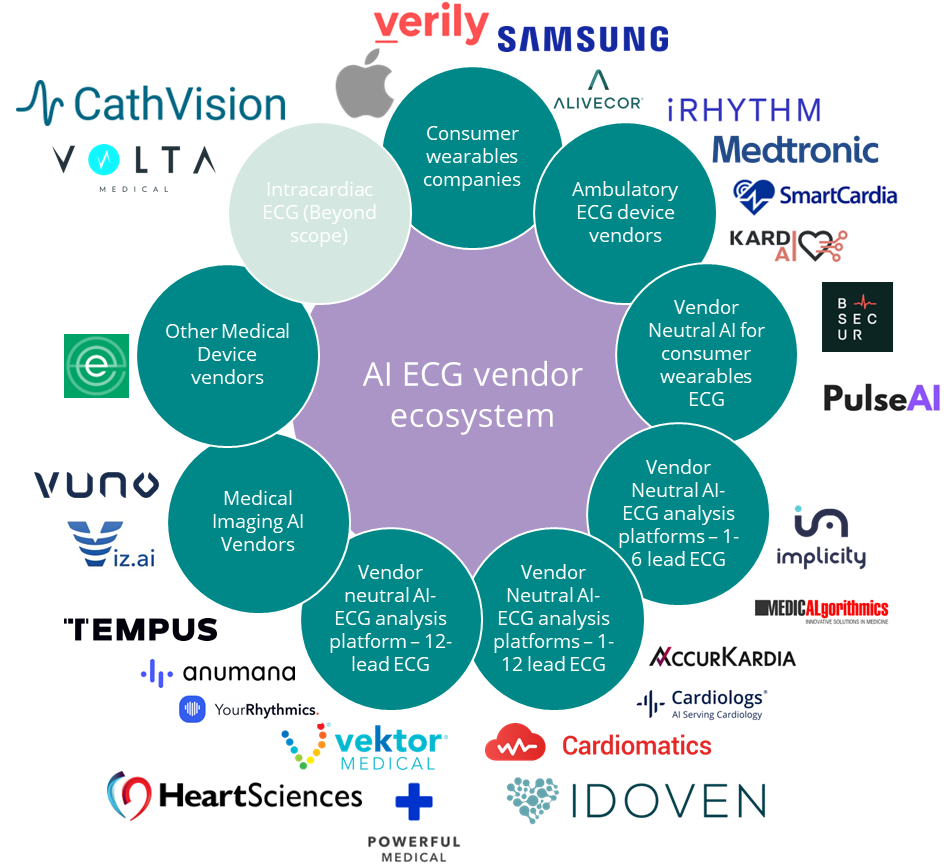

Active vendors in this space (i.e., with approved AI-ECG algorithms) vary considerably, from well-known consumer wearable companies such as Apple and Samsung, to ambulatory ECG device vendors like iRhythm and Medtronic. A burgeoning group of vendor-neutral, software-only AI-ECG platform companies has also emerged, including Cardiologs (acquired by Philips in 2021), Cardiomatics (Poland), and Accurkardia (US), whose algorithms can interpret ECG signals from 1-3 lead ambulatory devices up to a traditional 12-lead resting ECG. Figure 1: The AI-ECG competitive vendor landscape

Figure 1: The AI-ECG competitive vendor landscape

New Horizons

However, dramatic changes are afoot. Within the last six months, separate AI-ECG algorithms for detecting Low Ejection Fraction (Anumana), Hypertrophic cardiomyopathy (Viz.ai), and Occlusion Myocardial infarction (Powerful Medical) have all been granted regulatory clearance (the latter under the EU MDR) and are in the early stages of deployment. These algorithms have all been based on readings taken from a 12-lead ECG, still considered ‘the Gold standard’ despite recent advances in 1-6 lead ECG devices.

The pipeline of algorithms likely to clear regulatory hurdles and enter the cardiac market over the next 12-18 months include those for Pulmonary Hypertension, Cardiac Amyloidosis, Diastolic dysfunction, and Hyperkalaemia. Research is also underway into algorithms for the diagnosis of Aortic Stenosis and Myocarditis and should be ready for commercialisation in the next 18 – 36 months.

Higher up the cardiovascular patient pathway, AI-based ECG algorithms that create 2D and 3D maps of the heart (Vektor Medical) are being used to shorten ablation procedure times, resulting in reduced procedure costs and patient risks. Other vendors developing AI algorithms for electrophysiology (EP) settings include Anumana and Netherlands-based start-up YourRhythmics, which is developing algorithms which could provide clinical decision support to electrophysiologists in place of intrusive intracardiac ECG recordings.

Further synergies are being explored between AI-ECG algorithms and the fast-evolving market of digital therapeutics (which itself sits at the confluence of Digital Health and the Life Sciences). In July 2023 Eko Health announced a partnership with Japanese Life Sciences company Astellas Pharma to develop a non-invasive device Digital Therapeutics (DTx) solution for heart failure patients. The solution will leverage Eko’s Core 500 digital stethoscope (which includes an AI-based 3-lead ECG sensor) and existing Astellas partner Welldoc’s chronic condition management platform. Another vendor to watch in this space is Israeli start-up CardiaCare, currently developing a ‘world-first’ closed-loop, neuromodulation wearable for the non-invasive treatment for AFib.

Fertile Partnerships

Ongoing research partnerships have driven much of recent developments seen in the market. Mayo Clinic has been particularly active, having established Anumana as a spin-off in partnership with health data company nference. It has also supported emerging vendors such as Accurkardia and Northern Ireland-based PulseAI via its Platform_Accelerate Programme. In late 2023, HeartSciences announced a partnership with the Icahn School of Medicine at Mount Sinai to commercialise the latter’s extensive ECG data and algorithm library.

In Europe, a consortium of 18 member organisations under the EU-funded Machine Learning Artificial Intelligence Early Detection Stroke Atrial Fibrillation (MAESTRIA) project is supporting the development of novel therapeutics for AFib and Stroke care, utilising data from ECG, echocardiography, MRI, and CT.

The Life Sciences industry has also been actively involved in AI-ECG algorithm development, which hold the promise to identify greater numbers of suitable patients for its cardiovascular drugs portfolio. For example, in March 2023 Bristol Myers Squibb (BMS) partnered with Viz.ai to develop an AI-algorithm for identifying and triaging patients with Hypertrophic cardiomyopathy (HCM), a condition currently undetected in 80% of cases. In April 2022 BMS had received FDA approval for Camzyos, the first drug developed specifically for targeting HCM.

How Has Funding Progressed?

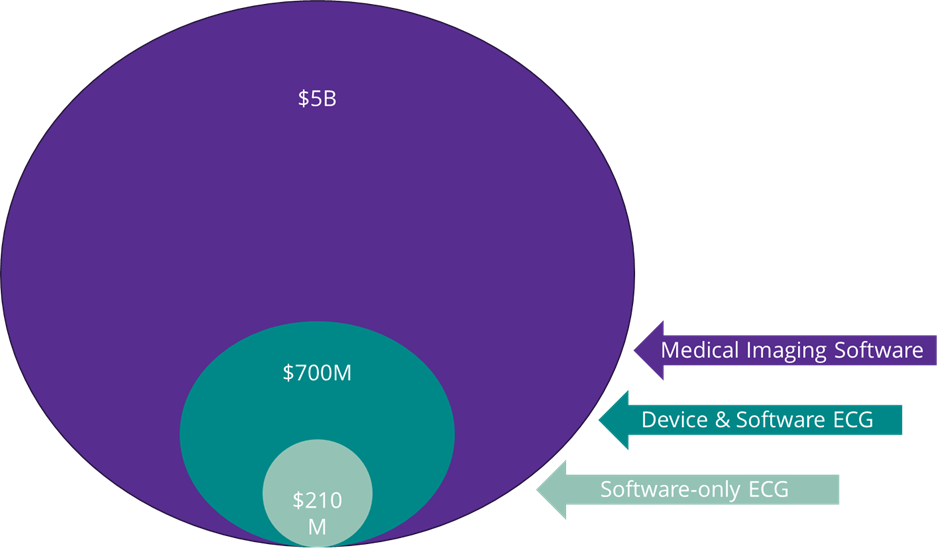

Reflecting the markets relative immaturity, the total funding (based on public data) raised since 2016 by software-only AI ECG vendors was just over $210 million. When including funding for device and AI-software vendors, such as AliveCor and iRhythm (pre its IPO), this figure increases to just over $700 million. However, this still pales in comparison to the nearly $5 billion raised by Medical Imaging AI software vendors over a similar period.

That said, funding for software-only vendors had been trending steadily upwards from 2019 until 2022, which saw nearly $120 million raised. Echoing wider trends in the market, VC funding for AI-ECG vendors fell off a cliff in 2023, to less than $5 million. However, at the time of writing numerous vendors are seeking to raise Series A funding rounds. Fund raising activity should pick up in 2024, as interest rate stabilise and vendors, buoyed by further regulatory approvals, plot their routes to market.

Figure 2: VC funding for AI in Medical Imaging vs. ECG

The Missing Piece

In a similar vein, the reimbursement framework for AI-in ECG is very much in its infancy. Only two CPT Cat III codes for ‘novel assistive AI novel assistive AI algorithmic ECG risk assessment’ are currently available, with a third expected to come into effect on the 1st of July 2024. It can take up to five years for a Cat III code to obtain permanent Cat I status, though how this pathway will be impacted by the continual development and demand for AI-based medical products is anybody’s guess.

On the flip side, falling reimbursement rates for traditional ECG interpretation, compounded by clinician shortages and increased cardiovascular disease burden, will drive the adoption of any solution that saves clinicians time without detracting from patient safety.

Final thoughts

With a growing suite of regulatory approvals, promising commercial deployments, and strong and growing scientific and commercial networks, there is no reason that the development and adoption of AI in Diagnostic Cardiology should not continue to accelerate. Expect to see big and possibly unexpected things in this market in 2024 and beyond.

Related Research

Signify Research’s Diagnostic Cardiology market coverage includes “AI in Diagnostic Cardiology ECG – World – 2023”, a qualitative deep-dive topical report on the current state of AI in Diagnostic Cardiology. Its two most recent data-centric global market reports, “Diagnostic Cardiology – World –Interim Report – 2023”, and “Ambulatory Diagnostic Cardiology – World – 2022” provide a global outlook of these markets, blending primary data collected from in-depth interviews with healthcare professionals and technology vendors to provide a balanced and objective view of the market.

About Gareth Jones

Gareth joined Signify Research in 2021 as Senior Market Analyst in the Digital Health team, where he covered emerging markets including Remote Patient Monitoring (RPM) and Ambulatory Diagnostic Cardiology. In 2023, Gareth joined Signify’s Clinical Care team where, his coverage areas will include Diagnostic Cardiology and Patient Monitors. Prior to Signify Research, Gareth gained 13 years of research experience in South Africa.

About the Clinical Care Team

The clinical care team provides market intelligence and detailed insights on the clinical care equipment and IT markets. Our areas of coverage include patient monitoring, diagnostic cardiology, infusion pumps, ventilators, anaesthesia and high-acuity IT. Our reports provide a data-centric and global outlook of each market with granular country-level insights. Our research process blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net