Written by

In the last 18 months, there have been several developments in the ultrasound AI market. New solutions have been commercially approved, reimbursement codes have been awarded and ultrasound OEMs and AI vendors are working closer together. This, along with the increased focus from ultrasound OEMs who are increasingly adding AI capabilities to their latest systems, highlights how serious OEMs are about the potential of AI in ultrasound. The growing interest in AI technology in general, boosted by the buzz around generative AI solutions such as Chat GPT, has also increased clinician awareness of the benefits in using AI with ultrasound, especially for workflow automation. In this insight, we discuss the major trends impacting the Ultrasound AI market.

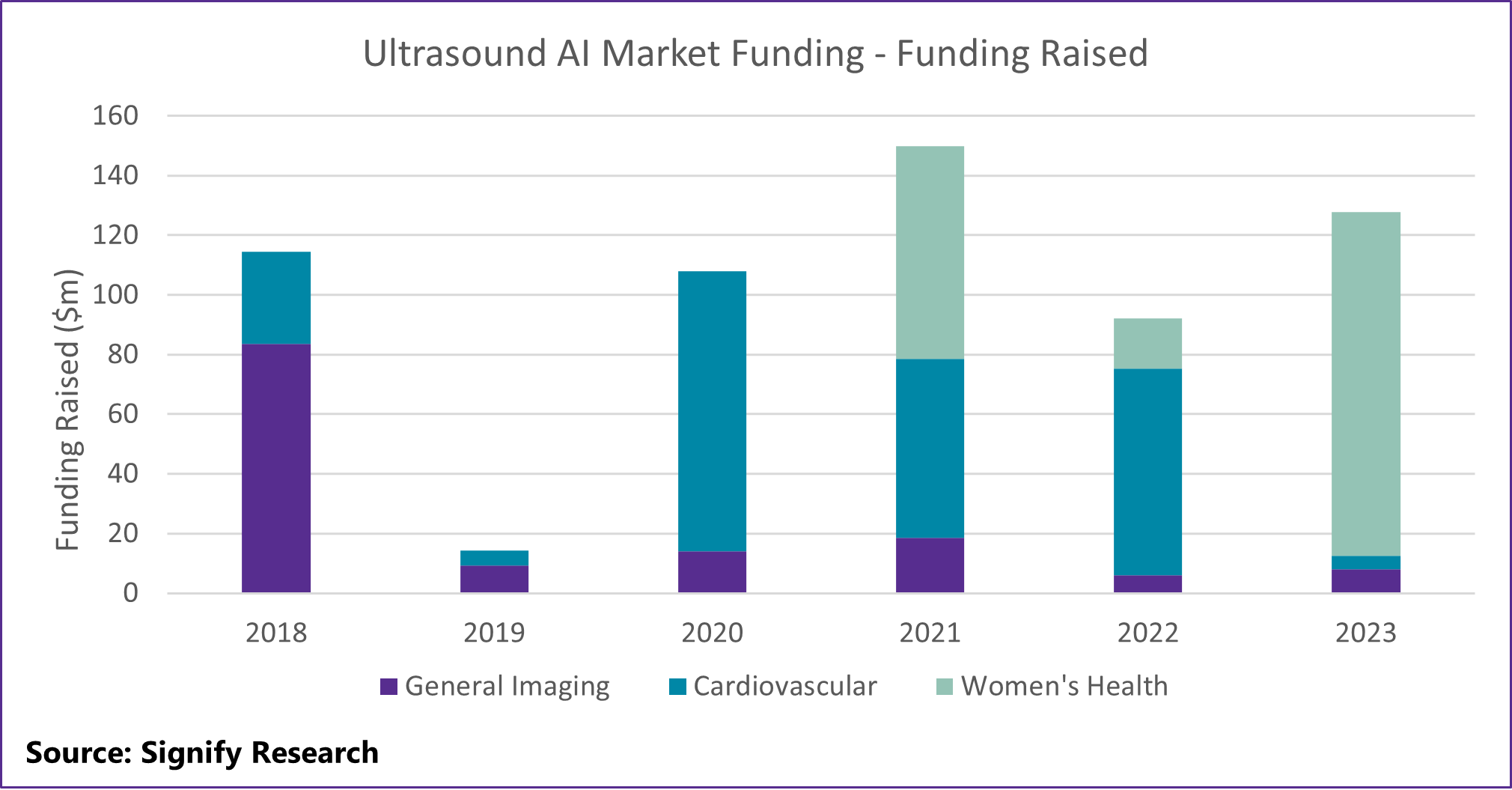

Funding is Increasing for the Development of Women’s Health Ultrasound AI Solutions

Despite a short-term dip in 2022, annual funding raised for AI development in ultrasound has remained above $100 million in the last four years. This highlights the growing interest in applying AI in ultrasound, and the efforts by ultrasound AI vendors in developing solutions. Historically, most of the funding raised to date being for the development of cardiology AI solutions (over 40%). However, there has been a significant increase in funding for companies developing AI solutions for women’s health, where total funding has ballooned to over $200m between 2021-2023.

Funding in the Ultrasound AI Market

This funding analysis only includes funding that was reported. Funding by vendors who did not disclose how much funding was raised has not been included. Funding raised for point of care solutions has been assigned to the clinical area it is targeting e.g., an AI solution to assist cardiac imaging at the point of care has been assigned to cardiology. Funding for ultrasound OEMs to develop women’s health ultrasound AI solutions, such as grants given by the Bill and Melinda Gates Foundation to GE HealthCare, Philips and Butterfly Network, have been included in this analysis.

Most of this funding is from the Bill and Melinda Gates Foundation. Over $100m has been granted to Philips, GE HealthCare and Butterfly Network, to develop AI-enabled applications to improve obstetric care in low- and middle-income countries. Funding has also been raised by newer entrants, such as Pulsenmore and Sonio, who have raised over $100m between them in the last two years. This indicates the increased focus by several vendors to develop tools to improve obstetric care, especially in rural areas and the home setting.

What is the Best Business Model for Ultrasound AI Vendors?

As the medical imaging AI market has evolved, vendors have looked to change the way they sell their solutions. Most vendors now favor an operating expenditure (OpEx) business model with a software-as-a-service (SaaS) subscription rather than a perpetual license. OpEx models (predominantly subscription licenses,) create a sustainable, recurring revenue stream for vendors, enabling improved revenue forecasting and planning for future business activities.

The partnership between AI vendors and ultrasound OEMs almost exclusively results in the OEM offering the AI solution as an optionable extra. One of the barriers in AI adoption is that customers commonly do not see the value of AI tools until they try them. This issue is exacerbated if the AI solution is offered as an add-on to the system sale by the OEM. Not only is the OEM less knowledgeable about the AI solution than the vendor that developed it, but they are typically not as adept at selling software as they are at selling hardware.

GE HealthCare now offers its SonoLyst solution (powered by Intelligent Ultrasound’s ScanNav AI), as standard on the Voluson Expert 22 system. However, the SonoLyst solution is still an optional extra on the Voluson Swift. With the inclusion of AI as standard on the ultrasound systems, this could soon be something ultrasound AI vendors will want for their AI solution adoptIntelligent Ultrasound will receive a royalty on each Voluson Expert 22 system sold by GE HealthCare, which despite being less than the price for the solution as an optional extra, will provide more consistent revenue.

Providing AI as standard will mean that all customers will have the AI solutions more readily available, leading to an increase in the usage of AI in ultrasound. This will therefore help raise the awareness of AI and its potential in ultrasound. Subsequently, the lower royalty received by vendors per system sold will be mitigated by increased unit sales compared to the number of customers who purchase the AI solution as an option. This will be a positive move for OEMs, as it minimizes sales effort for the specific AI solution. It will also enable the company to provide AI on all systems. However, by only including the AI as standard on the premium system, customers will be incentivized to purchase the higher priced system.

The Ultrasound AI Market is Consolidating

In the last 18 months, we have seen increased collaboration between ultrasound AI vendors and ultrasound OEMs. Specifically in 2023, there was two high-profile acquisitions: Caption Health by GE HealthCare and DiA Imaging Analysis by Philips. Other partnerships included UltraSight, who after receiving both FDA and CE approval in the last 18 months, partnered with EchoNous in June 2023.

By partnering with an ultrasound OEM, AI vendors will have more accessibility to bring their solutions to market, especially those with an image guidance solution that has to be integrated into ultrasound devices. Furthermore, ultrasound OEMs partnering with multiple AI vendors allows both vendor types to provide a more comprehensive offering. Similar deals are also being seen by AI vendors partnering with software companies and other AI vendors. Caption Health and Ultromics partnered in 2021 to offer a joint solution to accelerate cardiovascular disease detection and treatment.

This is a trend Signify Research expects to continue moving forward, especially from the smaller Ultrasound OEMs, who do not have the capacity or capability to develop their own AI solutions.

AI Marketplaces Could Have More Market Traction in POC Ultrasound

There have been new marketplaces recently launched in the POCUS market: Clarius launched its Clarius Marketplace in October 2022 and Butterfly Network launched the Butterfly Garden in July 2023.

The introduction of two new marketplaces for the handheld ultrasound market in such a short period of time suggests that whilst the commercial traction of marketplaces is currently limited in the whole ultrasound market, it could have greater appeal in POCUS. With POCUS scans performed in a variety of ways, from imaging the heart, the lungs, or for nerve injections, a lot of different AI solutions will be needed compared to those used, for instance, in cardiology. For this reason, an AI marketplace could have better commercial traction in the handheld ultrasound market compared to the wider ultrasound market. Not only is handheld ultrasound used more frequently in POCUS, but it is also the product of choice for many newer users of ultrasound, due to its lower cost compared to cart and compact systems. As handheld ultrasound users are less experienced in they have a greater need for AI assistance. Subsequently they will benefit from an AI marketplace that offers a range of solutions to meet the varying needs of the POCUS market.

The Signify View

The Ultrasound AI market has seen significant development in the last 18 months. There has been visible expansion both in the number of vendors developing solutions and in the clinical applications being targeted. Signify Research’s infographic provides an overview of the ultrasound AI ecosystem, as well as on market growth projections.

Despite these market developments, many independent AI vendors are struggling to find effective routes to market and business models. Most partnerships between ultrasound OEMs and AI vendors require the OEM to sell the AI solution, but this has had limited success. Two new AI marketplaces have been launched by Clarius and Butterfly Network, but it remains to be seen if clinicians are ready for the app store concept or require a more consultative sales process.

There is huge potential for AI in ultrasound and it will inevitably play an important part in the market. The challenge for AI vendors will be to navigate the complex path to success.

Related Research

The second edition of this report provides a qualitative assessment of the market opportunity for artificial intelligence in ultrasound. It provides a comprehensive review of the market trends and recent innovations, and forecasts the future development of the market. Based on in depth interviews, the report reviews the market activities and strategies of both AI start-ups, scale-ups and ultrasound system OEMs.

About The Author

Mustafa joined Signify Research in 2020 as part of the Medical Imaging team which covers areas such as ultrasound, general radiography and machine learning in medical imaging. Prior to that he obtained a PhD in Pharmacy and Physiology from the University of Kent and has three years of post-doctoral experience working on optimising healthcare for genetic Cardiac diseases. In his spare time, he has a passion for sport and fitness and spending time with his wife and son.

About the Medical Imaging Team

Signify Research’s Medical Imaging team formulates expert market intelligence for some of the leading Ultrasound, CT, MRI, and X-ray vendors. Combining primary data collection and in-depth discussions with industry stakeholders, our thorough research approach yields credible quantitative and qualitative analysis, helping our customers make critical business decisions with confidence. Furthermore, our commitment to seeking a plurality of perspectives across the markets we cover guarantees that our insights remain independent and balanced.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net