Written by

Cranfield, UK, date 13th March 2024 – The medical FPD market, totalling just under 78,000 units in 2022, witnessed a slight retraction in both units and revenue. The most significant decline was seen in mobile general radiography, which was attributed to a surplus during the pandemic. A decline was also seen for mammography due to a shortage of semi-conductors, inflation hikes, and a market correction following elevated investment in breast imaging systems in 2021 as budgets returned post-COVID. However, the resurgence of elective procedures, coupled with pent-up demand, contributed to the positive uptake of mobile C-arm technology.

Signify Research projects the medical FPD market to surpass 97,000 units by 2027. Despite this projected increase in unit sales, the expected continued decline in average selling price suggests that market revenues will not experience a parallel growth trajectory.

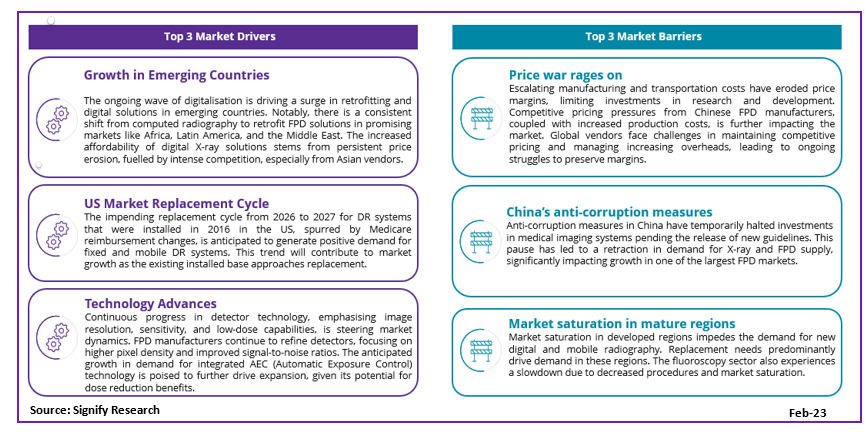

In the graphic below, Signify Research has outlined the main factors supporting market growth and highlighted some challenges that FPD vendors are currently addressing.

Top Predictions for the FPD Market

In the ever-evolving competitive market, here are our foremost predictions for the landscape of medical FPD vendors.

- More investment in applications outside of Medical

- As the medical flat-panel display (FPD) market intensifies with rising competition from Asian vendors, global manufacturers are strategically shifting their focus towards less saturated sectors.

- Among these, the industrial and security markets are emerging as promising segments, offering higher profitability and lower competition. Additionally, sectors such as dental and veterinary applications present significant growth opportunities, particularly with the anticipated digitalisation in the veterinary X-ray market

- FPD vendors will start looking at the next generation of scintillators

- Purchasers also prioritise pixel resolution and detective quantum efficiency (DQE) considerations. FPD manufacturers are innovating by developing thicker scintillator layers to elevate the achievable DQE levels in their detectors. Exploring the potential of nanotechnology, researchers aim to enhance scintillator properties, focusing on improved efficiency, reduced noise, and increased durability.

- Concurrently, strides are being taken to engineer thinner and lighter scintillators, mainly geared towards portable and handheld devices’ portability and manoeuvrability requirements. This ongoing trend seeks to augment the mobility and flexibility of imaging equipment. Additionally, there is a concerted effort within the industry to identify and incorporate cost-effective materials for scintillators without compromising performance

- Chinese FPD players strengthening global market share

- China based iRay is not only maintaining its ascent in the market but also bolstering production volumes while gaining market share from its domestic counterparts. Its panels’ enhanced reliability and quality have led to heightened acceptance, fostering a robust adoption in white labelling collaborations.

- Original Equipment Manufacturers (OEMs) and other global Flat Panel Display (FPD) vendors seamlessly integrate iRay’s panels, incorporating their own software and rebranding the technology. Moreover, iRay’s strategic move to locally assemble detectors in countries like South Korea poses a direct threat to domestic vendors. The enduring relationships between industry-leading OEMs and global FPD vendors are hanging in the balance as top-tier medical imaging entities increasingly opt for Chinese FPD panels, further solidifying iRay’s global influence.

- Increasing integration of deep learning and noise reduction software in FPDs

- Leading high-end and premium Flat Panel Detector (FPD) vendors are unveiling cutting-edge AI-based software features encompassing deep de-noising or intelligent noise reduction technology, dose reduction capabilities, and scatter correction features. This strategic move serves as a distinctive edge in an increasingly saturated market landscape.

- Moreover, FPD vendors are pioneering innovative software solutions, leveraging advanced image processing algorithms. These technologies are designed to elevate image clarity, providing intricate details of soft tissue and skeletal structures while minimising radiation exposure. These endeavours underscore a commitment to pushing the boundaries of imaging capabilities and setting these vendors apart in an increasingly competitive environment.

- More FPD companies are entering the system market

- The intensification of competition within the Flat Panel Detector (FPD) market has spurred certain vendors to venture into the X-ray system market, strategically advancing up the value chain. This trend is particularly conspicuous in diagnostic X-ray applications, with notable players such as KA Imaging, DR Tech, and the more recent entrant, Trixell Thales.

- The prospect of additional FPD vendors exploring this avenue seems likely. However, this shift also presents challenges for FPD vendors, as they compete directly with their Original Equipment Manufacturer (OEM) customers for specific product lines.

- Market consolidation

- As FPD prices reach unprecedented lows and profit margins come under pressure, the industry is poised for consolidation. Recent instances include Varex’s acquisition of Direct Conversion, Detection Technology’s takeover of Harbour Imaging, and Careray’s strategic investment, acquiring a 30% stake in ISDI Limited. In the face of escalating manufacturing costs driven by inflation and supply chain disruptions, achieving economies of scale becomes imperative for sustaining low production costs and maintaining competitiveness.

- Consolidation not only empowers smaller vendors to fortify their product portfolios, providing more comprehensive solutions for the broader FPD market but also facilitates the exploration of new sales channels, broadening market access.

Competitive landscape

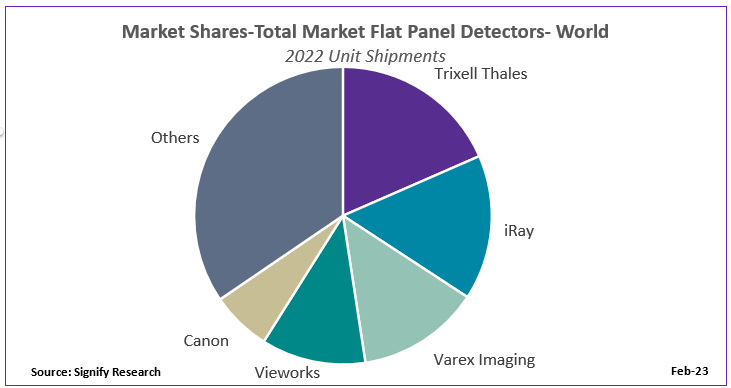

The medical flat panel detector market remains highly competitive, with the top five vendors accounting for over 65% of the market share. Trixell Thales leads the market with over 18%, followed by iRay in second place and Varex in third. iRay expanded its market share in 2022 due to its increased production capacity and competitive pricing, enabling its global expansion. Conversely, Careray faced market retraction due to intense competition from fellow domestic vendor iRay. The aggressive price war by Chinese FPD companies compelled international vendors to reassess their supply chains and establish production facilities in more cost-effective countries such as China and India.

Premium FPD market vendors persist in strategic investments, focusing on crucial differentiators and innovations such as glass-free detectors, integrated AEC chambers, dual-energy detectors, IGZO and long-length detectors.

Future outlook

The saturation of the low-end FPD market, compounded by an ongoing price war escalated by the global presence of Asian FPD vendors, poses a significant threat to the profit margins of global FPD vendors. In response to these challenges, medical FPD prices are projected to stabilise, shifting from years of double-digit price erosion to positive increases in the next two years. On a global level, a low single-digit decline in price is projected from 2025 through 2027. The over-saturation of the medical FPD market will likely drive consolidation, with predictions of acquisitions or mergers among FPD companies.

To navigate this landscape, FPD vendors are progressively investing in research and development to elevate their product lines, showcasing the latest innovations in both hardware and software. These advancements encompass IGZO technology, flexible detectors, photon counting, and the integration of AEC chambers directly into the detectors. Developed countries and high-end hospitals remain the primary markets for these higher-end FPD products, where clinical precision is paramount. To remain competitive, medical FPD vendors are anticipated to move up the value chain and venture into the equipment manufacturing market. On the software front, there is a growing uptake of deep denoising and AI-empowered anti-scatter solutions, serving as differentiating factors in the industry.

Related Research

Medical Flat Panel Detector Report – World – 2024

Signify Research’s report “Medical Flat Panel Detector Report – World – 2024” builds on their 2023-edition and will provides a data-centric and global outlook of the market. The report blends primary data collected from in-depth interviews with FPD vendors, to provide a balanced and objective view of the market.

About The Author

Bhvita joined Signify Research in 2020 as part of the Medical Imaging Team, focusing on the X-ray market. Prior to joining, she brought with her 4 years of experience covering X-ray, MRI, and CT research at IHS Markit. She received her bachelor’s degree with honours in Biology and Psychology from Aston University.

About the Medical Imaging Team

Signify Research’s Medical Imaging team formulates expert market intelligence for some of the leading Ultrasound, CT, MRI, and X-ray vendors. Combining primary data collection and in-depth discussions with industry stakeholders, our thorough research approach yields credible quantitative and qualitative analysis, helping our customers make critical business decisions with confidence. Furthermore, our commitment to seeking a plurality of perspectives across the markets we cover guarantees that our insights remain independent and balanced.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net