Written by

Cranfield, UK, 08 April 2024 – Over the last 12 months, Signify Research has tracked generative AI (gen AI) product announcements in healthcare to understand the most prevalent use cases and those lacking traction. These announcements have been captured in our product database, part of the Generative AI Market Intelligence Service. In the latest edition released in early April, Signify Research captured over 300 applications either being developed or already deployed in relation to generative AI in healthcare.

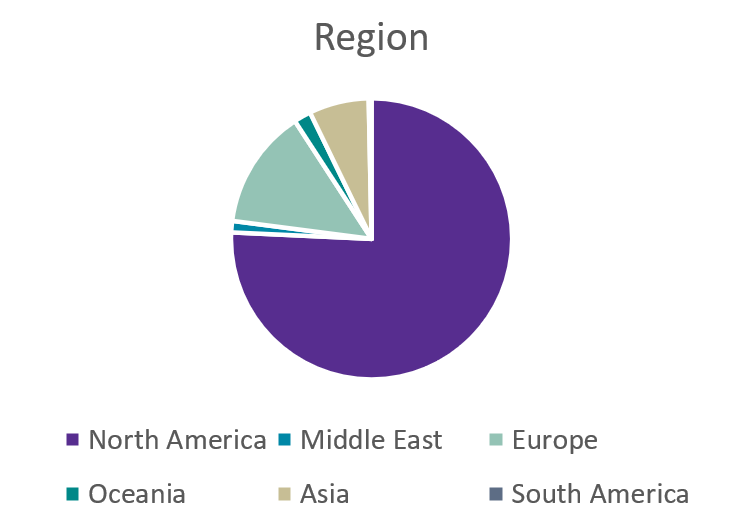

It comes as no surprise that North America, particularly the US, is the epicentre of healthcare-focused gen AI product announcements. This dominance is not without reason. Firstly, the US accounts for more than 50% of global healthcare expenditure, making it a logical breeding ground for healthcare innovations. Secondly, the US boasts the highest concentration of health IT firms, further reinforcing its position as a hub for health IT products leveraging gen AI. Lastly, most models originate from proprietary sources like AWS Bedrock, Google Vertex AI, Azure Cloud, and NVIDIA BioNeMo, making it easier to integrate models from OpenAI, Anthropic, and MedLM without the technological commitment required for open-source platforms.

Smaller organisations often struggle to leverage open-source AI models due to the significant technical expertise and resources required for deployment. In contrast, proprietary models from large tech firms offer more user-friendly support and infrastructure, albeit at higher cost and less flexibility. This is why we see many partnerships between Big Tech, technology vendors, and healthcare providers to construct these solutions. One example is HCA Healthcare, which, in partnership with MEDITECH and Google, seeks innovative ways to bring gen AI to address specific challenges.

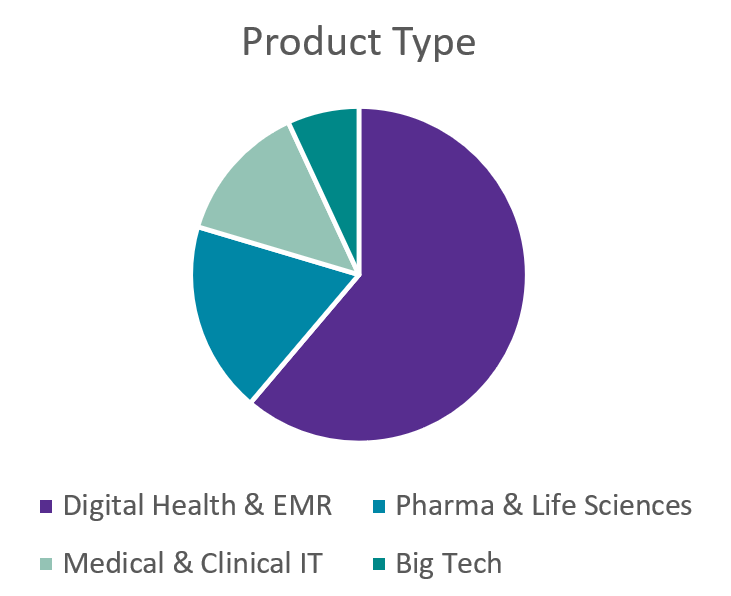

Most products are focused on Digital Health and EMR, followed by Pharma and Life Sciences and Medical and Clinical IT. “Big Tech” signifies cross-adaptable applications such as foundation models and LLMops provided by technology companies, not necessarily field-specific, like NVIDIA BioNeMo, which can be used across all three aforementioned domains.

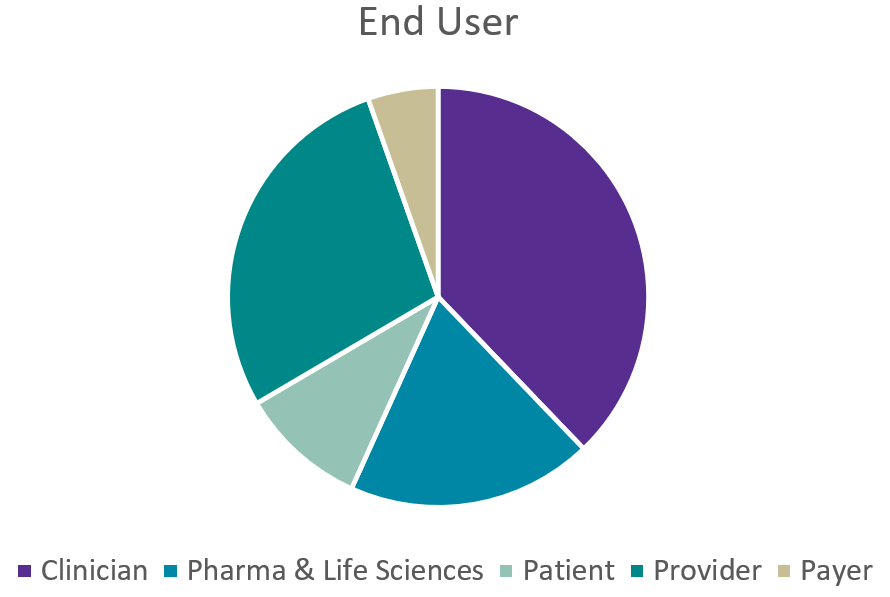

Clinician-Centric

“Clinicians” are the primary beneficiaries of generative AI, as tech optimises their burdensome workflows. This is followed by “providers”, which refers to the broader healthcare organisations (rather than at the individual level) leveraging AI for population health, analytics, and admin tasks. While life sciences have seen numerous announcements, many NVIDIA partners are still in trial phases, potentially understating the full scope of generative AI’s impact.

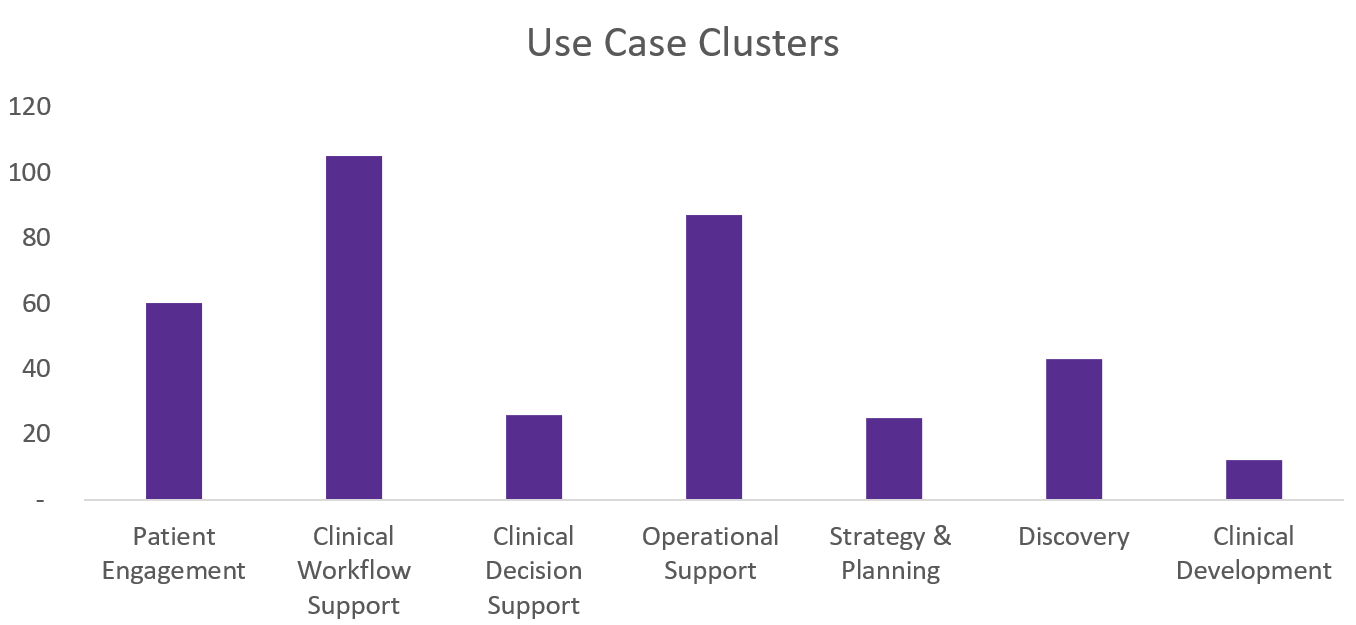

Unsurprisingly, Clinical Workflow Support (focused on clinicians) was the most advanced use case cluster, followed by Operational Support (focused on providers). One reason operational Support was rated highly is it included customer support and professional services, some of which tend to be horizontal and have lower regulatory requirements. Please note that the sum of applications on the diagram below is higher than the total number of applications, as one application can potentially support both Patient Engagement and Operational Support or both Workflow and Decision Support.

Coveted Capabilities

Although not directly related to the use case clusters, the short description depicts the application’s primary characterisation and sums up the total number of applications in the product database. It is important to note that the Foundation Model figure is largely inflated, as domain-specific foundation models in pathology, including Aignostic, PaigeAI, and Owkin, have very specific applications yet are considered foundation models in the product database. This includes research initiatives that are not operational, such as AntGLM-Med, which is a research-based foundation model in China.

Looking specifically at applications, Drug Development has the highest number of applications. as it can accelerate the process, optimise molecular design, explore unexplored chemical spaces, handle the complexity of multiparameter optimisation, enable efficient virtual screening of millions of potential drug candidates in silico, and facilitate drug repurposing.

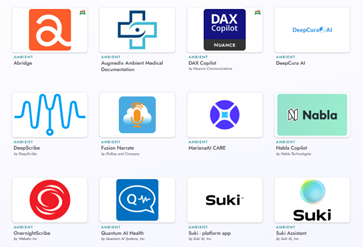

Transcribing Medical Encounters is the second-highest application area. It is worth noting that some of the vendors are duplicated, as more than one Ambient Listening solution exists. For example, Nuance has DAX Copilot as well as PowerScribeOne that is focused on medical imaging.

Professional Services refers to all operational-styled applications, including HR, marketing, and admin. These can be completed by non-healthcare-specific firms; however, only the ones with a presence in healthcare have been included in the database.

In the realm of data analytics, generative AI models offer numerous advantages. They enable users to interact with data using natural language queries, making data exploration more accessible. These models can analyse complex data and generate human-readable insights, narratives, or explanations, aiding in data storytelling and communication. By learning patterns from data, these models can identify anomalies or outliers that deviate from the norm, supporting anomaly detection. Finally, by understanding user preferences and data patterns, generative AI can provide personalised recommendations for products, services, or content, enhancing user experiences.

The category Patient Communication is followed shortly. The category is specific to the patient and has the primary function of answering questions that are not medical; thus, it does not need to be certified as software as a medical device (SaMD), such as a chatbot for scheduling appointments, etc. Medical chatbots, on the other hand, provide medical advice and are not limited to patients; i.e. can be used by clinicians as well.

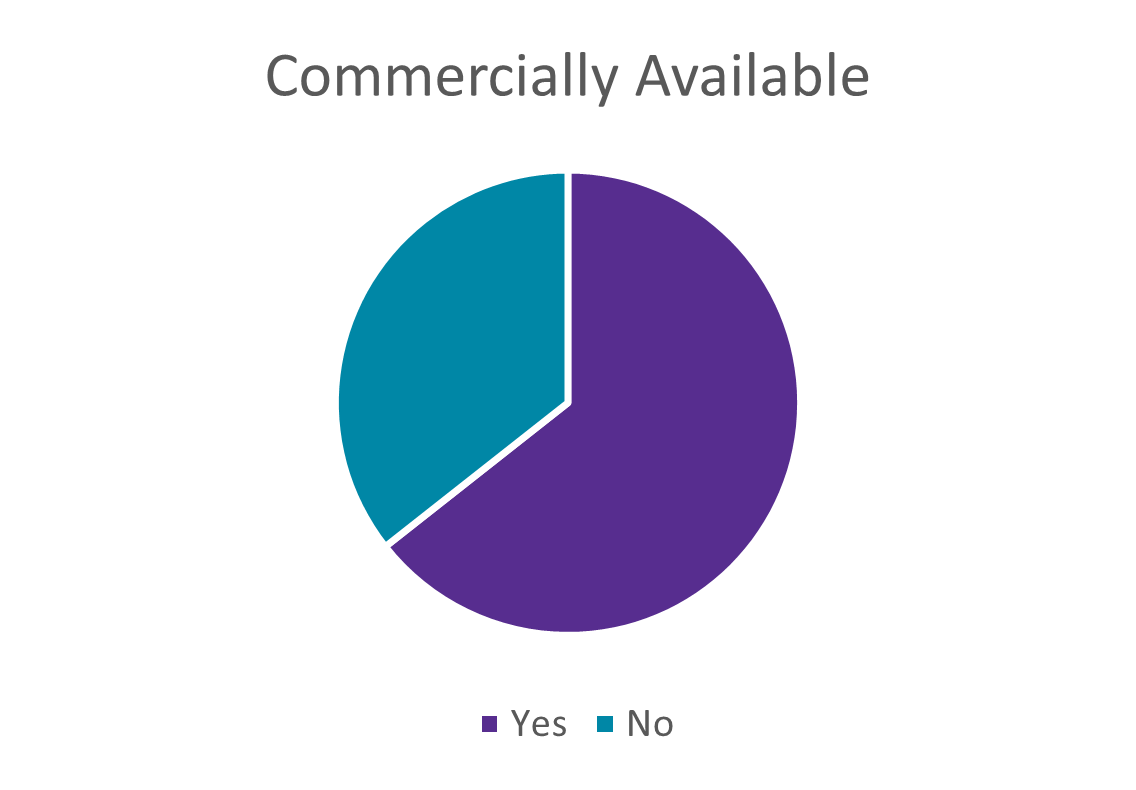

Although most applications are commercially available and can be consumed by end-users, a large proportion is still being developed. It is possible that some use cases with current traction may have an interesting use case but lack commercial viability, leading to them being dropped. The database is updated quarterly, and high-level insights will be shared once published.

Lessons Learned

There are a few conclusions that can be drawn from the research.

Big Tech will be at the centre of generative AI, but healthcare technology vendors will be at the centre of generative AI deployment.

Big Tech will be at the centre of generative AI due to its immense computational resources, cutting-edge research and development efforts, access to vast amounts of data for training AI models, and the ability to seamlessly integrate and deploy generative AI solutions through its cloud services and software platforms. With their resources and capabilities, Big Tech giants like Google, Microsoft, Amazon, and NVIDIA are well-positioned to drive innovation and advancement in generative AI.

However, healthcare technology vendors will be central to generative AI deployment. These vendors have a deep understanding of the healthcare sector’s unique requirements, regulations, and complexities, making them better equipped to tailor and deploy generative AI solutions that meet the specific needs of healthcare providers, patients, and regulatory bodies. While Big Tech may drive the development of generative AI technologies, their successful adoption and integration within healthcare will heavily rely on the expertise and intermediary role of healthcare technology vendors, who will bridge the gap between cutting-edge AI and real-world healthcare applications.

Partnerships are at the core of facilitating gen AI deployment.

When considering potential partnerships, it’s helpful to categorise them into two buckets: partnerships between Big Tech & Incumbents and Big Tech & Smaller Vendors. Historically, Big Tech companies have faced challenges in directly entering the healthcare market with their own solutions, often serving more as enablers through their cloud, AI, and ML platforms. This can be partly attributed to a lack of clinical expertise, which is more prevalent among healthcare incumbents or startups focused on solving specific problems.

In the first bucket, challenging well-established healthcare incumbents like Siemens Healthineers, GE HealthCare, Epic, and Philips is a formidable task that Big Tech companies may be reluctant to undertake directly. However, partnering with these incumbents is a more feasible and mutually beneficial approach, as evidenced by the increasing number of collaborations, such as GE and NVIDIA or Philips and AWS. It seems likely that more partnerships are likely to follow, with one potential possibility a partnership between Microsoft and Siemens. Alternatively, Big Tech companies can pursue acquisitions, similar to Microsoft’s acquisition of Nuance and Oracle’s acquisition of Cerner, to establish a stronger foothold in the healthcare applications domain.

In the second bucket, while Big Tech could compete with startups by deploying its solutions, the question arises: what is the point? Typically, startups aim to tackle specific niches with point solutions that may be too narrow for Big Tech companies to give significant attention to. Instead, more appropriate options include:

- Investing and acquiring successful startups can be a viable strategy for Big Tech companies to rapidly gain access to innovative technologies, talented teams, and new market opportunities. For example, through its affiliation with Gradient Ventures, Google invested in Rad AI in 2021, which recently announced the integration of Google’s MedLM into its solutions.

- Partnering with newer companies could be mutually beneficial. For instance, PaigeAI can digitise pathology slides at a fraction of the cost thanks to its partnership with Azure, enabling it to secure its position as one of the top digital pathology vendors able to train its foundation model on many data points, thereby enhancing its performance.

- Adopting a VC-type approach and establishing accelerator programs allows Big Tech companies to foster innovation by supporting and nurturing multiple startups simultaneously. This enables them to diversify their investments, identify promising ideas early, and potentially gain a competitive advantage in emerging markets or technologies. AWS, for example, launched an AWS accelerator for generative AI, where startups receive support and resources to innovate and scale.

It’s worth noting that pursuing the first two options (partnerships and acquisitions) is an entirely appropriate strategy for healthcare incumbents, and many have already been doing so. Furthermore, healthcare technology vendors use their marketplaces to act as “sandboxes” offered by these organisations and serve as testing grounds and allow them to identify successful companies for potential acquisition, mimicking an accelerator-type approach.

Ambient Listening space will start consolidating in the next year

As demonstrated earlier, there are numerous ambient listening solutions available in the market. Nuance, which has been an industry leader in Ambient Listening, with approximately 80% of healthcare providers using its technology, is being significantly challenged by up-and-coming startups such as Abridge, Nabla, DeepScribe, Suki, and several dozens more listed in the product database. Nuance’s market share is threatened as its previously technologically advanced scribing tool faces democratisation. Other startups can now leverage similar technology and offer it at different price points, which will be a top consideration for healthcare purchasing decision-makers such as CFOs, CIOs, and CTOs.

In the coming year, it is likely that the top ambient listening solutions to emerge and aggressively challenge Nuance’s market share as the capabilities become more homogenous with technological advancements. One key differentiator will be native EMR integration, enabling the seamless push and pull of information to and from EHRs without needing ad hoc integration from separate applications. In this regard, Nuance does have an advantage due to its close integration with Epic, the largest EMR vendor in the US, as well as other EHR vendors. It should focus on maintaining this to fend off market share erosion.

However, the broader push for interoperability means plug-and-play integration is much simpler now than a few years ago. For instance, 12 Ambient Listening technologies are now offered for Primary Care in the recently reopened Epic marketplace. Similar developments will likely be seen with other EMR vendors.

Epic Marketplace Ambient Listening Solutions

De-skilling

Traditionally, clinicians and researchers had to acquire specialised skills, such as proficiency in SQL (Structured Query Language), to navigate and extract insights from large datasets. However, GenAI enables them to accomplish the same tasks using natural language processing (NLP), eliminating the need for specialised technical knowledge. By creating tools in this area, vendors aim to simplify navigating and analysing complex data from sources like Health Information Exchanges (HIEs), data lakes, or procuring dashboards with health insights. This domain is relatively less regulated, providing an opportunity to streamline intricate processes and facilitate easier interaction with complex data. This has been supported by many use cases around data analytics applications.

This Insight offers a high-level summary of our findings on these applications. For a more detailed exploration, feel free to connect with the Signify team. It’s crucial to acknowledge that the gen AI product landscape is rapidly evolving, with new products surfacing regularly. Please note that our database exclusively tracks applications utilising gen AI; products without generative AI capabilities, such as non-generative NLP solutions, are not part of the scope.

Related Research

This Market Intelligence Service delivers data, insights, and thorough analysis of the worldwide market potential for vendors leveraging Generative AI in healthtech. The Service encompasses Medical Imaging, EMR & Digital Health, Pharma & Life Sciences, and Big Tech vendors, exploring their opportunities and strategies in the realm of generative AI.

About The Author

Vlad joined Signify Research in 2023 as a Senior Market Analyst in the Digital Health team. He brings several years of experience in the consulting industry, having undertaken strategy, planning, and due diligence assignments for governments, operators, and service providers. Vlad holds an MSc degree with distinction in Business with Consulting from the University of Warwick.

About the AI in Healthcare Team

Signify Research’s AI in Healthcare team delivers in-depth market intelligence and insights across a breadth of healthcare technology sectors. Our areas of coverage include medical imaging analysis, clinical IT systems, pharmaceutical and life sciences applications, as well as electronic medical records and broader digital health solutions. Our reports provide a data-centric and global outlook of each market with granular country-level insights. Our research process blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net