Written by

Cranfield, UK, 16th May 2023 – Value-based care (VBC) is a healthcare delivery model that differs from traditional fee-for-service because rather than compensating providers based on the number of services provided, it ties the amount providers earn to the results they deliver for their patients. The quality of these healthcare services is measured by patient outcomes that are based on metrics such as rate of hospital readmission, timeliness of care, and overall patient satisfaction. This VBC model holds providers accountable for improving population health outcomes while simultaneously allowing them greater flexibility to decide how care is delivered to their beneficiaries.

The VBC delivery model encompasses various approaches with the most common being Accountable Care Organisations (ACOs) and Integrated Delivery Networks (IDNs) in the US and Integrated Care Systems (ICS) in the UK. Both countries’ approaches are networks of healthcare providers (hospitals and physicians) who work together to deliver high-quality coordinated care to beneficiaries while controlling costs. The benefits of VBC models include better patient health outcomes at a lower cost, streamline delivery via coordinated care teams, focused preventative care and treatment plans for patients, less physician burnout, lower costs for payers, and a healthier patient population due to better adherence to treatment.

While there are many benefits to VBC, there are also some significant obstacles that must be overcome for this type of healthcare delivery model to be a success. This includes dealing with disparate IT and health records systems, outdated workflows, and lack of internal resources which is a consequence of patients seeing multiple physicians, specialists, etc. who are using different data handling platforms throughout the course of treatment.

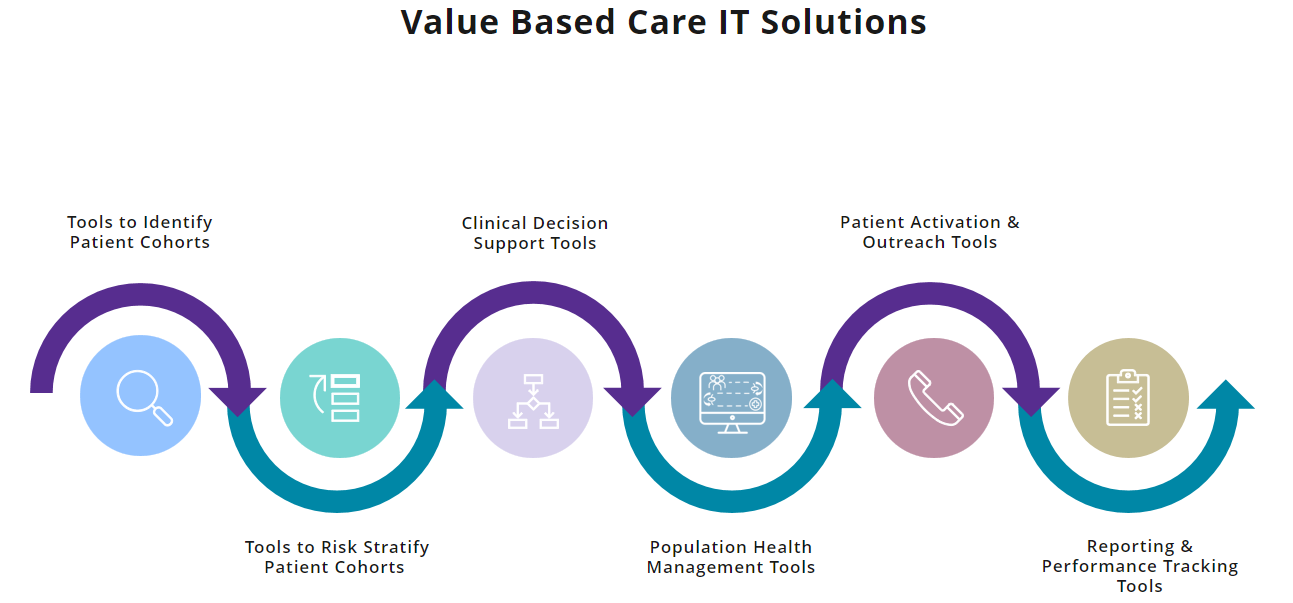

When it comes to VBC IT solutions, there are six tools that are essential for tracking, monitoring, and measuring patient outcomes. These include IT tools to identify patient cohorts, to segment patients by risk, to aid clinical decision-making, to manage care coordination, to carry out patient activation, and finally, to measure performance and report outcomes.

Over the years, Signify Research has had the opportunity to speak to 100s of VBC decision-makers and buyers from ACOs and IDNs in the US and similar organisations internationally about their healthcare IT needs. Our conversations with these organisations have provided greater insights into the current drawbacks of utilising these technologies as well as what needs to change to improve these IT tools for the better.

Tools to Identify Patient Cohorts

Our research has highlighted that electronic health record (EHR) systems are the main sources of patient information that are used to identify specific patient cohorts to target as part of VBC, coupled with manual data handling processes. EHR systems can vary across providers’ settings, with some being more basic with limited clinical decision support (CDS) on offer including minimal highlighting of care gaps, and no priority ranking of patients or insights on financial impacts of closing these care gaps. EHR systems that are more advanced tend to provide modules that have robust CDS that highlight actions to prioritise patients and provide some input on cost impact of closing care gaps.

However, gathering this information to identify patient cohorts to target for VBC is not always a straightforward process. A majority of ACOs and IDNs that leverage EHR systems to identify patients use a mixture of DIY business intelligence tools such as Tableau, PowerBI, and Excel, for example, combined with some form of a dedicated commercial health insights solution drawing on EHR data. This process is not straightforward and involves interrogating multiple data sources in various locations to develop a fuller patient view that includes manually pulling data from EHRs/Data Warehouses, claims portals (US-only), self-developed DIY tools, and social determinants of health (SDoH) tools. Having to pull in data from multiple sources manually does not always display in a way that can help these organisations clinically, especially when some of the data is insignificant or inaccurate.

When identifying patients to target for VBC, key things that care management teams look at include frequency of hospital admissions/readmissions, frequency of ED visits, type and number of chronic conditions, social needs data, medication spend, and screening tests. As VBC organisations continue to grow and mature, the demand for more data points beyond EHRs is becoming increasingly important to help accurately identify patients to close care gaps. With this comes growing interest in the need for sophisticated IT tools that automate processes and improve current workflows.

Tools to Risk Stratify Patient Cohorts

The VBC providers we have spoken to have highlighted a reliance on several off-the-shelf algorithms that are used to segment patient cohorts identified from EHRs into high-risk/low-risk categories as a way of prioritising who needs immediate interventions and care plans. The algorithms in use include, for example, Milliman RX, Hierarchical Condition Category (HCC), Charlson Comorbidity Index, QAdmission Risk Algorithm (UK), Electronic Frailty Index (UK), and Kaiser Triangle.

The reliance on these algorithms once again requires care management teams to utilise manual data handling processes that include a mix of self-developed business intelligence tools combined with some health insights software. As risk stratification is an important part of VBC, most organisations are currently not using sophisticated tools for various reasons related to issues of cost and lack of internal resources. But the interest and need are there to look at IT tools that can improve workflows and help to focus on high-risk, high-cost patients in a more efficient and less laborious manner.

Clinical Decision Support Tools

Across VBC organisations we have engaged with, there is a wide variety of CDS software tools in use depending on where the ACO, IDN or other organisation is based on their IT set-up journey. Some have minimal or no CDS tools for closing gaps in care and rely entirely on manual processes to find and prioritise patients for care plans. Other organisations have CDS support in the form of limited actionability that provides some software assistance with identifying cohorts, but still requires manual work to input/extract relevant patient data. The most advanced VBC organisations have developed integrated tools/dashboards that are combined with cohort identification and risk stratification IT tools and CDS modules providing care gap closure recommendations.

While advanced CDS set-up is what most organisations aspire to, the system is still not perfected as many CDS options are not integrated with care coordination team workflows requiring timely manual processes and additional staff resources. There is a growing demand for the use of mature, integrated tools that mirror the VBC journey and bundle cohort identification, risk stratification, and CDS in health insights into one seamless end to end workflow.

Population Health Management Tools

Another health IT need includes improvements to current population health management (PHM) tools on the market. Many organisations currently use broader dedicated PHM tools that enable care management teams to view cohorts based on risk and then drill down into specific patients to receive input and advice on what actions are needed to close gaps in care. This specialised software allows for data visualisation of common actions across cohorts that would lead to the greatest impact from a financial and clinical perspective.

While dedicated PHM software is mostly used in medium to large-scale VBC organisations, many of the buyers we have spoken to have highlighted the dissatisfaction that cohort ID is mostly from siloed data sources that are not always accurate or up to date which increases the potential for patients to be incorrectly prioritised. Also, many of the tools are not as user-friendly and require dedicated support from IT/informatics team to manipulate data. The demand is for solutions that not only provide a holistic patient view, but also can be easily manipulated by care management teams without having to rely on technical or informatics expertise.

Patient Activation and Outreach Tools

Our conversations with VBC decision-makers and buyers have also illustrated that despite the demand and use of IT tools for PHM, the telephone remains the primary method of contacting patients and enrolling them into VBC. Enrollment success varies greatly across organisations, with some leveraging additional outreach tools such as texting tools and various patient apps and portals to contact patients.

Patient communication is initiated and managed via workflows that once again originate from the EHR which houses patient contact information. Organisations that have smaller, less diverse populations and those who have either invested in specific PHM IT tools to manage the process or who have developed their own in-house IT tend to experience higher patient enrollment in VBC.

However, while not high on the IT improvement wish list, many VBC buyers have expressed a desire to access outreach tools that better integrate with other care coordination workflows to streamline and expedite patient outreach activities and generate engagement.

Reporting and Performance Tracking Tools

To judge the eligibility of ACOs and IDNs for reimbursement payments and shared cost-savings, these organisations are required to participate in annual audits that measure performance and track outcomes. Analysing data for these audits is extremely valuable, but it tends to be a labour-intensive process and many healthcare organisations lack adequate resources and skill sets to create these reports.

Currently, most organisations use some form of DIY BI tools created by internal staff to track various program success metrics and KPIs around strategy, operational, and process improvements. Most medium– to– large scale organisations rely on internal data analytics/informatics teams to develop IT tools via Tableau, Excel, Qlik that provide details on specific performance measures.

This method of reporting again requires an abundance of manual tracking/reporting activities with automated tools used less commonly. And this reliance on specific data analyst teams creates a backlog of reporting which makes it impossible to monitor performance in real-time so strategies can be implemented to correct or improve outcomes before year-end.

What PHM solutions are truly needed?

In summary, the six types of health insights IT tools that are essential for VBC organisations are not without significant drawbacks. What is clearly not working is the lack of a holistic 360-degree patient view, and data limitations in terms of latency and access with multiple data feeds leading to missing and outdated patient information. With the variety of vendor PHM IT tools in use that are falling short and still need to rely on manual processes, there are growing challenges in creating clear, coordinated workflows that share information back and forth between care management teams and frontline providers.

Our conversations with VBC healthcare leaders have illuminated three key purchase drivers for any PHM IT tool which includes examining how these tools improve patient care, improve clinical staff workflow/efficiency, and reduce data fragmentation/data siloes. What is needed for VBC are IT tools that ensure actions recommended by dedicated care management teams are visible and front-facing for providers to act upon as they interact with patients. Also, having real-time data feeds and tools to inform care management would be extremely beneficial to VBC organisations in terms of monitoring and improving healthcare outcomes.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

W: www.signifyresearch.net