Written by

08th March 2021- Written by Sanjay Parekh – Capital investment for companies developing medical imaging AI applications has totalled more than $2.6 billion since 2014. Despite the COVID-19 global pandemic, almost a quarter of the total funding ($592.3 million) was raised last year (2020) alone, and most of this investment was raised by companies from China.

This report covers:

- The total funding and number of deals by quarter since 2014.

- The type of investments raised by companies since 2014.

- The distribution of funding by company and regionally.

- The number of medical imaging AI companies founded since 2010 and a list of companies that have raised more than $50m.

- The top five most funded companies across the Americas, EMEA, and Asia.

In 2020, funding for medical imaging AI companies was almost $600m, which was an increase of $142m on the previous year ($450.2m) despite the challenges faced by the global markets, including healthcare, due to the COVID-19 pandemic. Most of the funding raised (45%) last year was by companies from China, but excluding this, there was a marked decline in funding received by companies in other countries.

China is now the largest venture capital market in Asia and second only to the US worldwide. While the IT and Internet sectors account for most investment, the healthcare sector is also popular, and this has benefitted Chinese medical imaging AI companies. Compared to 2019 when medical imaging AI companies from China only accounted for 26% of the total global funding ($450m), this was almost double in 2020. The first Class III NMPA (China’s regulatory body) approval for Keya Medical’s DeepVessel FFR AI solution may be one of the driving factors behind this. Then in November 2020 Shukun Technology and Deepwise both obtained Class III approvals, Shukun for its coronary CT angiography analysis software and Deepwise for its pulmonary nodule detection software. These approvals are likely to open the floodgates for other medical imaging AI companies to receive similar approvals for their solutions and grow their commercial presence, enticing further investments.

However, funding for medical imaging AI companies from the USA has declined sharply from more than $410m in 2018 to less than $150m in both 2019 ($117m) and 2020 ($141m). Funding for companies from EMEA tipped just over $100m in 2020, but this remains far less compared to the Americas and Asia.

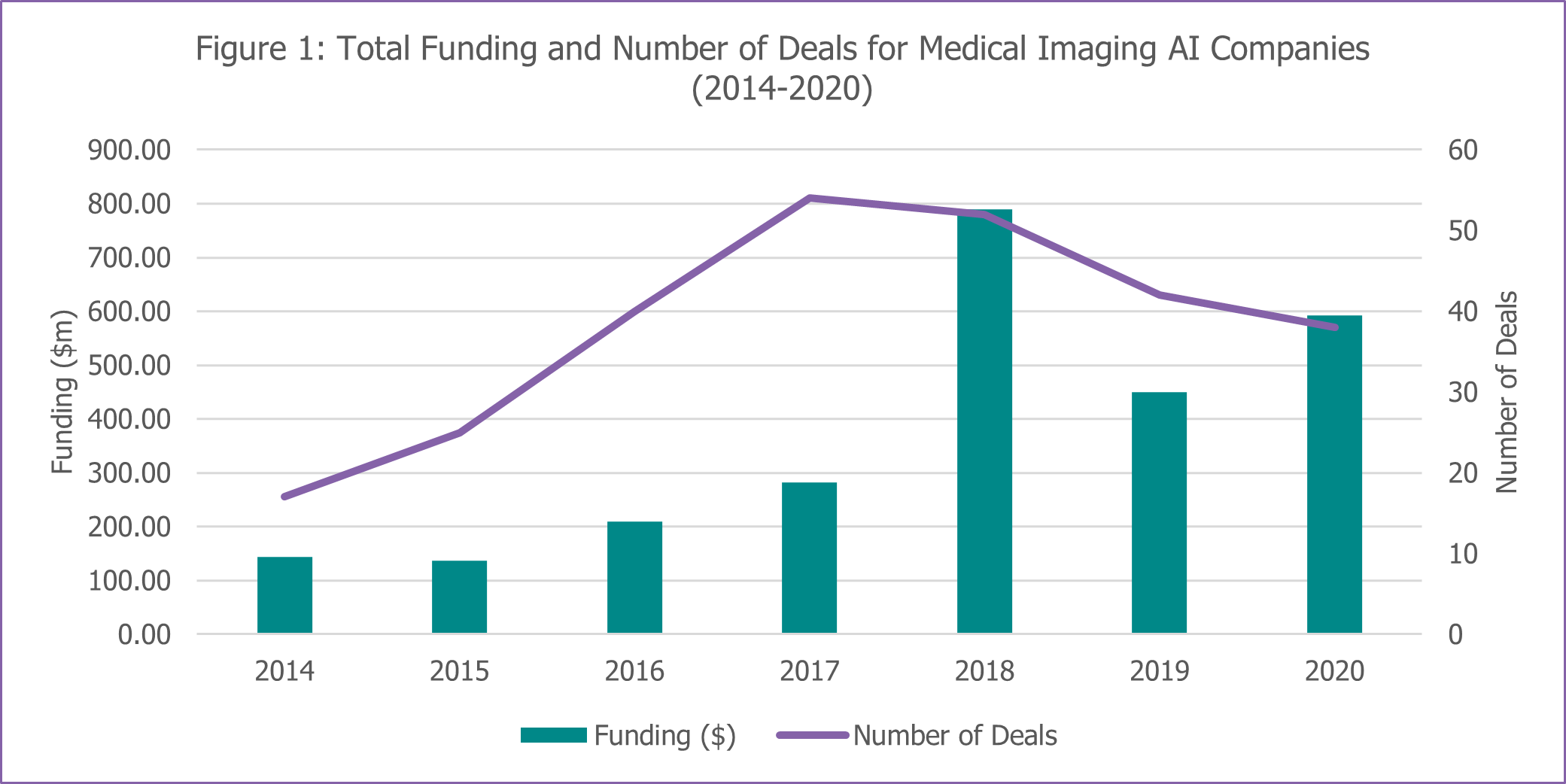

Funding for medical imaging AI companies peaked in 2018 at $790m (see Figure 1: Total Funding and Number of Deals for Medical Imaging AI Companies), a year after the peak number of new entrants to the medical imaging AI market (30 companies in both 2016 and 2017 respectively).

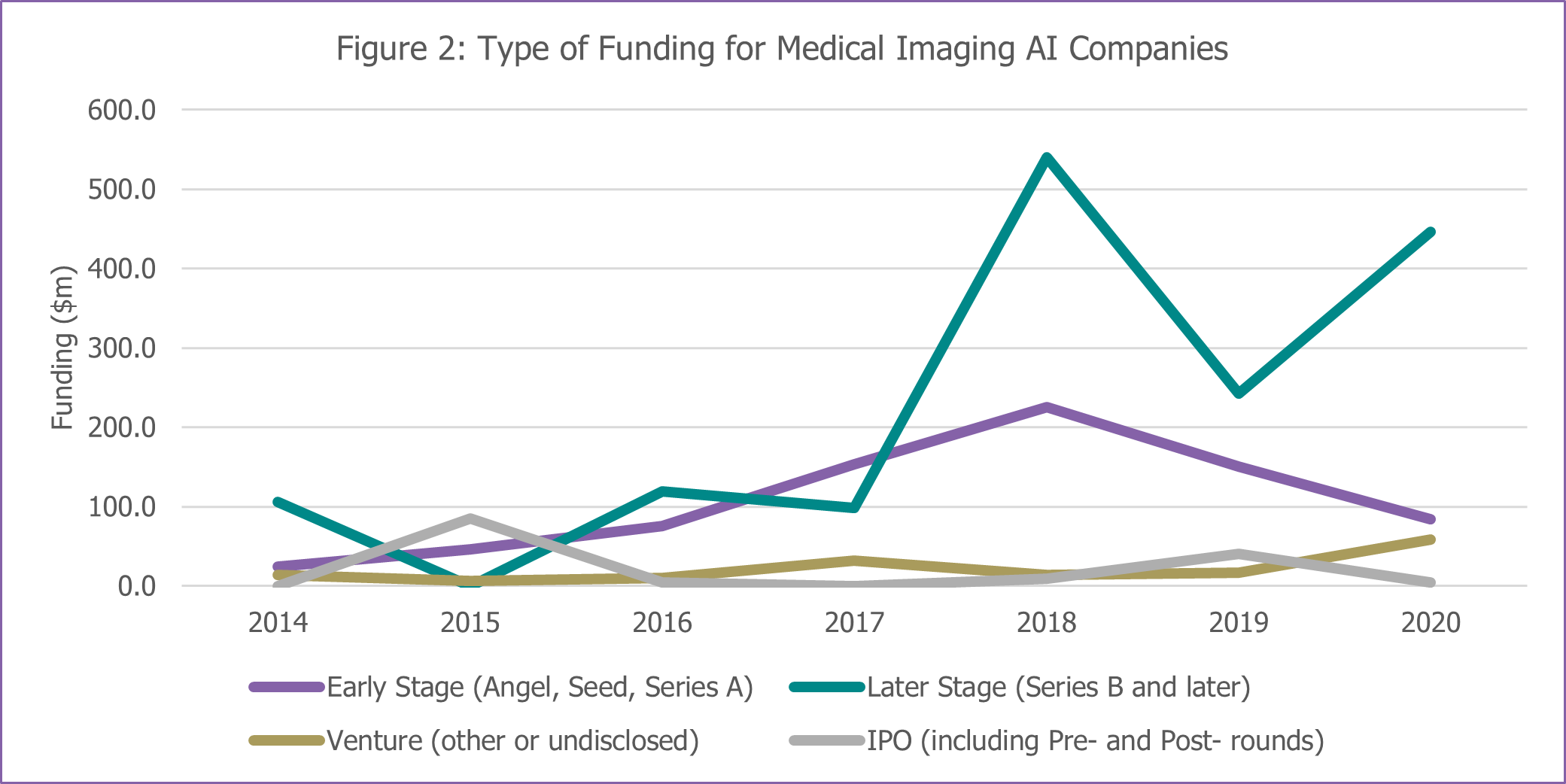

Since 2018, there has also been a notable shift in the type of funding medical imaging AI companies received (see Figure 2: Type of Funding for Medical Imaging AI Companies). Early-stage funding (Angel, Seed, Series A) peaked in 2018 at $225m, but this was dwarfed by the $541m for later-stage funding (Series B onwards), which was largely accounted for by HeartFlow’s Series E funding round ($240m).

Excluding HeartFlow’s large Series E, later-stage funding is still greater than early-stage funding in 2018 and the trend has continued. This suggests recent investments have favoured the growth of existing companies, rather than nurturing new ones, making it more difficult for start-ups to secure funding to enter this increasingly competitive market.

HeartFlow remains the most successful company in terms of investment raised, totalling almost $500m, but over the last couple of years three companies from China (Shukun Technology, DeepWise, and Keya Medical) have crossed the coveted $100m mark for funding raised.

As an alternative to pursuing new venture-capital investment, a handful of medical imaging AI companies have filed for an IPO. Some of the more established companies, such as iCAD (NASDAQ, USA), Volpara (Australian Securities Exchange), Median Technologies (Euronext Growth Paris, France), and Intelligent Ultrasound (FTSE AIM, UK), have previously carried out IPOs and more recently South Korea’s JLK went public in December 2019 and Vuno followed suit at the end of February 2021 with a $33 million IPO. We expect to see more companies pursue IPOs in the coming months and years.

Summary of the Key Findings:

- Over 185 companies are developing machine learning (AI) solutions for medical imaging.

- The total funding raised by medical imaging AI companies is $2.6 billion across 268 deals since 2014.

- $9.72 million was the average size of a funding deal for this period.

- Since 2014, companies from the Americas raised the most funding ($1.07 billion) followed by Asia ($973 million) and EMEA ($543m).

- 75% of the total investments raised by medical imaging AI companies is accounted for by the top 25 most funded companies.