High-acuity clinical information system (CIS) battleground: Best of Breed versus EHR

11 April 2023 – Contribution by Arun Gill – Featured in Circle Square Digital Health Trends – March 2023

Where do opportunities exist?

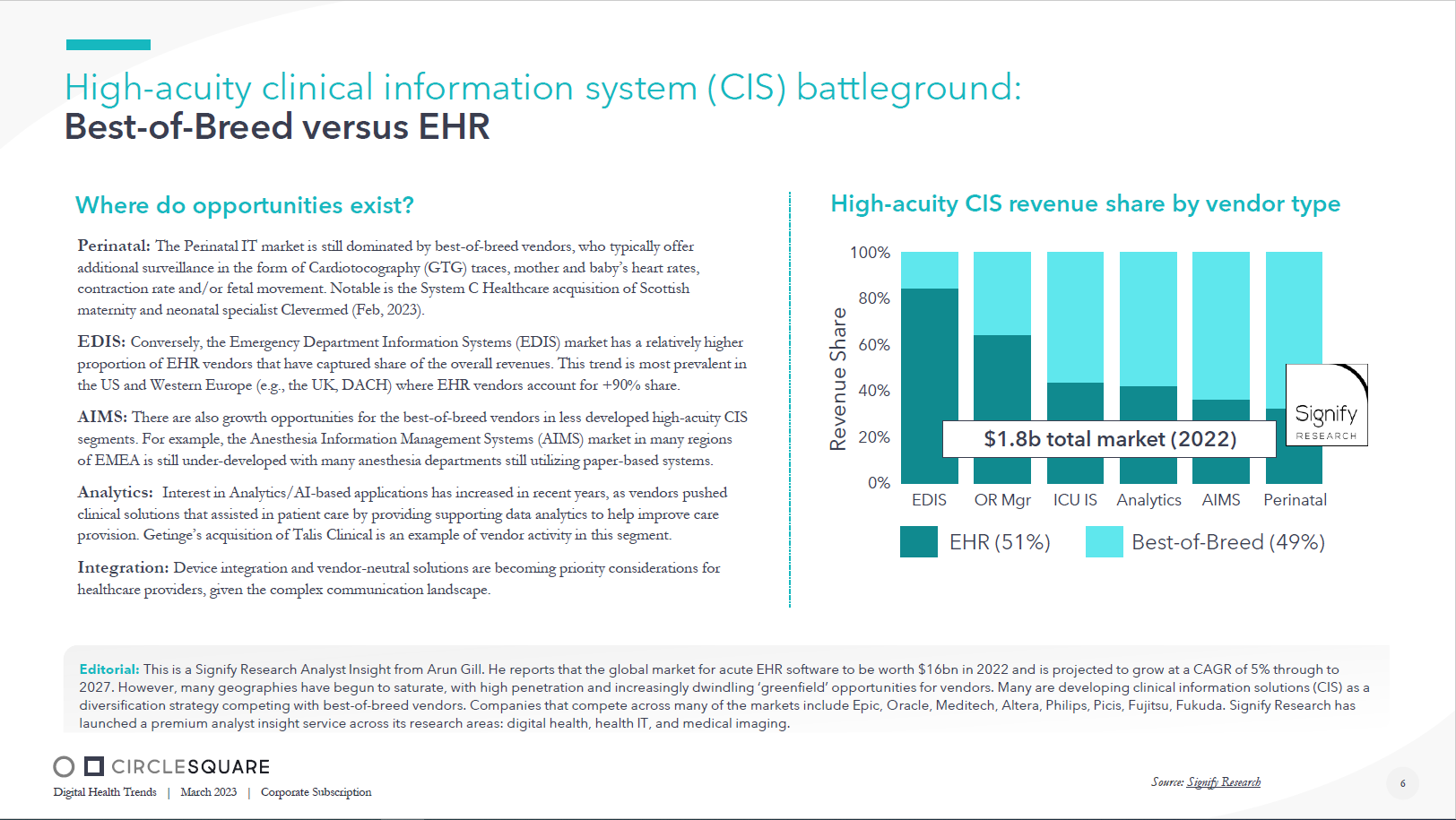

Perinatal: The Perinatal IT market is still dominated by best of breed vendors, who typically offer additional surveillance in the form of Cardiotocography (GTG) traces, mother and baby’s heart rates, contraction rate and/or fetal movement. Notable is the System C Healthcare acquisition of Scottish maternity and neonatal specialist Clevermed (Feb, 2023).

EDIS: Conversely, the Emergency Department Information Systems (EDIS) market has a relatively higher proportion of EHR vendors that have captured share of the overall revenues. This trend is most prevalent in

the US and Western Europe (e.g., the UK, DACH) where EHR vendors account for +90% share.

AIMS: There are also growth opportunities for the best of breed vendors in less developed high acuity CIS segments. For example, the Anesthesia Information Management Systems (AIMS) market in many regions

of EMEA is still under developed with many anesthesia departments still utilizing paper based systems.

Analytics: Interest in Analytics/AI based applications has increased in recent years, as vendors pushed clinical solutions that assisted in patient care by providing supporting data analytics to help improve care

provision. Getinge’s acquisition of Talis Clinical is an example of vendor activity in this segment.

Integration: Device integration and vendor neutral solutions are becoming priority considerations for healthcare providers, given the complex communication landscape.

Editorial: This is a Signify Research Analyst Insight from Arun Gill. He reports that the global market for acute EHR software to be worth $16bn in 2022 and is projected to grow at a CAGR of 5% through to 2027. However, many geographies have begun to saturate, with high penetration and increasingly dwindling ;greenfield’ opportunities for vendors. Many are developing clinical information solutions (CIS) as a diversification strategy competing with best of breed vendors. Companies that compete across many of the markets include Epic, Oracle, Meditech, Altera, Philips, Picis, Fujitsu, Fukuda. Signify Research has launched a premium analyst insight service across its research areas: digital health, health IT, and medical imaging.

Source: Signify Research