Epic is expected to enter the German EHR market and CGM buys m.Doc

2nd June 2023 – Contribution by Arun Gill – Featured in Circle Square Digital Health Trends – May 2023

Epic market entry

Software multinational SAP’s late 2022 announcement that it would cease supporting Oracle Cerner’s i.s.h.med EHR solution by 2030 required a swift and decisive response from Oracle Cerner.

The DMEA 2023 conference would have been an ideal location to reassure Oracle Cerner’s German customers, although no major announcement was made. Epic, keen to break into the German EHR market, and CompuGroup Medical SE & Co. KGaA (CGM), eager to secure a greater slice of the German hospital EHR pie, are two of several vendors waiting to swoop at the expense of Oracle Cerner.

CGM acquires m.Doc

CGM, the leading DACH EHR vendor in revenue terms, continued its acquisitive foray by obtaining a majority stake in patient portal provider m.Doc GmbH. The move is partly driven by CGM’s strategy to benefit from Germany’s Hospital Futures Act (KHZG), which is

supporting digital healthcare projects via 4.3 billion of funding.

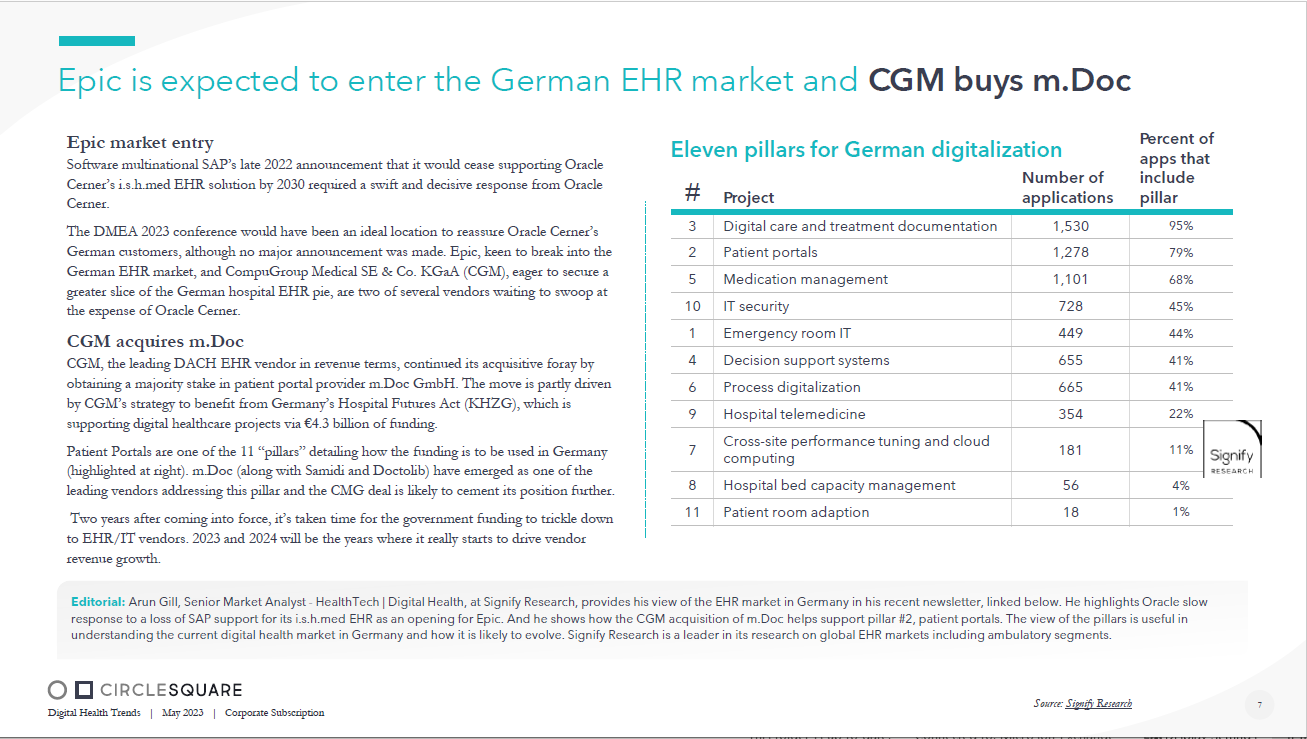

Patient Portals are one of the 11 ‚”pillars‚” detailing how the funding is to be used in Germany (highlighted at right). m.Doc (along with Samidi and Doctolib) have emerged as one of the leading vendors addressing this pillar and the CMG deal is likely to cement its position further.

Two years after coming into force, it’s taken time for the government funding to trickle down to EHR/IT vendors. 2023 and 2024 will be the years where it really starts to drive vendor revenue growth.

Editorial:

Arun Gill, Senior Market Analyst – HealthTech | Digital Health, at Signify Research, provides his view of the EHR market in Germ any in his recent newsletter, linked below. He highlights Oracle slow response to a loss of SAP support for its i.s.h.med EHR as an opening for Epic. And he shows how the CGM acquisition of m.Doc he lps support pillar #2, patient portals. The view of the pillars is useful in understanding the current digital health market in Germany and how it is likely to evolve. Signify Research is a leader in it s r esearch on global EHR markets including ambulatory segments.

Source: Signify Research