Written by

25th November 2022 – As detailed in our recent Global Remote Patient Monitoring (RPM) report, the RPM market is set for a period of robust growth, as healthcare providers look to technology to deal with the aftermath of the Covid pandemic against a backdrop of spiralling costs and dwindling resources.

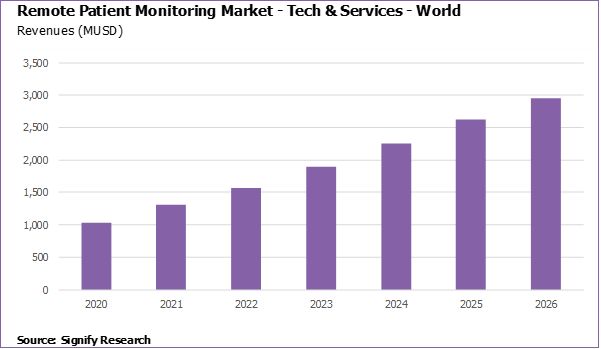

Increased fiscal and political commitment from governments, the implementation of reimbursement frameworks, and larger structural shifts in healthcare are all driving the market forward; revenues from RPM technology and service provider sales are projected to grow from $1.31B in 2021 to $2.95B in 2026. Just as crucial for growth, however, will be how RPM vendors and practitioners are able to navigate its integration into existing clinical workflows, particularly in disjointed health systems where the costs and benefits of adoption are not evenly distributed.

Follow the money

In the US, by far the most advanced market, RPM has been used by the US Department of Veterans Affairs (VA) for nearly 20 years. Outside of the VA health system, the CMS’s introduction of reimbursement codes for RPM in 2019 and 2020 has boosted the market, though not to the extent that some had predicted. Initially restricted to patients with chronic conditions, coverage was expanded to include patients with acute conditions in response to the Covid-19 pandemic. In a similar vein, the Acute Hospital Care at Home (AHCaH) initiative was launched in November 2021, allowing Medicare-certified hospitals to treat patients with inpatient-level care at home.

Concerns have been raised that the reimbursement model, in its current guise, risks RPM being deployed for more commercial than clinical motives, but there is no denying it has stimulated the market. Longer-term, however, the shift to value-based-care and population health management models, in the US and elsewhere, will be the primary driver of the market (more on which later).

Outside of the US, support for RPM, be that in the form of statutory health insurance linked reimbursement or government contracts, remains sporadic. Germany introduced a reimbursement framework for digital health apps (DiGAs) in 2019. The scheme has not been without its critics, who cite a narrow focus on patient reported – rather than device recorded – data, issues around pricing models and a general lack of uptake from the population at large. France is due to finalise its own RPM-specific reimbursement policy during 2022, though what impact the current political impasse in the country will have on this remains an open question.

Where healthcare procurement is controlled by a single payer (i.e., government), national or regional tenders are driving RPM use. At the onset of the pandemic, the UK’s NHS – which had been exploring RPM pre-Covid – quickly established a Virtual Covid Wards program to remotely monitor patients upon discharge from hospital. Further virtual ward expansion is on the agenda, with NHS England recently calling on all forty-two of its Integrated Care Systems (ICSs) to create an additional 24,000 virtual ward beds by December 2023. In Australia, state-wide contracts have been issued for RPM of Covid-19 and other conditions, while several large regional contracts have (or are due) to be awarded in Sweden.

More than just a tech-platform

Given the precarious state of health systems around the world, now would seem an opportune time to step-up the roll-out of RPM. However, as is well known, technical efficacy is only the first step on a much longer journey towards technological acceptance and adoption. How will the new technology – RPM in this case – fit into existing ways of working? Who will be responsible for identifying suitable patients, onboarding, and keeping them engaged for the duration of the RPM program? Will clinicians have the bandwidth, in addition to their existing duties, to monitor and act upon the reams of additional data that RPM will generate?

Recognising these significant potential impediments to adoption, many RPM platform vendors offer an array of services in addition to platform access, particularly in the reimbursement-driven independent primary care practice market in the US. Here, the vendor charges the clinician on a per-patient-per-month basis for a full turnkey ‘RPM-as-service’ model encompassing patient identification, onboarding, engagement, and monitoring. The clinician, in turn, claims reimbursement back for each patient enrolled on the platform directly from the CMS. These additional services are less de rigueur in larger US health systems, which have more clinical and technological reserves to draw upon, but they are still a common feature.

In markets where the public sector dominates, such as the Nordics and the UK, the outsourcing of clinical services remains controversial (something that The Lancet’s recent paper on outsourcing in the NHS is unlikely to temper). That said, RPM programs in these geographies are typically on a far smaller scale than those in the US and it remains to be seen if, considering severe clinical resource constraints, the demand for outsourced monitoring services picks up as RPM numbers rise.

We believe that the bundling of clinical monitoring services with RPM platform access will remain an integral feature of the market, continuing to be demanded by buyers of RPM solutions across the provider, payer, and employer landscape. For providers, the outsourcing of monitoring and other ancillary services (e.g., coaching) for less complex, lower-acuity patient populations to RPM platform vendors will free them up to prioritise more acute and complex patient cohorts. For RPM platform vendors targeting the payer and employer markets, who lack the inhouse clinical expertise of providers, these additional services are a fundamental component of the overall value proposition.

A fragmented, fluid vendor eco-system

The RPM platform vendor market itself is highly fragmented, both within and between countries. Few vendors have reached anything approaching significant scale, baring a handful of (mostly) US-based vendors. Elsewhere, markets remain discreet entities where domestic suppliers dominate, though some vendors have achieved significant international expansion, be that via acquisition, partnership or on under their own steam.

There has also been a steady flow of new market entrants, another characteristic of an immature market. Aggressive growth projections coupled with a (until recently) buoyant funding landscape, the shift to virtual care and remote working ushered in by the pandemic, and specific policy interventions such as reimbursement are all fuelling this.

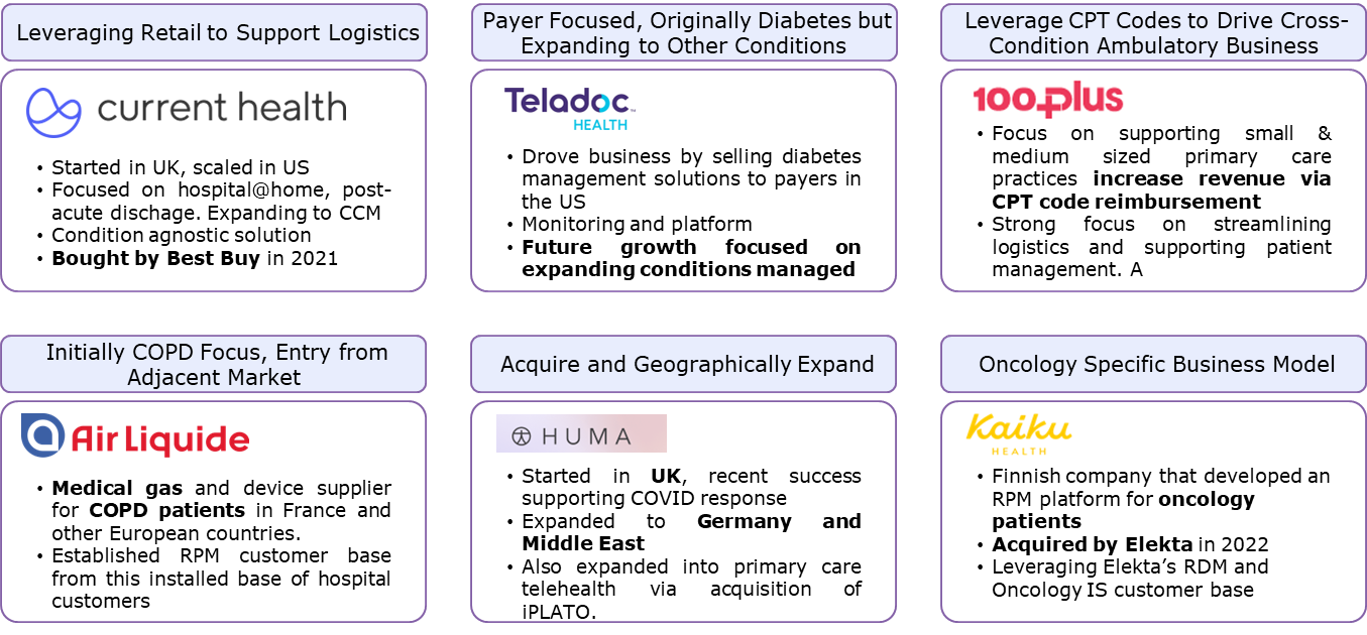

To further highlight its fragmented and fluid nature, consider the numerous branches of industry that have converged upon the RPM market. While telehealth, medication adherence and clinical trials may seem obvious bedfellows for RPM, companies with interests as diverse as telecommunications, consumer electronics, and medical gases are all participating in the sector. A small sample of the plethora of routes to the RPM market is given below:

Despite this variation, common themes in the market are beginning to emerge, such as the provision, by platform vendors themselves, of additional services including patient enrolment and platform monitoring services, as alluded to earlier.

Another noticeable pattern is a divergence in the market between vendors specialising in the monitoring of specific conditions, often using in-house proprietary devices, and condition and device agnostic platform vendors. In the case of the latter, some previously condition-specific platforms have already started adding new condition workflows – particularly around co-morbidities – to their platforms, citing provider demands for less point and more enterprise-scale solutions.

For condition-specific vendors, the downside of a curtailed total addressable market (TAM) is offset by the higher barriers to entry that specialisation necessarily entails. Maintenance of these barriers, however, will be contingent upon continuing R&D investment and a best-of-breed standard of product and service delivery. For those competing in the device and condition-agnostic segment, competition will intensify as the market matures towards saturation. Consequently, we expect the pace of M&A and other partnerships to accelerate in the medium-term.

Towards population health management

The biggest long-term driver of the RPM’s acceptance and adoption will arise from broader trends taking place within healthcare towards more integrated models of care delivery and population health management.

This shift has been underway for some time, with varying degrees of success, whether in the creation of Accountable Care Organisations (ACOs) in the US, Territorial Professional Health Communities (CPTS) in France, or the Integrated Care Systems (ICSs) established under NHS England (the latter of which became statutory bodies at the beginning of this month).

While regional details may vary, the grander vision is more consistent. In this reimagined system, providers must, through the judicious use of technology, offer the highest standard of care possible within the constraints of a finite budget per-patient. Interoperability of patient data and clinical workflows between a health system’s various constituent parts is a fundamental underpinning of this transition. The end goal is a healthier population, requiring less complex and costly treatments from healthcare facilities.

Applied correctly, RPM could become a key tool in this undertaking. Take the US, where diabetes claimed over 100,000 lives in 2021 and costs upward of $25 billion annually in hospital readmissions. Giving clinicians the tools to remotely monitor, manage and engage large cohorts of patients with diabetes and other chronic conditions may go some way to putting a dent in these appalling numbers.

Key take-aways for vendors

RPM platform vendors cannot rely on the principle of a rising tide lifting all boats but must carefully consider the intricacies of their target markets and adapt accordingly. Key operational issues to consider include integration with existing clinical workflows and health IT systems, and the provision of additional services such as patient enrolment and platform monitoring. Growth strategies will also need refining as the market matures towards a replacement model, monitoring technologies continue to improve, and health systems continue to evolve towards more integrated models of care.

About the Report

Remote Patient Monitoring – World – 2022 provides a data-centric and global outlook on the current and projected uptake of RPM. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK. To find out more: enquiries@signifyresearch.net, T: +44 (0) 1234 436 150, www.signifyresearch.net

More Information

To find out more:

E: enquiries@signifyresearch.net,

T: +44 (0) 1234 436 150