Written by

Huma, a UK-based Remote Patient Monitoring (RPM) platform provider, recently announced its acquisition of iPLATO Healthcare, a major supplier of patient engagement software to primary care organisations throughout the UK. While not as prominent as other recent healthcare deals, such as Oracle’s purchase of Cerner or IBM Watson’s recent sale, Signify Research believes the deal is indicative of broader trends in the digital health sector and merits further analysis.

This is the latest deal in a flurry of M&A activity involving RPM companies over the last 12 months. In the UK, RPM vendor Docobo was snapped up by System C, a leading health and social care software company, in November 2021. In the US, over the course of 2021, Boston Scientific acquired Preventice Solutions, Connect America bought 100Plus, while Hillrom acquired a number of RPM companies before its own acquisition by Baxter. More recently, Resideo, itself spun-out of Honeywell in 2018, sold its LifeCare Solutions RPM business to Clear Arch Health. Interestingly, Huma’s deal appears to be one of the rare cases in which the RPM company is the buyer rather than the seller.

Huma and the RPM market

Huma is a digital health company whose RPM platform is widely used within the EMEA healthcare and lifesciences sectors for remotely monitoring both primary and acute care patients and supporting participants in clinical trials. The investment community is clearly bullish on the company’s prospects, having ploughed over $250 million into Huma since it was established in 2011, $130 million of which came from investors including Bayer, Hitachi, Samsung, Sony and Unilever in a single funding round in May 2021. In February 2021 The Financial Times named Huma as ‘Europe’s fastest growing healthcare company’.

Huma’s RPM solution has already been deployed to remotely monitor Covid 19 patients, and those with chronic conditions, in 15 NHS organisations across the UK, as well as in Germany and the UAE. Plans are afoot for further expansion into India and France.

The NHS has been cognizant of RPM’s enormous potential benefits, such as reduced hospital readmission rates, for some time. In 2016 it set an ambitious target of being able to offer RPM services to 25% of people suffering with chronic conditions by 2020 (although it ultimately fell well short of this target). Its virtual Covid wards, of which Huma has been a significant participant, have played a crucial role in alleviating some of the burden that has been placed on the NHS during the pandemic. In December 2021 the NHS announced plans to treat 15% of Covid patients remotely.

Further afield, France began experimenting with RPM through its ‘Etapes’ programme in 2018 and is expecting to introduce reimbursement structures to support the wider adoption of RPM during 2022. Similar initiatives are underway in Germany, under its 2019 Digital Health Act. In the United States, the world’s largest healthcare market, RPM has been reimbursed under The Centers for Medicare & Medicaid Services (CMS) since 2018. Certain restrictions around the use of RPM were further lifted as part of a broader package to stimulate the uptake of telehealth services as Covid initially broke during 2020. At the federal level, 17 states now require commercial health insurance plans to cover RPM.

iPLATO and the primary care virtual care market

iPLATO’s patient engagement software, on the other hand, is used in nearly 3,000 NHS primary care organisations, encompassing 26.6 million patients. Its myGP app is one of the most downloaded medical apps in the UK, with 1.7 million active monthly users.

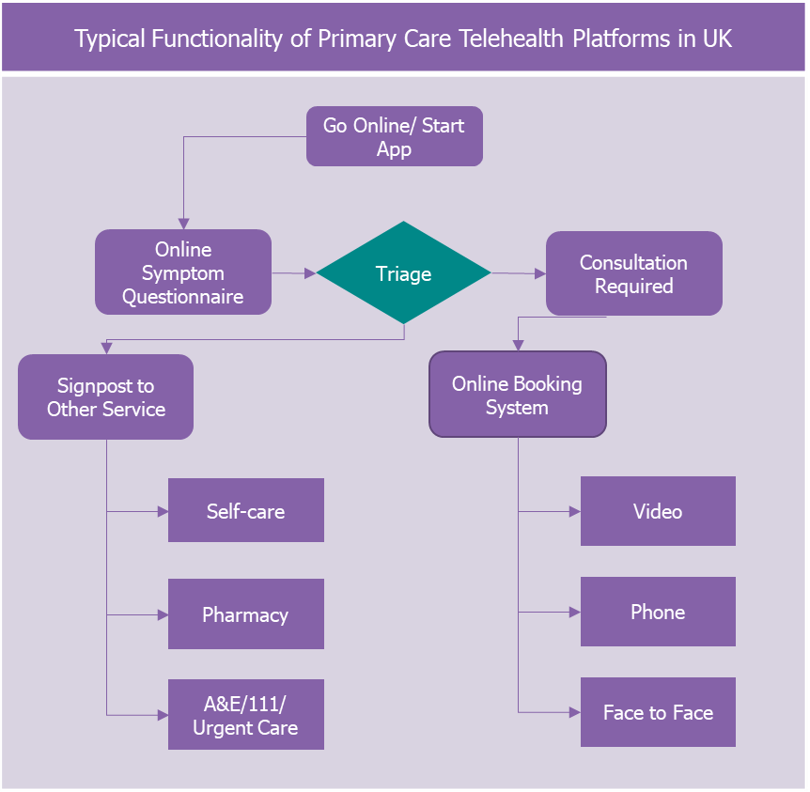

Primary care providers in the UK are reimbursed on a capitation basis (i.e. a flat fee based on the number of patients within a GP practice’s catchment area). Thus, primary care platforms, provided by companies such as iPLATO, are expected to provide a broad range of functions beyond simple video consultations to include triage, patient education and self-help tools, and potential signposting to third-party providers. A schematic overview of these capabilities is presented in the diagram above.

While the pandemic has no doubt accelerated the digitisation of primary care across the UK, many of the foundations for this had been laid in the preceding years. iPLATO’s initial breakthrough came in 2018 when its platform was purchased by eight NHS clinical commission groups (CCGs), using funding provided via the GP Forward View framework. The company’s market position was given a considerable boost in mid-2021 when it was awarded a central NHS contract, to the tune of ¬£3.5 million ($4.8M), that allows all GPs in England to access its platform (two other vendors, eConsult and EMIS, were awarded similar contracts). At the time of writing, iPLATO’s share of the primary care virtual care market in the UK is estimated to be between 30%-40%.

What the deal means for Huma and iPLATO

As a consequence of this acquisition, Huma now finds itself as a top-three vendor in the markets for both RPM and the primary care virtual care, with ample opportunity for cross-selling to both. No other vendor straddles both markets from such commanding heights. iPLATO’s leading position in the UK primary care market presents a highly lucrative opportunity for Huma to roll-out its RPM offering which, up until now, has predominantly been used in acute care settings (barring some Covid-related primary care projects).

On the flip side, iPLATO can now leverage Huma’s NHS Acute Trust customer base to capture a share of the acute care virtual consultation platform market, a market that appears to be open following the non-renewal, in 2021, of incumbent vendor Attend Anywhere’s national contract to supply outpatient virtual care solutions across England. This contract had been valued at £4.9 million ($6.7M) at the time of its issuance in 2020.

In the longer term, the merger potentially opens up international markets to iPLATO where Huma has an established footprint. Germany, where Huma has already deployed RPM for Covid 19 patients, appears a case in point because its fee-for-service model in primary care has, thus far, stymied the development of more sophisticated primary care platforms (most solutions are largely focused on just providing a video platform). Entering the German market will not be easy for iPLATO; there are currently over 30 authorised platform vendors, meaning it is very much a displacement market. However, its solution is well atuned to the evolving needs of the digital health space in Germany, giving it a fighting chance of success.

Perhaps most significantly, Huma will also be acquiring iPLATO’s omni-channel patient engagement capabilities, currently utilised for a variety of tasks ranging from encouraging attendance at cancer screenings to promoting the uptake of flu or Covid 19 vaccines. The effectiveness of an RPM programme is underpinned, to a large extent, by the initial willingness of patients to enroll in it and their subsequent ability to remain engaged with the platform for the required period of time. It is not difficult to see the attraction here from Huma’s point of view.

What the deal means for the broader RPM and healthcare markets

An entity combining Huma’s RPM capabilities with iPLATO’s virtual primary care offering gives a tantilsing glimpse into the future provision of integrated healthcare; where the traditional gaps between primary, acute and social care can be bridged with the aid of digital technologies. The NHS is already moving in this direction, with the establishment of 42 Integrated Care Systems (ICSs) across England. Digital platforms that can, among other things, facilitate patient engagement, RPM and triage, will be cruciual to this transition.

The shift towards integrated care, the pandemic and ongoing advances in technology all support the continuing adoption of RPM going forward. Huma’s acquisiton of iPLATO is the latest in a series of deals that illustrates this trend. As the market matures over the short-to-medium term, it is unlikely this will be the last RPM deal we cover.

Related Reports

Signify Research will be assessing the global RPM market in its forthcoming (end March 2022) report: Remote Patient Monitoring – World – 2022 The report provides a regional and global outlook on the current and projected uptake of RPM solutions, developments in the regulatory environment and the evolution of the capabilities and features of RPM platforms. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the specific markets.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

More Information

To find out more:

E: enquiries@signifyresearch.net,

T: +44 (0) 1234 436 150