Written by

Cranfield, UK, February 2023 – The infusion pump market has gone through a period of accelerated product development in recent years, with the COVID-19 pandemic injecting the much-needed momentum to spur interest in clinically advanced solutions. Signify recently assessed the global market for infusion pumps, dedicated sets and associated software solutions in its report Infusion Pumps – World – 2022. Here we dive deeper into the trends that are developing within the market and will be affecting future product dynamics.

Connected digital solutions are the focus

The COVID-19 pandemic has had a lasting impact globally, with economic recession seen in all countries. Inflation also remains at an all-time high, resulting in a tightening of financial conditions. Hospitals are having to be savvier in their spending patterns, and as such there is increased demand for more cost-effective solutions that help to improve the level of patient care and safety to reduce unwanted errors and subsequent unnecessary costs. Healthcare systems have now refocused efforts to improve both clinical and cost efficiency, to help reduce the burden on resources.

The pandemic is expected to further encourage hospitals to develop hospital-wide infrastructure to improve care provision moving forward. This will expediate demand for connected infusion solutions, that can communicate with both IT solutions and associated devices used in the patient pathway. The main aim will be to improve workflow and cost efficiency, reducing some of the pressure on nurses and physicians.

Reimbursement heavily relies on the level of care provided. As such, healthcare systems need to ensure solutions guarantee the safety of the patients. Medication errors continue to challenge healthcare systems; in 2017, the WHO estimated the annual cost of medication errors to be $42 billion. Through its Global Patient Safety Challenge on Medication Safety, The WHO pledged to reduce this by 50% by 2022. Consequently, integrated drug error-prevention software (DERS) continues to be of high importance, enabling decision support feedback in the form of alerts for entered doses that are too high or too low compared with standard concentration parameters.

Smart pumps are the new normal

Consequently, smart infusion pumps have now advanced to not only reduce adverse drug events, but also to enable centralised data management through their connection with the central information systems utilised in hospital. As such, it is now standard for all infusion pumps to be ‚Äòsmart’, with the majority of purchasing requirements stating the need for DERS in addition to connectivity and interoperability.

With growing demand for centralised infusion systems, the ability to enable safe and effective drug management is also increasing, enabling automated infusion within the set limits within the drug library. Solutions have also been developed to enable continuous administration of critical drugs through automated programming, that reduces programming time. The smoother transition also contributes to fewer alarms to also help improve the patient experience.

Historically, smart pumps were mostly used in developed regions, but interest in emerging countries with advancing healthcare systems is also increasing. Additional developments in the infusion software market include:

- Inclusion of additional analytics that enable more informed decision making, with the overall aim to increase cost efficiency.

- Bi-directional communication with both the EMR and other devices to provide real-time information and allow automated programming.

- Remote patient viewing that can also provide remote control of infusion pumps to reduce the need for a clinician to attend the patient as frequently.

Product recalls continue to hinder market players

However, with the increasing use of software and use of ‚ÄòSMART’ pumps the number of infusion pumps being recalled is increasing. In the last three years, the infusion market has faced a total of six major product recalls, with software being at the crux of five of these. The long, drawn-out and costly processes required to correct the underlying issues, and the length of time product shipments are halted has a huge impact on the affected vendors’ sales. With safety specifications at their highest, the infusion market continues to be a difficult place to compete. However, with few alternatives to provide medication and fluid delivery, the infusion giants (such as with Baxter, BD, ICU Medical) see the benefit in taking the rough with the smooth. Recalls are expected to continue but will also highlight the importance of ensuring solutions are rigorously and routinely checked for any safety defects.

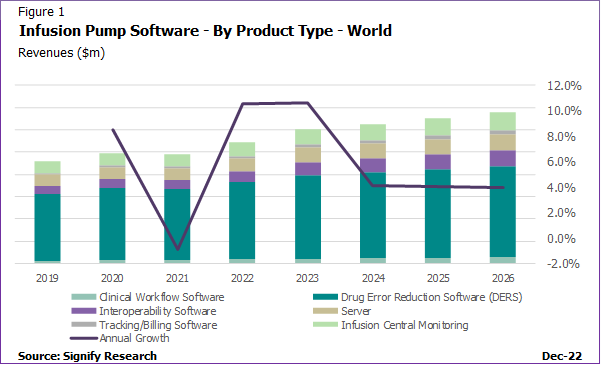

Outlook for Infusion Pump Software

In 2021, drug error reduction software (DERS) was by far the largest portion of software revenues globally. With most vendors now incorporating DERS into the infusion pump, the use of DERS has spread to emerging regions. Prior to the pandemic, remote access to devices was already an emerging trend. However, the pandemic has also highlighted the severe lack in healthcare resource and staff shortages in the most critical of care settings. This has driven the need to protect both the patients and the healthcare staff and subsequently the demand for solutions that reduce the need for person-to-person interaction if it is not absolutely necessary. The ability to access patient data quickly and effectively has been a driving force in the adoption of infusion central monitoring solutions, enabling a quicker alert to action patient requirements. The infusion central station monitoring segment was the second largest market in 2021 and is projected to remain so through to 2026. Overall, the infusion software market is projected to have the fastest revenue growth of all infusion solutions, above that of the pump and dedicated set markets. With increasing use of connected solutions, it will be important for infusion vendors to ensure their software solutions can not only guarantee improved patient safety at the bedside but are also cybersecure from potential data hacking.

About the Report

“Infusion Pumps – World – 2022” provides a data-centric and global outlook of the infusion pumps, dedicated sets and associated software markets. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK. To find out more: enquiries@signifyresearch.net, T: +44 (0) 1234 436 150, www.signifyresearch.net

More Information

To find out more:

E: enquiries@signifyresearch.net,

T: +44 (0) 1234 986111