Written by

Earlier this month saw the announcement that telehealth technology provider Avizia had acquired Carena, a Seatle-based virtual care provider. The deal marks Avizia’s first steps into directly providing physician support services; at the same time it highlights a wider trend seen across the telehealth industry of platform and hardware vendors offering physician support services to complement their technology offerings. Here’s our take on the deal.

Avizia’s Telehealth Offerings and Business

Spun out of Cisco in 2013, Avizia has become a leading provider of enterprise-scale telehealth platform and hardware solutions. Its products are used by more than 480 health systems, mainly in the US, but with deployments in 38 countries. Historically the company has performed well addressing the acute telehealth market, supporting largely high-acuity clinical applications such as stroke management and behavioural health. Increasingly its customer base has expanded to address telehealth demands in lower-acuity settings such as care transition, rehabilitation services and rural care. Although the company has offered solutions that allow a provider to offer branded direct-to-consumer telehealth applications, this has been less of a focus for Avizia. Avizia signed a strategic partnership with MLS Telehealth in January 2017 allowing it to address physician support service demands of its customers.

Carena’s Telehealth Offerings and Business

Founded in 2000, Carena designs and operates virtual health clinics for health systems. Its solutions are targeted at health systems that are looking to deploy on-demand virtual clinics as an extension to their existing services. Carena provides the platform, integration, marketing and physician support services that allow a provider to roll out a branded virtual clinic. More than 120 hospitals have deployed Carena’s solution. Its physician support services are staffed by a team of board-certified nurse practitioners and medical doctors who specialize in providing medical care in a virtual setting. These providers are licensed across a number of states including Arizona, California, Georgia, Illinois, Iowa, Kentucky, Missouri, Nebraska, Oklahoma, Oregon, Pennsylvania, Washington and Wisconsin.

What’s Avizia Gained and What are Its Challenges

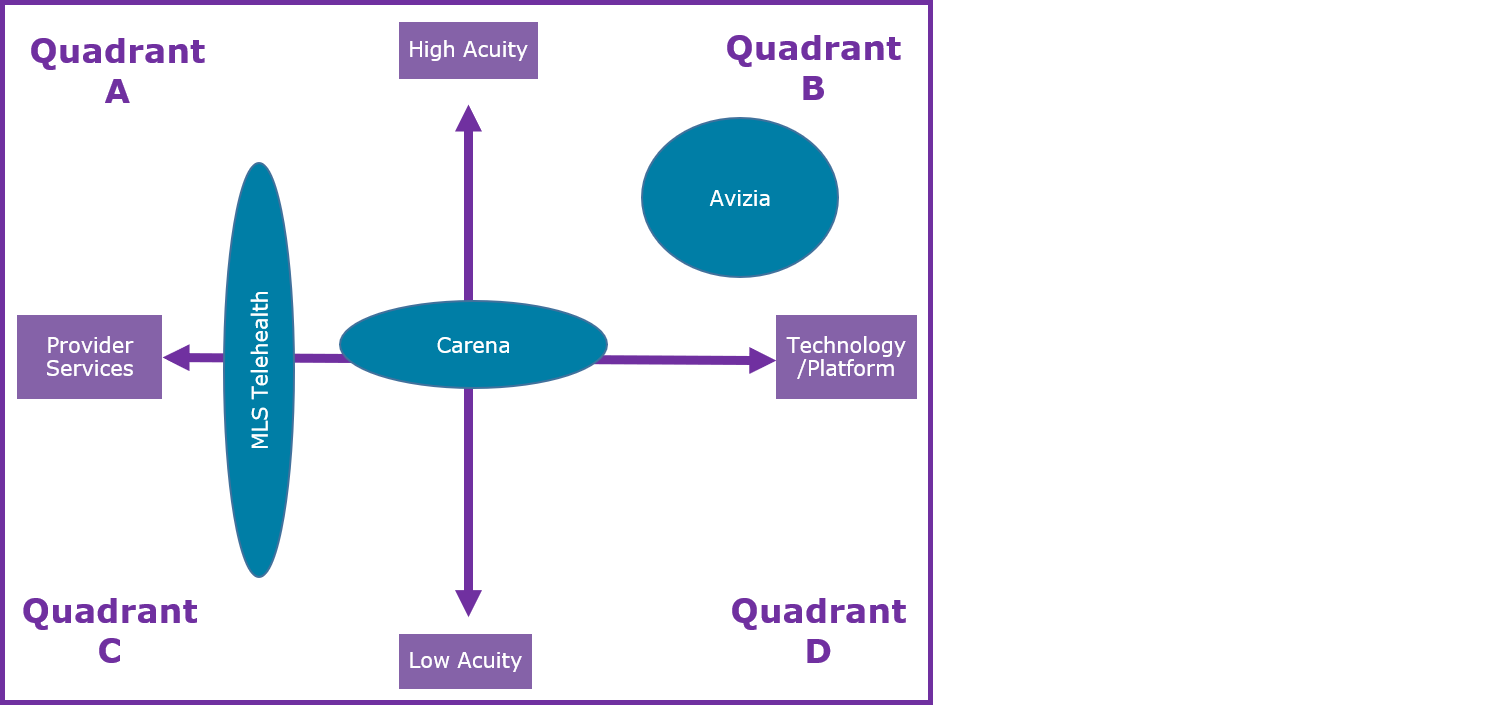

The diagram below shows pre-acquisition where Avizia sat in terms of the range and types of services that are offered to the telehealth market. The diagram segments the market into

Quadrant A – High-acuity service provision

Quadrant B – High-acuity technology provision

Quadrant C – Low-acuity service provision

Quadrant D – Low-acuity technology provision

Avizia was very much focused on high-acuity technology provision (Quadrant B). Its partnership with MLS Telehealth earlier in the year allowed it to also address high-acuity service provision (Quadrant A). However, this “strategic partnership” approach kept the company focused internally on platforms and hardware, without being pulled into the intricacies and legislative demands of becoming a provider. In acquiring Carena, it moves it firmly into the services quadrants and into lower-acuity technology provision (Quadrant D), offering direct-to-consumer, on-demand solutions.

In terms of potential gains, the Carena acquisition exposes Avizia to a whole new revenue stream in the form of physician support services, whilst bolstering the range of offerings for the needs of health systems. Increasingly its main competitors in high-acuity technology provision (Quadrant B), such as Philips and InTouch Health, have also added physician support services to their portfolios. The move into the direct-to-consumer, on-demand segment also opens up new revenue opportunities for the company at lower-acuity levels, although its an area that’s already relatively crowded. Carena operates slightly higher up the acuity ladder than some companies in the lower quadrants, such as Teladoc and DoctorOnDemand; in many ways it acts as a signposting, support and referral service to higher-acuity clinical services. So while the deal allows Avizia to move down in terms of acuity, it’s not so far down that it’s completely out of context with its legacy brand.

The deal does present challenges though and marks a change in direction for the company towards addressing the physician support services market. To-date Avizia has been a hardware and software technology provider. Its strategic relationship with MLS was the first step to moving into one of the provider services quadrants, but a strategic relationship is very different to actualy being an operator of physician support services itself, as outlined below.

For example, the state by state provider registration and licensing requirement differences in the US are a significant hurdle for service providers. This is amplified when expanding the model into different countries around the globe. Doing so across a range of conditions will be an even more difficult prospect. The fact that Carena has licensed providers in a number of states already has allowed Avizia to get a “leg up” in terms of this process and the acquisition brings with it the expertise to expand this geographic footprint. Furthermore Carena specialises in supporting on-demand episodic urgent care for acute conditions, which aligns well to Avizia’s focus on providing platforms for acute and urgent care settings. Therefore, the physician support service expertise can be kept relatively focused on addressing this requirement.

That-being-said, the strategic partnership approach it had originally taken with MLS may well have offered a less risky route to addressing this market. Others, such as Reach Health, have come to this conclusion. However, the fact that companies such has InTouch Health had made the jump into physician support services may have meant a similar move for Avizia was too hard to resist.

Other Quadrant Movers and Shakers

Avizia’s acquisition of Carena is one of a number of recent acquisitions from telehealth technology vendors and service providers making the jump from one of the above quadrants to another. InTouch Health’s acquisition of telehealth service providers C30 Medical Corporation and AcuteCare Telemedicine (ACT) earlier in 2017 represented a similar horizontal jump from high-acuity technology provision (Quadrant B) to high-acuity service provision (Quadrant A). Teladoc’s acquisition of Best Doctors in June 2017 was an example of a company making the a vertical move from low-acuity service provision (Quadrant C) to high-acuity service provision (Quadrant A).

In terms of moving vertically there are a number of challenges. When moving down to lower levels of acuity, high-acuity vendors and service providers face the challenge of a much more competitive market and one that is likely to become increasingly commoditised. Differentiation will become an increasing challenge as will competition in terms of pricing. However, the specialist expertise required to support these services tends to be much less demanding. Therefore, although barriers to entry can be lower, desiging a profitable business model at lower levels of acuity is a much greater challenge. This is illustrated well if you take the example of Teladoc. It managed to generated $123M in revenues offering services in lower-acuity markets in 2016, but still operated at a net loss.

Moving to higher acuity presents its own challenges too, as a greater depth of expertise in supporting complex clinical conditions is required, as are closer relationships with health systems. Barriers to entry when moving up the pyramid therefore tend to be more complex, but the returns in terms of profitable business models can be much greater.

Moving horizonally on the diagram brings a different set of challenges. Being a health care service provider demands an extremely different set of internal skills to offering a software platform or technology solution (e.g. the state by state licensing of providers mentioned earlier). Furthermore, the broad range of specialisms required to address the plethora of conditions that could potentially fall under the remit of a “telehealth service” means that any attempt to expand into service provision is a huge undertaking. The partnership route, originally taken by Avizia, means that platform providers can instead focus on their core compentency and leverage capacity and specialism where needed, without having to develop it in-house. However, the demand to remain competitive in terms of offering the full portfolio of products and services in house appears to be driving an increasing number of vendors to make horizontal moves.

About the Report

The information presented in this insight sets the scene for Signify Research’s upcoming market report “Acute, Community and Home Telehealth – 2017 Edition”. This report will present the market for telehealth platforms, hardware and services and will include projections and market sizings for more than 20 countries.

The report is available as a stand-alone product, but it is also a component of Signify Research’s newly launched “Population Health Management and Telehealth Service”. This is a year-round service that provides ongoing data, insights, and analysis on the global population heath management and telehealth markets. The service includes four market reports delivered over a 12-month period, regular updates of key market metrics, competitive environment and market share analysis by product type and region and quarterly analyst briefings to each subscriber firm.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

To find out more:

E: Alex.Green@signifyresearch.net , T: +44 (0) 1234 436 150

www.signifyresearch.net