Written by

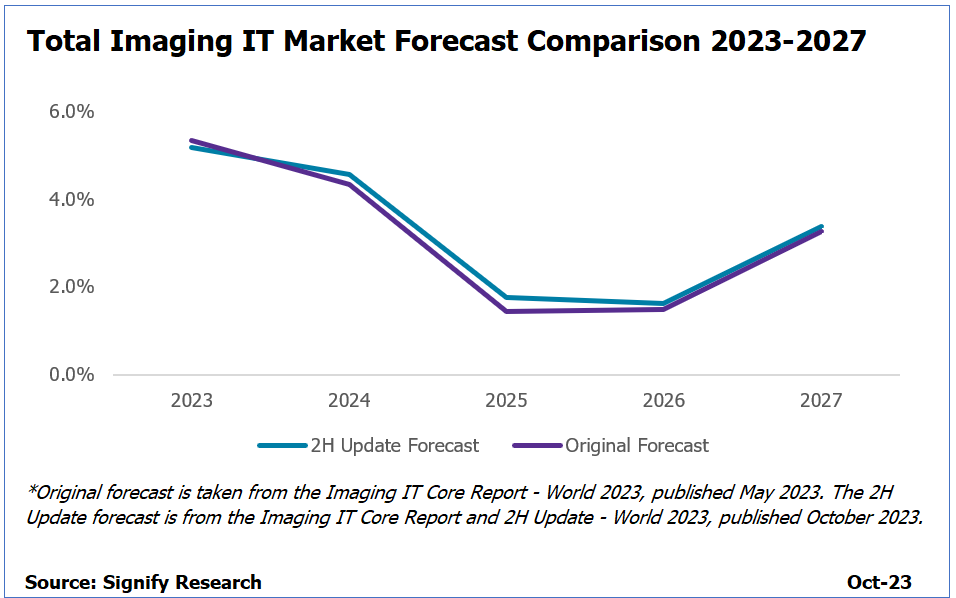

31st October 2023 – Cranfield, UK – Provider investment in imaging IT has continued despite previous caution associated to economic headwinds, with vendors reporting strong pipelines heading into 2024. Signify Research’s global imaging IT forecast witnessed a small adjustment, with our original forecast anticipating a 5.3% growth in 2023 (published in May 2023), compared to 5.2% growth now expected from our latest research, following 1H sentiment from vendors.

The graph below compares Signify Research’s original forecast from May 2023 to our latest report, Imaging IT Core Report and 2H Update, published October 2023.

Opportunities and short-term pipelines are strong in the USA market; the radiology IT renewal market is in full swing with the tail-end of renewals expected to lead continued demand into 2024. Beyond North America, investment has renewed with growth expected short-term in markets such as Brazil and China following a slow-down in 2022, as well as momentum building across the Middle East with strong investment in digitalisation and advanced technologies such as AI. Additionally, deals in markets such as Australia are evolving, with a greater emphasis on enterprise deals outside of radiology, with the first state-wide contract awarded for cardiology IT in 2023. The slight downturn in Signify Research’s 2023 forecast for the imaging IT market is due to the slow down across Western Europe, with the impact of larger, more complex deals lengthening deal cycles.

Mid-term however, the growth dynamic across the global imaging IT market shifts, from mature markets to emerging markets. With the next 5-year plan in China expected in 2026 and anticipated to drive further digitalisation, alongside the next cycle of private equity investment following the rebound of the Chinese economy, China is predicted to be a mid to long-term growth engine. Similarly, the economic boom forecast in India alongside Latin America and ASEAN will begin to shift vendors outlook for growth., However, the key question will be, which vendors can adapt to capitalise on these opportunities?

The Importance of Demonstrating Value

Short-term, whilst mature markets offer vendors a chance to grow, investment observed is aligned with refining business models, product bundling, integrating partners in additional specialties and leveraging advanced technologies proficiently within the platform offering to differentiate in the market.

The emphasis on longer-term strategies such as cloud, enterprise imaging and AI have returned to the forefront of provider discussions post-pandemic. However, as providers manage stretched operating margins, worsened by inflation, and continued CMS reimbursement cuts in markets such as the US, alongside a global shortage of radiologist staff, coupled with those employed increasingly under pressure and experiencing burnout, investment into new platforms and technologies will be under greater levels of scrutiny. As a result, efficiency and productivity remain a fundamental driver in vendor selection, but with emphasis on proving the value and ROI of the product.

As imaging IT vendors seek partnerships or acquisitions to meet the growing demand for a cloud-native, multi-speciality enterprise imaging platform with AI orchestration, value cannot be overlooked. Not only the value the core platform offers, but the end-to-end offering. Imaging IT vendors need to evaluate partners on multiple levels; technical compatibility, customer overlap and opportunity, as well as independent value generated by the tools, products, or architecture. For the wider ecosystem, vendors have already begun transitioning messaging, with cloud vendors positioning additional cloud services to optimise the technology deployment or cost-effective storage offerings. Additionally, AI ISVs increasingly leveraging the larger capital funding rounds raised to conduct clinical trials to demonstrate real-world health-economic benefits of adopting the technology.

Preparation for Mid-Term Growth

Whilst customer use-cases will promote value across mature markets, vendors also need to evaluate how the business will continue to grow once atypical renewal cycles and EU funding slows, with markets across North America and Western Europe forecast to slow 2025-2026.

Whilst mature markets slow, growth across the imaging IT market is expected to be led my countries such as China, India, as well as across the Latin American, Middle Eastern and ASEAN regions. Product investment and overall dynamic of emerging markets can differ quite significantly, although there are pockets of enterprise imaging in markets such as Thailand, Turkey, Mexico, alongside momentum in AI slowly increasing. However, the influence of these advancements is significantly less in emerging markets, as in most instances, price and a local presence (either direct sales and service teams or a local reseller) is the deciding factor in contract awards.

In order to prepare, vendors must first evaluate established relationships as well as which markets (if any) are the right strategic fit. Does the company have existing partners in the region in which it can leverage, or business infrastructure? What are the market dynamics such as evaluating how IT is sold? Is it bunded with hardware? What features or tools do providers in that given market prioritise when selecting a vendor?

Although emerging markets offer higher growth prospects, these markets are much smaller in comparison to the US for example, and often have higher risk profiles. However, in an increasingly saturated market which is already witnessing components of the ecosystem being commoditised, the opportunity versus risk will be one that each vendor needs to evaluate carefully.

Prioritisation for Success

Despite the economic headwind and uncertainty felt amongst imaging IT vendors and providers heading into 2023, the market remains robust. As such, product innovation is back in full swing with the year, offering a multitude of partnerships (both for AI and enterprise imaging) and the expectation of new product releases at RSNA 2023.

Imaging IT vendors are thus at a pivotal stage; whilst they cannot take their eye off the tail-end of the replacement cycles in mature markets and sizable investments being made throughout Europe, mid-term strategies for growth cannot be left too late. For future success, prioritisation will be essential.

About Amy Thompson

Amy joined Signify Research in 2020, and is now the Research Manager for Healthcare IT, focusing on imaging and clinical IT, AI in medical imaging and teleradiology. Prior to that, she brings four years’ experience as a Senior Analyst; supporting business strategy and market sizing.

About the Medical Imaging / Imaging IT Team

Signify Research’s imaging IT service provides expert market intelligence and detailed insights across radiology IT, cardiology IT, and advanced visualisation IT, alongside operational workflow & business intelligence tools. Combining primary data collection and in-depth discussions with industry stakeholders, our thorough research approach yields credible quantitative and qualitative analysis, helping our customers make critical business decisions with confidence. Throughout the course of 2023/24, the imaging IT team will be further assessing developments in the market through its’ Imaging IT Market Intelligence Service.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net