Written by

Co-authored with Imogen Fitt

Healthcare is innovating at such an incredible speed that it can be difficult to keep track of and assess which start-ups, products and innovations are most likely to impact healthcare and healthcare businesses in the short-midterm – Our forthcoming project, Digital Precision Medicine – World – 2024’, will offer insight into how investors and healthcare companies should approach and prioritise different emerging markets, including digital twin software which is the focus of this insight. It will also evaluating the emerging digital technologies driving precision medicine in healthcare, including genomics, artificial intelligence and digital therapeutics amongst other tools.

However, when considering cutting edge technology, the first challenge is how to define a new product type. We therefore begin by asking: what is a digital twin?

The Framework

Digital twins are replicas produced in a digital environment used to simulate effects. When applied to healthcare settings they come tailored to many specific situations, and can be modelled on cells, tissues, organs, patients, medical devices, care units, departments, entire hospitals, or wider healthcare ecosystems.

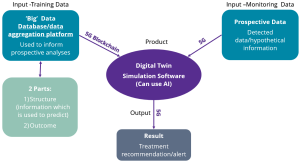

The components of a digital twin are summarised in figure 1 below:

Figure1: A digital twin is simulation software fed by ‘big data’. Hypothetical/screening data is then input into the system and used to predict results of an action.

The software component of a digital twin can employ a range of analysis techniques, with some being rather simple and others advanced. Computer vision, natural language processing, machine learning, deep learning and generative AI are all examples of techniques which can be used to create a model. Each model must be specifically written for a unique purpose using individual training data and so in practice due to the substantial number of potential applications and data types across healthcare these models vary considerably today.

Some potential benefits to using digital twins in healthcare can include:

- Inform and improve patient care by simulating the effects of interventions on specific organs or individuals.

- Enable more effective patient engagement through allowing patients to interact with models regarding lifestyle changes.

- Predict and minimise adverse events in vast populations, such as the likelihood of pandemics, or even individual events like heart attacks.

- Support equipment maintenance and logistics, through flagging when and where demand may increase.

- Improve education programmes through providing trainees more examples to practice techniques on.

- Speed up development timelines for therapeutics through improving product design and trial success rates.

To summarise, at its simplest the digital twin can be defined as a set of algorithms trained by input data which can be fed a hypothetical scenario to produce a predicted result which is designed to be as close to ‘reality’ as possible.

But with the number of potential applications, and therefore products, being so vast where should investors and collaborators focus their attention on in the short term?

Polishing the Surface

Differentiation and value proposition between digital twins will always be somewhat unique to all potential stakeholders. For example, a medical imaging equipment manufacturer is much more likely to derive short-term benefits from digital twins designed to support the function and maintenance of the equipment it produces, compared to digital twins designed to simulate the effects of a drug on a candidate (where a pharmaceutical company might make more use of it).

Table 1 provides a summary of the many places across healthcare digital twins could be applied and offers some insights relevant to commercialisation in each.

| Segment | Use | Commercial Notes |

|---|---|---|

| Clinical Diagnosis and Treatment Planning? | Virtual Organs | Can help simulates a procedure or intervention. Requires less data than full-body software, but vendors often only address one organ today as development can be complex. Often vendors sell concurrently to MedTech or life science firms. Heart, brain, and liver has received the most interest. |

| Predictive Medicine | Forecasting how a person ages, when illnesses appear, what course they take, and what the most effective treatment is. Often requires more complex data to be more effective, this data is not simple to get, and start-ups must either structure their own data or limit the size of training pools. It can be as focused as predicting reactions to radiotherapy in oncology (simpler to develop), or complex like predicting an individuals’ health in the future (incorporates many diseases and ‘what-if’ scenarios). These solutions will take significant effort to gain regulatory approval to be used in clinical settings to inform patient care. | |

| Drug Discovery | Clinical Trials Supplementation/ Patient Matching | Data generated by DTs could reduce long patient recruitment processes or simulate control arms. Unlearn.ai for example used digital twins to simulate patient trajectories for Alzheimer’s disease and multiple sclerosis. This application also relies on large datasets to make results more reliable but has a lower barrier to entry than clinical markets as a screening method. Most models use small datasets today and vendors are focused on common diseases. |

| Virtual Organ/Tissue/ Cell/Genome |

Helps simulate preclinical tests and is intended to understand disease pathology/drug responses more effectively. Modelling at the cellular level can be extraordinarily complex, but the preclinical segment represents a lower barrier to entry and could achieve commercial success sooner. Vendors may have to prospectively collect data to inform the model and will rely on ‘omics. | |

| Operational | Demand forecasting | Helps ward/hospital management. Most likely to impact clinical care at scale sooner as there is a lower barrier to entry. HealthTech vendors with large installed bases at a significant advantage. Business analytics software can help facilitate these solutions, and there is some risk of commoditisation. |

| Adaptive Personalised Patient Engagement | An example is Babylon’s AI Healthcheck, which is a chatbot digital twin covering 20 diseases and offering a five-year forecast. This information won’t impact clinical care but will encourage lifestyle changes and patient interaction. Telehealth providers in particular will be able to leverage this solution, however the software is already offered free by Babylon and is most likely to be commoditised. |

As is shown above, there are many ways digital twins can impact healthcare, and whilst it can be hard to differentiate between all the solutions out there, there are some general lessons that can be applied across the spectrum.

- Digital Twins designed to simulate operational requirements will likely scale quicker.

Digital twins for operational analyses are perhaps the most prolific form of digital twins used today in healthcare today. Whilst these products can’t be considered common by any means, the vendors focused on these types of products also tend to be much larger and commercially mature than start-ups. This implies that such solutions will be able to scale in deployment to existing customer bases more easily.These tools can be used to help with forecasting across equipment fleets, hospital departments or entire neighbourhoods, and generally involve being able to monitor a sequence of events that drive supply and demand. By highlighting inefficiencies and prompt improvements at ‘failure points,’ this can have operational implications on equipment capacities, staffing, and care delivery models.

Siemens Healthineers is one example of a multibillion-dollar HealthTech giant that is involved in developing operational solutions. For example, it has partnered with Mater Private Hospital in Dublin to improve their radiology operations. In 2019 the partnership released a whitepaper revealing that Siemens and Mater had performed an overall assessment of the current operations and used this information to simulate potential improvements to workflows, which ultimately led to reduced waiting times, faster patient turnaround, and lower staffing costs for MRI and CT scans.Such outcomes make the return on investment for digital twins in this operational context immediately clear, which means that solutions are more likely to be accepted and thus purchased by decision makers. These types of solutions also don’t need to seek regulatory approval, a significant barrier faced by other types of solution which increases the cost of development.Other multibillion-dollar HealthTech giants such as Philips and GE Healthcare have also made similar investments in recent years, with GE Healthcare’s Hospital of the Future Simulation Suite designed specifically for modular use in healthcare, allowing healthcare institutions to incrementally model an ED, then add the OR, then an entire the hospital; before adding further hospitals into a network.These products have sparked attention from several significant healthcare players, but because these vendors already have such large installed bases with which to get a head start on commercialising solutions, there is limited opportunity for new blood to enter the scene and impact competitive dynamics. - Physiological digital twins will have a higher barrier to entry for clinical use and can vary in complexity.

The human body is so intricate that we haven’t begun to touch the surface of understanding it fully. However, there are some things that we do know well, such as structural components for example.One popular area of focus in digital twins is organ modelling. An example which is attracting a lot of attention recently lies in cardiac care, where computer simulation is increasingly being viewed as an essential design tool by cardiac device and services companies. In these scenarios, digital twin software can help visualise and predict the impact of new techniques and solutions for surgical intervention. These can help inform designs and reduce costs associated with prototyping and testing, allowing companies to get products and services to market faster.One such company helping provide these kinds of solutions is PrediSurge, a French start-up which offers PlanOp™ for MedTech, digital twin software designed to simulate cardiac interventions. This allows the company to address both the life sciences and clinical markets, which is advantageous as it can start generating incoming whilst collecting the necessary evidence to achieve regulatory approval and scale its clinical use.Many others are also working to develop similar software. Siemens Healthineers for example is developing a digital twin of the heart to improve drug treatment and simulate cardiac catheter interventions. European startup FEops is another vendor which has received its first regulatory approval and commercialised the Feops Heartguide platform in 2019. The company also has solutions tailored to MedTech and clinical environments and offers physicians insights to evaluate device sizing and positioning pre-operatively.Other popular areas of research include liver and brain models, with the European Commission investing €38M in an EBRAINS 2.0 project which will push forward digital twin approaches through modelling and simulation.One thing to note is that each organ often has unique complexities which can impact development, causing starts-ups and larger HealthTech vendors to be less likely to invest in multiple development projects at a time!Some start-ups are approaching the physiological space more aggressively. Qbio, for example, is ingesting any type of information about the human body. This reportedly includes genetics, biochemistry, imaging, quantitative anatomical data, vitals, wearable data, medical, family & social history and more. Its Gemini product automatically structures this data and is intending to provide its customers personalised health forecasts with recommendations for change. This is no small feat; the company is concurrently developing a scanner, digital twin and foundation model that will be integrated into a turn-key offering. With ~35 staff according to its website, it is likely that this will take some time.As is frequent in healthcare, the applications targeting the ‘lowest hanging fruit’ often contain the most saturated clinical environments. But are there any common barriers vendors face which can be used to assess potential?

Fog on the Glass: What are the Barriers?

Because digital twins are in essence the same structure, shown previously in Figure 1, there are four common barriers vendors will face when trying to develop and commercialise solutions:

- Accurate Models Require High Quality Data – Which is in Short Supply

Software designed to predict outcomes requires vast amounts of high-quality longitudinal data, which is not commonly available today across healthcare and life sciences.

For operational purposes this can often be collected prospectively using business analytics tools, which requires significant investment but is not impossible. Similarly, cell and tissue studies may be able to take advantage of high throughput processing used in drug development to accumulate data quickly.

But where clinical data is concerned, there is a lot more difficulty, as it is often unstructured and hard to process in large volumes. Structuring this data into machine-readable content can often require significant effort. For some rare diseases there will also be an acute shortage of data due to the smaller populations of patients receiving care.

Some vendors may be able to partner with academic institutions, which generally have more structured and rare data types available. In addition, there are a growing number of vendors, such as Medexprim, Epic and Flatiron, with data aggregation platforms designed to aggregate and structure clinical data across healthcare networks and even provide access to third parties. Some cloud vendors have similar offerings to support structuring data as part of an organisation’s migration to cloud infastructure.

- Patient Privacy Concerns Can Inhibit Data Collection

Patient privacy is a particularly sensitive topic today, and with regulations like HIPAA and GDPR in place, vendors must not misstep when dealing with data, especially if it is being used in external settings. This issue becomes particularly acute when live databases are used, and although advanced techniques like federated learning have been offered as a solution, the nascent state of these technologies inevitably will contribute to the slower uptake of related solutions.

- Regulatory Hurdles, Legislation Around AI is Still Unclear

Following on from this, there are significant regulatory challenges, especially when AI is concerned. Regulatory authorities are already grappling with the challenges associated in governance of AI, and digital twins use a number of emerging technologies that make oversight difficult. For this reason, there are few clinically orientated digital twins approved for us by the FDA today, which limits confidence from customers and stymies addressable markets.

- Digital Twins are Linked to Several Emerging Technologies and Trends

Infrastructure is a significant rate limiting step to the adoption of digital twin software, which will dictate how quickly these solutions can be deployed at scale. Across healthcare, cloud architecture, 5G networks and blockchain implementations are few and far between, and it is ultimately these technologies which will pave the way for larger and more complex models to be implemented.

As was shown in Figure 1, digital twin software can utilise adjacent technologies such as 5G infrastructure, which enables faster and more reliable connectivity, and blockchain which can help ensure data integrity. Both these technologies support the use of live databases to keep training data continually supplemented, which should also contribute to improving the model’s accuracy. However, both aren’t very common in healthcare settings today, which has a corresponding impact on where digital twins can be implemented successfully at scale.

Whilst for some simpler use cases, such as cardiac digital twins, implementation is possible today, as software is used more and demand becomes higher, vendors will inevitably experience challenges. Cloud-based solutions have been adopted slowly across healthcare due to provider concerns around costs associated, patient data and the security.

The Reflection – What are the Key Takeaways?

Although many of the digital twins discussed in this insight are still at the earliest stages of commercial maturity, activity is still bustling in the sector. Pilot sites are in place and data is being collected which can help raise the business case for further investments.

Solutions aimed at life science settings are likely to scale quicker, with organ and patient models also possessing the opportunity to make an entry to clinical markets later down the line.

For operational digital twins, the barrier to entry is significantly lower and uptake is likely to be quicker as return on investment is proven; however, this market also presents significant risk for new entrants.

In regard to patient outcomes, we may see the rise of digital twins coupled with value-based care. However as is the case with Babylon Health, these solutions are more likely to be commoditised into tele-health platforms.

Finally, whilst data access will be integral to early-stage development, route-to-market is expected to have a larger impact in the long term. Partnerships with HealthTech vendors will be integral to achieving quick commercialisation, and partnerships are expected to make or break vendors in the near-term. Digital twin company Sim&Cure have for example, partnered with multibillion dollar surgical vendor Medtronic to promote their Sim&Size pre-operative planning software. Considering Medtronic already has big business within this field, the medical device giant’s vouch of confidence is sure to help influence healthcare provider’s opinions as well as open the door to many commercial conversations for the smaller company.

In conclusion, digital twins have the potential to be impactful in a wide range of healthcare settings. Whilst the technology is still a long way from delivering a complete, lifelong, physiological model of a patient, there are solutions that are expected to impact the market in the near-term, with many opportunities.

About Alexandra Bream

Alex joined Signify research in 2023 as a market analyst in the diagnostics and life sciences area. In summer 2023, Alex graduated from the University of Birmingham with a first-class degree in Biochemistry.

About the Diagnostics and Lifesciences Team

The Diagnostics and Lifesciences team provides market intelligence and detailed insights on the multiple healthcare technology markets where the clinical world intersects with the preclinical. Our areas of coverage include digital pathology, laboratory information systems, clinical Real-World Data (cRWD) platforms, oncology information systems, tumour board software, oncology decision support software and radiotherapy IT. Each report provides a data-centric and global outlook of its markets with granular country-level insights. Our research process blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net