Written by

Against the turbulent backdrop of high inflation and sporadic economic recovery, the global CT market’s growth was more subdued in 2022 than in the mid-pandemic market of the previous year. Despite this, total sales of CT equipment surpassed $6 billion in 2022, and recent projections from Signify Research give cause for optimism over our 5-year forecast period and beyond. Burgeoning appetite for modern diagnostic imaging capabilities in emerging markets, the fundamental need for advanced procedures to deliver clinical precision in mature markets, and advancements in AI reconstruction and workflow optimisation tools will propel an estimated global revenue CAGR of 6.7% between 2022 and 2027.

The medium-term outlook has its blemishes, however. Workforce shortages and dampened economic conditions could disrupt replacement cycles in some significant regional markets. In this respect, the Russian market’s war-induced volatility represents perhaps the most egregious example. Ongoing trading tensions between China and the US also pose considerable risks for medical device supply chains, including CT.

AI-Empowered Workflows Primed to Take-off

Refining diagnostic accuracy, workflow and operational efficiency, and quality of care stand out as the most significant priorities for diagnostic imaging facilities in 2023. Hence, strains such as the limited availability of trained technicians and tightening budgets, made particularly stark by the pandemic, have accelerated the clinical adoption of deep-learning AI tools to augment workflow efficiency. Such augmented workflows improve patient throughput and diagnostic confidence by automating protocoling and promoting image consistency. The focal point of AI commercialisation continues to be facilitating enhanced levels of care in facilities where a lack of resources compromises care quality.

On the image reconstruction front, deep-learning algorithms can facilitate reduced radiation exposure and the ability to recover images in the event of scanning errors, promising to be a notable differentiator between OEM’s solutions in the future. In a move that may have set the industry standard, GE HealthCare’s TrueFidelity software is being increasingly deployed as part of its smart subscription model, emphasising consistent upgrades across a fleet of CT systems.

Although clinical studies on pre- and post-scan AI software are ever corroborating the value these solutions can provide, hesitancy amongst clinicians is currently prohibitive of widespread adoption. The desire for further clinical validation and demonstrated ROI means it will likely take years before AI software in CT truly ‘crosses the chasm’ (Medical Imaging AI Market Forecasted to Surpass $1.7 Billion by 2027).

The Coming Photon Counting Revolution

Steady penetration of commercial photon-counting technology promises to have a transformative impact on the CT market over the next 20 years. While vendors have actively engaged in research for nearly two decades, it was not until Siemens’ NAETOM Alpha gained FDA approval in 2021 that commercially available PCCT became a reality. Offering game-changing advantages over conventional detectors, including unrivalled spatial resolution, diminished radiation dosage, and low iodine contrast-to-noise ratios, photon counting will be considered the gold standard for advanced CT imaging procedures in the long term.

As it stands, penetration has been limited by unfavourable ROI linked to the considerable price tag and lifetime ownership costs. Though, the ‚Äòprestige’ derived from offering PCCT imaging to private payers has swayed some clinics to look beyond such concerns. Indeed, developing supply chains for cadmium telluride crystal, an essential component in the manufacture of PCCT detectors, will elevate the market outlook as equipment prices fall. Signify Research estimates that nearly 100 systems have been installed globally in clinical and research facilities.

The competitive landscape, too, promises to be an interesting dimension to the market’s evolution. Siemens’s closest rivals, GE HealthCare and Canon Medical, are still in the clinical evaluation stage of development, and it is not yet clear when their systems will enter the market. A lively debate around optimal detector materials is underway, with GE HealthCare determined to bring the first silicon-based detector to market.

Evolving Requirements and a Shifting Product Mix

The development of healthcare systems globally, including the expansion of primary care and digital infrastructure, ranks among the primary drivers of CT market growth over the forecast period. Aligning with these drivers is an evolving range of clinical applications, affecting not only for which procedures CT equipment is being used but also segment growth trends. Stimulating demand from the value-end of the market through to premium, materialising lung cancer screening initiatives, including those backed by the EU, will supplement CT market growth steadily over the next decade (Lung Cancer Screening Set to Reshape the CT Market, But Which Vendor Will Come Out on Top). Notable segment trends can also be discerned by geography. In emerging markets, the picture is mainly one of steady modernisation: demand for value CT systems is slowing and transferring to the mid-range as interest in versatile performance solutions swells. In mature markets, rising demand for advanced CT procedures is driving the premium segment’s growth. For instance, revisions to US and UK chest pain guidelines in the past few years recommend cardiac CT (typically above 64 slices) as a first-line test for CAD.

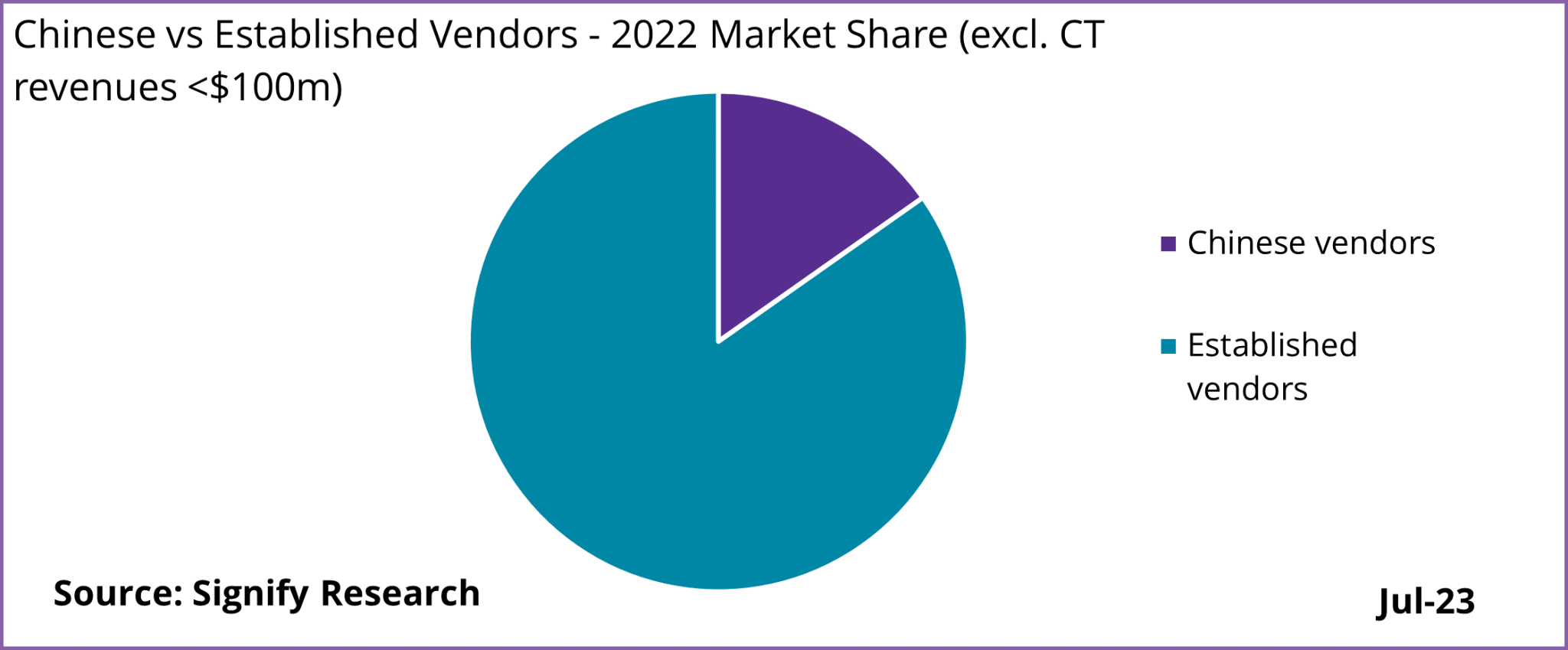

Chinese Vendors Poised for More Traction

While 2022 represented a lacklustre year for China-based vendors, owing mainly to disruption from local lockdown measures, the challenge they pose to established competitors will likely intensify over the medium term. In addition to steady market share gains domestically, United Imaging and Neusoft have made concerted efforts to break into new geographies in recent years. United Imaging, for instance, entered the US market in 2018, and its aggressive overseas sales strategy has recently netted the company novel installations in Western Europe. Critical to their success has been undercutting on price, without forfeiting technical features, and sizable government subsidies.

However, hurdles other than sustaining price erosion lie ahead if Chinese vendors wish to expand their global reach. One disadvantage is the gap in R&D spending between themselves and rivals Siemens Healthineers, GE HealthCare, and Canon Medical (SPI Medical Imaging: United Imaging: Self-Awareness and Strategic Dilemmas). Such a disparity leaves cutting-edge technological innovation out of scope and could see Chinese companies lose out as their peers continue to strengthen their photon-counting CT and AI offerings, technologies which could, provided the right amount of investment, heighten market expansion and lead to new clinical opportunities. Another more immediate barrier is a lack of brand awareness, credibility, and loyalty in mature geographies. This is further exacerbated by evolving purchasing models that increasingly include lifecycle support services for multi-modality fleets. A critical question for Chinese vendors in the near term is how to establish a reliable network of personnel to provide these services responsively.

Much More on the Horizon

A combination of both the expanded clinical and technological opportunities indicate a robust market outlook for CT equipment over the forecast period. In the medium-long term, the enduring clinical relevance of CT will likely be expanded upon as providers take advantage of PCCT and AI, particularly in already established markets. The Chinese market, the largest globally, is expected to see a decisive shift to mid-range and premium investment in the wake of recent licensing changes. Other trends to monitor include the growth of outpatient settings amid reimbursement challenges, market cannibalisation of other modalities, such as high-end DR, and the pace of CT-enabling infrastructure development in emerging markets, including imaging facilities and PACS architecture.

About Matthew Watson

Matthew joined Signify Research in 2022 as part of the Medical Imaging team. He holds a first-class MA degree in Economics, graduating from Heriot-Watt University in 2022, and previously worked as an intern at Unilever.

About the Report

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111