Written by

Information stored within medical image archives and clinical information systems has vast potential in Real-World Data studies, however, curation is labour-intensive and time consuming. As a primer for our new report, we explore the opportunity for technology vendors in providing platforms designed to unify and curate these resources with a key underlying question: What commercial opportunity exists for unified clinical data platforms?

Since hospitals first began digitising patient records, hospital IT has evolved into a menagerie of products documenting, analysing, and tracking patients throughout the course of their lives. Most of this clinical information is stored for the ‚Äòforeseeable future’ within Electronic Health Records (EHRs), Clinical Information Systems (CIS) and medical image archives.

The result is “mountains” of clinical data, which must be adequately managed and filed for future need. As research enters an increasingly “data-hungry” period, these siloed, data “mountains” have value beyond the diagnosis and treatment of individuals.

Digital records can, with new AI-based technologies, aid research in diagnosis, therapeutics, and health economics across a variety of applications.

The term for the data used in these types of studies is Real-World Data (RWD), defined during the scope of our study as “all health-related information collected outside of a randomised clinical trial”. This definition is generated partially from the FDA’s own criteria, combined with consensus amongst academic literature. The term RWD has become a “buzzword” in healthcare in recent years as excitement around interoperability and artificial intelligence has grown.

Data, Data, Everywhere; But Not Enough is Grab-and-Go

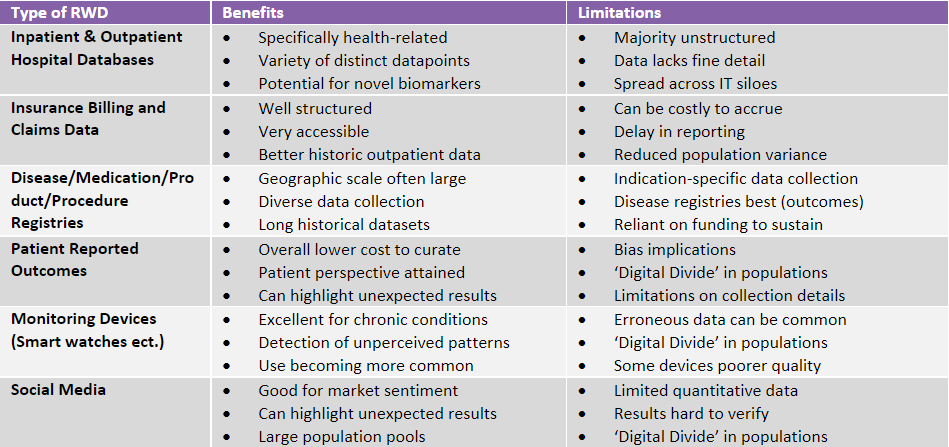

There are many types of RWD, and not all is gathered from an EHR, CIS or imaging archive. In fact, the use of certain types of RWD, such as claims and billing data, is already very well-established today, with an increasing number of research studies using RWD to support new drug indications in the US.

Less common, however is the use of clinically housed information, which whilst having distinct advantages over other types of data, see Table 1, is much harder to curate.

Table 1: Types and associated benefits/limitations of Real-World Data.

Consequently, there is a significant underutilisation of clinically related information stored within hospitals for RWD studies today.

The fundamental questions we are therefore addressing in our new study are:

- How should healthcare vendors, particularly those responsible for storing and organizing this information, improve access to this data?

- How do such vendors make the most of this opportunity strategically and commercially, and ultimately where should they begin?

These questions cannot be answered in full during a single article; however, on two key aspects we have provided our initial view of the market’s eventual evolution.

Challenge 1: Define Your Offering, and How Much You’re Willing to Invest

Data provision sits on a spectrum, relying on two key factors for commercial success. The first trade-off to be decided when approaching a new market is how much ‚Äòeffort’ or involvement a company is willing to invest to achieve the desired financial benefit or ‘value’.

Often, low effort ‚Äòbasic’ provision of data for studies has very limited value to buyers, who are required to go on and curate the data themselves. However, on the other end of the spectrum, high effort options can essentially compete with/cause providers to evolve into a CRO. In these instances, business models can alter significantly, tying financial benefits to project success, thus increasing risk overall for the vendor.

Figure 2: The different approaches available to healthcare technology vendors when providing RWD for 3rd parties.

As Figure 2 shows, we believe there is a relative ‚Äòsweet spot’ for healthcare vendors to target as platform providers for RWD clinical data unification. This positions vendors beyond the role of ‚Äòdata-brokers’ whilst also minimising extensive research involvement.

The benefits of such an approach involve less risk for the providers of the data, less investment required from the outset, as well as the freedom of pursuing a generalist approach, allowing vendors to target a wider base of potential customers.

There have been several vendors recently launching products aimed at this space, ultimately providing access to RWD through ‚Äòdata-unification’ platforms. Whilst these vary considerably in form and function, all capitalise on the already-existing partnerships these vendors have with healthcare providers. Life Image’s Real-World Imaging™ Data inventory is one such example.

However, not all vendors will inevitably choose to develop an in-house solution. Meditech announced its intent to collaborate on an integrated solution within Meditech’s Expanse platform in March this year. This will enable the use of Google Health’s search and summarization capabilities within its Expanse EHR, essentially allowing Google’s self-developed tools access to Meditech’s customer data (with provider approval).

Of course, Meditech’s approach has so far been the exception not the rule. Strategies like this both offset development costs whilst still providing value to users of the platform. Whilst Meditech likely won’t be raking in the financial rewards, it also allows the company to quickly enter the RWD market and be seen by providers as a forward-thinker.

Challenge 2: Follow the Money‚ All of it?

The second question when commercialising any product, should revolve around the payment model, with vendors asking themselves who it is that they intend to target as customers?

There are numerous potential users of RWD platforms, see Figure 3 below, with each possessing their own specific requirements. Pharmaceutical customers, for example, currently work mostly with RWD on specific, siloed projects, purchasing when the need arises, whereas payors are much more likely to continually evaluate a broader range of information.

Figure 3: Diagram showcasing the prospective purchasers of Real-World Data, and the relative short-term revenue opportunities associated with each.

Fortunately, there is no shortage of funds when considering any one of these customer types. Indeed, our initial research indicates that many vendors are weighing up all potential options. Vendors should carefully consider whether to approach each of these segments independently, scaling incrementally as they go along, or a more generalised approach that allows servicing multiple customer needs with a singular offering.

Customers can also be grouped into two distinct focus areas, diagnostics and therapeutics.

Google, mentioned above, are predominantly targeting diagnostics. Current users of its Care Studio reside within both the academic and healthcare administrator sectors, and through these efforts, most of Google’s work focuses on improving operations in and between hospitals.

Philips Healthcare, on the other hand, is targeting it’s ‘Clinical Trial Accelerator’ app at the therapeutic development market, aimed at improving the development of treatments using RWD.

The nature of information required for both types of studies varies immensely. Whilst diagnostics may be more concerned with large volumes of surface-level data used to identify early indicators of disease, therapeutics requires fine details to pin down causal and confounding factors.

Whilst scale of entry will inevitably depend on an individual company’s available resources and unique partnerships, vendors should approach these distinctions carefully when designing solutions, as both will eventually be required by the market in order to realise true value.

A Winding Road With Many Paths

It’s clear from the brief answers to these two basic questions, that the market for RWD, let alone the market for RWD unification platforms, is extremely complex. Both vendors and customers are exploring new territory whilst healthcare itself is evolving.

Consequently, there are several ongoing trends occurring across hospital IT that will affect RWD provision soon. Adoption of cloud-storage, structured reporting tools and AI will inevitably have an impact on the way this RWD is stored, reviewed and accessed, and it’s clear that over the next few years vendors must keep a continual eye on this fluid market. Those that can leverage their position in the market with a dynamic, adaptive platform strategy, may unlock a substantial new growth opportunity. That said, such is the nascency and fluidity of the emerging RWD market for unified clinical data, some could be caught out by limited tractions and high development costs. While the potential rewards are enticing, the risks are equally substantial.

About the Report

Real-World Data ‘A Strategic Analysis – 2022’ evaluates the opportunity for healthcare technology vendors in developing a ‘Data Unification Platform’ providing Real-World Data to third parties. The study will also examine some of this market’s most pressing questions, tailoring our focus on RWD chiefly to information gathered by EHR, CIS and imaging software. To find out more, please email the report author Imogen Fitt at Imogen.Fitt@signifyresearch.net.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK. To find out more: enquiries@signifyresearch.net, T: +44 (0) 1234 436 150, www.signifyresearch.net