Written by

Despite Covid-19 grinding the world to a halt for numerous months and placing the global economy into the deepest recession since World War II, the imaging IT market has emerged from the pandemic relatively unscathed. Other medical imaging markets suffered drops in revenue of 5-15%, which could have been a similar story for the imaging IT market, with core platform deals being postponed and sizable deals not coming into consideration until later in 2020. Vendors were able to mitigate this scenario by offsetting the loss in new business with “add-ons” for existing customers, accommodating home reporting and supplementing revenues with smaller departmental budgetary deals such as image exchange and universal viewers.

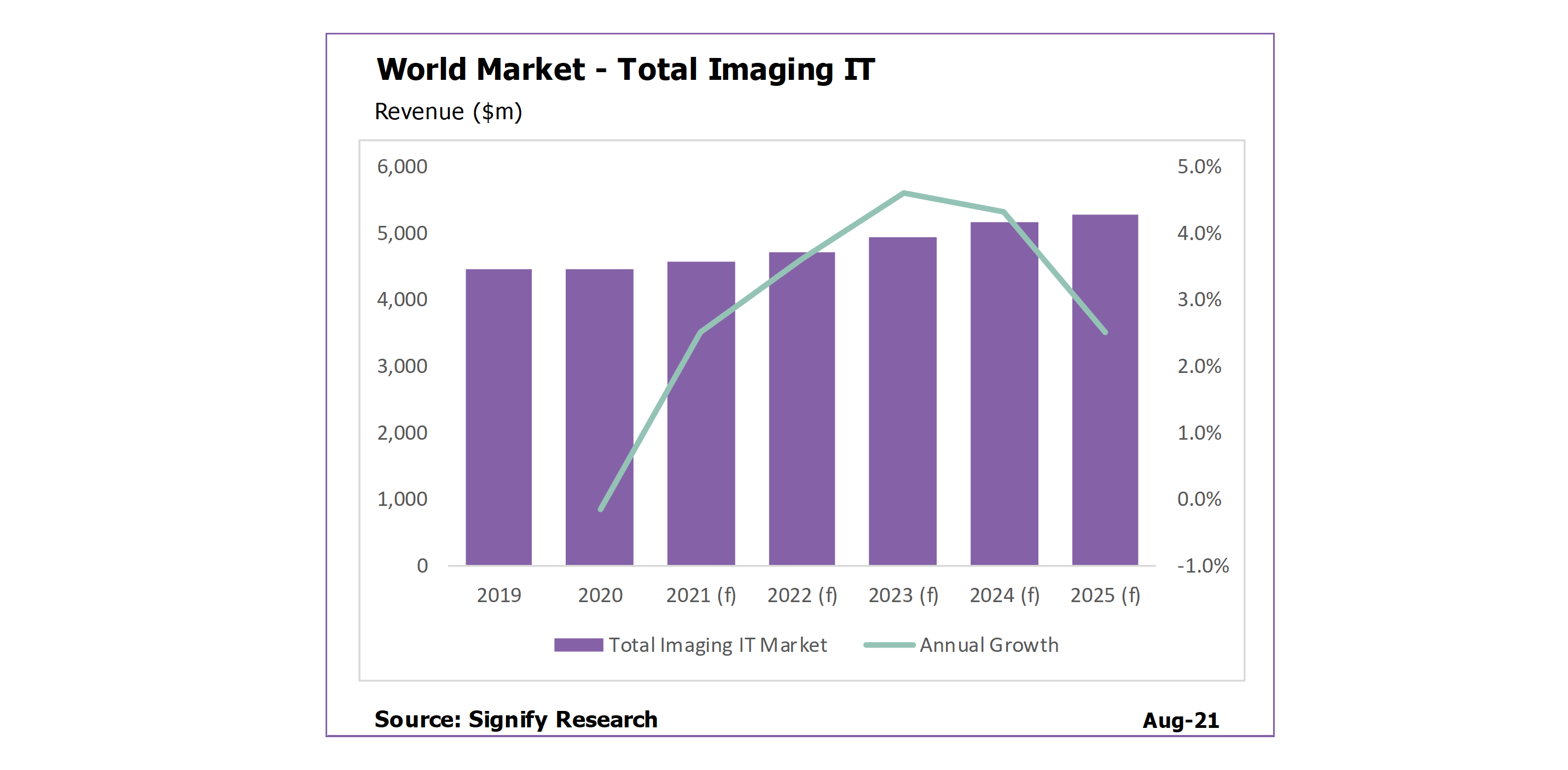

Overall, the imaging IT (radiology IT, cardiology IT, advanced visualisation) market saw a drop of 0.2% in 2020, with recovery expected in 2021 and into 2022 across mature markets such as the US, Western Europe and pockets of Asia Pacific. Recovery has been propelled by two factors: extraordinary funding for healthcare services, which has promoted new procurement initiatives for imaging IT and “kick starting” focus on enterprise imaging and multi-disciplinary diagnostics workflow, combined with many mature markets’ quick adoption of vaccination programmes and preventative initiatives. This has allowed talks to resume on delayed procurement and replacement deals, including sizable regional tenders, that, coupled with pent up demand of missed procedures, mean we are expecting solid growth later in our forecast period in 2022-2024.

The pandemic had different levels of severity across emerging markets creating volatile performance. In some instances, the true impact of Covid-19 will be felt in 2021 and into 2022, due to the height of Covid-19 cases and death rates not peaking until 2021. Recovery will be a mixed outlook too; although overall these markets were hit harder, due to the growth potential some markets will bounce back with expected recovery to begin 2022 into 2023, across SE Asia for example; others, especially with severe economic impacts of COVID-19, will have a far more subdued recovery, as we anticipate for countries such as Brazil and India.

*(f) represents years in our forecast period. Total Imaging IT includes revenue from Radiology IT, Cardiology IT and Advanced Visualisation IT. These numbers have our Covid-19 impact baked into market size and forecast

Prioritising Productivity

Providers are in an unprecedented situation post COVID-19, which is placing significant financial pressure on them to rebalance their budgets after overcoming and managing Covid-19. This will lead to a priority being placed on products and strategies that support efficiency and drive productivity.

To support healthcare provider’s drive for efficiency, we expect hospitals to broaden their enterprise imaging strategies outside of radiology, with departments such as cardiology, oncology and digital pathology all being areas of focus for consolidation. The pandemic created the momentum to catapult EI adoption above what we had previously expected in the forecast period (2021-2025). The realignment of centralised governance across hospitals has allowed the conversation to move beyond the radiology department, highlighting the inefficiencies in legacy platforms and the benefits for collaboration with consolidated technological footprints.

With anticipated financial constraints, productivity will be an asset to maximise a provider’s budget. There are several paths available to providers to achieve productivity gains, such as deployment of artificial intelligence, operational workflow tools or analytics and BI tools. The adoption of these tools, and a factor determining vendor success, will be their ability to demonstrate return on investment for providers. In the short-term, every penny in the budget will have to be justified and put through due diligence, so taking a risk on an unproven tool is unlikely to happen despite the promises a vendor makes.

Across emerging markets, we expect similar trends. There is expectation that emerging countries will demonstrate a “leap-frog” effect in adopting enterprise imaging and products such as AI and cloud. With the growing investment from government and public cloud vendors, infrastructure and technology will soon have the potential to match mature markets.

Adapting to this new world

Although the imaging IT market demonstrated resilience in 2020, the impact on the market in the short to mid-term will lead to vendors having to adapt and accommodate this post-pandemic world. Looking forward, less is not always more.

With the increased requirement for productivity tools and the accommodation of a true enterprise imaging strategy, vendors will need to ensure their portfolios support this direction, whether through the formation of partnerships, acquisitions or native product development. Depending on the type of vendor, adapting to this new world will require differing strategies, with each having their own strengths and challenges to manage.

Larger imaging IT vendors that have the breadth of core platforms, AI and operational workflow and BI tools, appear to be in a position of strength. However, they must overcome internal challenges of providing seamless integration to provide the efficient user experience expected by providers.

“Challenger” vendors in imaging IT, whose strategies align with enterprise imaging consolidation have been able to offer flexibility in their offering to suit customer requirements. These vendors have weathered the Covid storm better than most, with alterative deployment methods, OpEx business models and earlier cloud technology options all contributing to this performance. Continued success will rely on their ability to scale up their operations to manage more extensive portfolios and service lines.

We have already seen evidence of vendors adapting to this market shift, with numerous acquisitions announced in 2021 that expand product portfolios. Intelerad’s acquisition spree to expand their cardiology IT offering in 2020 – 2021 with their latest addition of Heart IT to support clinical workflow automation and visualisation, is one such example. In addition to acquisitions, there have also been vendor product releases at RSNA 2020, with vendors making significant announcements to expand and better integrate their portfolio such as Siemens with Syngo Carbon.

Vendors Cannot Afford to Stand Still

The imaging IT market remains one with opportunities for vendors to grow. The focus is shifting away from selling new core platforms in mature markets, to expanding your footprint within existing clients utilising add-ons such as operational workflow or AI. The future will be based on creating a partnership whereby the vendor and provider enter a journey towards the shared goals of efficiency and productivity, which will prove the most lucrative path for all parties involved.

For vendors to capitalise on these opportunities and to be a suitable partner, they cannot afford to stand still. There is limited presence in the market with vendors that have the breadth of portfolio and internal resource to take advantage of this opportunity at scale. Although with strong M&A activity continuing in 2021 and new product releases at RSNA 2020, some vendors have seen the opportunity and are working towards rounding out portfolios.

The question for success, will not only rely upon a vendor’s ability to acquire, partner or build in isolation, but they will need to ensure a seamless integration to maximise the user experience. A timely task.