Written by

Current State of Play

The Remote Patient Monitoring (RPM) market, though still facing a number of teething issues, has potential for significant levels of growth over the coming years. Since Signify Research’s 2022 iteration of its Remote Patient Monitoring – World report, the market has evolved, but still faces several of the same challenges as it did two years ago. The push both during and post-Covid towards more decentralized and virtual models of care delivery continue to steer the market towards further RPM adoption, the pressures regarding a challenging economic climate remain, along with providers burdened with tight operating margins and the ever-present issue of staffing shortages.

Further Consolidation is Expected

Signify Research’s current estimations project the total RPM market, including adjacent markets such as hospital-at-home and life-sciences to reach $4.6B in 2028, having surpassed the $2B mark in 2023. The strong levels of investment, partnership and M&A over the past year should instil some confidence in both vendors and providers alike, towards an overall bullish outlook for RPM adoption.

Validic’s acquisition of Trapollo in May 2023 is an example of such activity, with the merger having been targeted towards leveraging Trapollo’s logistics expertise to support the scaling of RPM programs. Validic’s more recent partnerships with device manufacturers Smart Meter and Withings in February 2024 reaffirmed this sentiment. Another notable announcement in the new year was Florida-based RPM and chronic care management provider HealthSnap’s $25M Series-B funding to accelerate its product roadmap amidst increasing demand for remote care solutions.

The wider RPM market has also seen the entrance of a number of more diverse IT solution developers. One notable example being Ricoh, which launched an RPM enablement service to support the deployment of devices, inventory tracking and logistics in October 2023, and multi-industry IT solutions vendor Iron Bow Technologies, partnering with Carium to launch a new RPM solution to market last year.

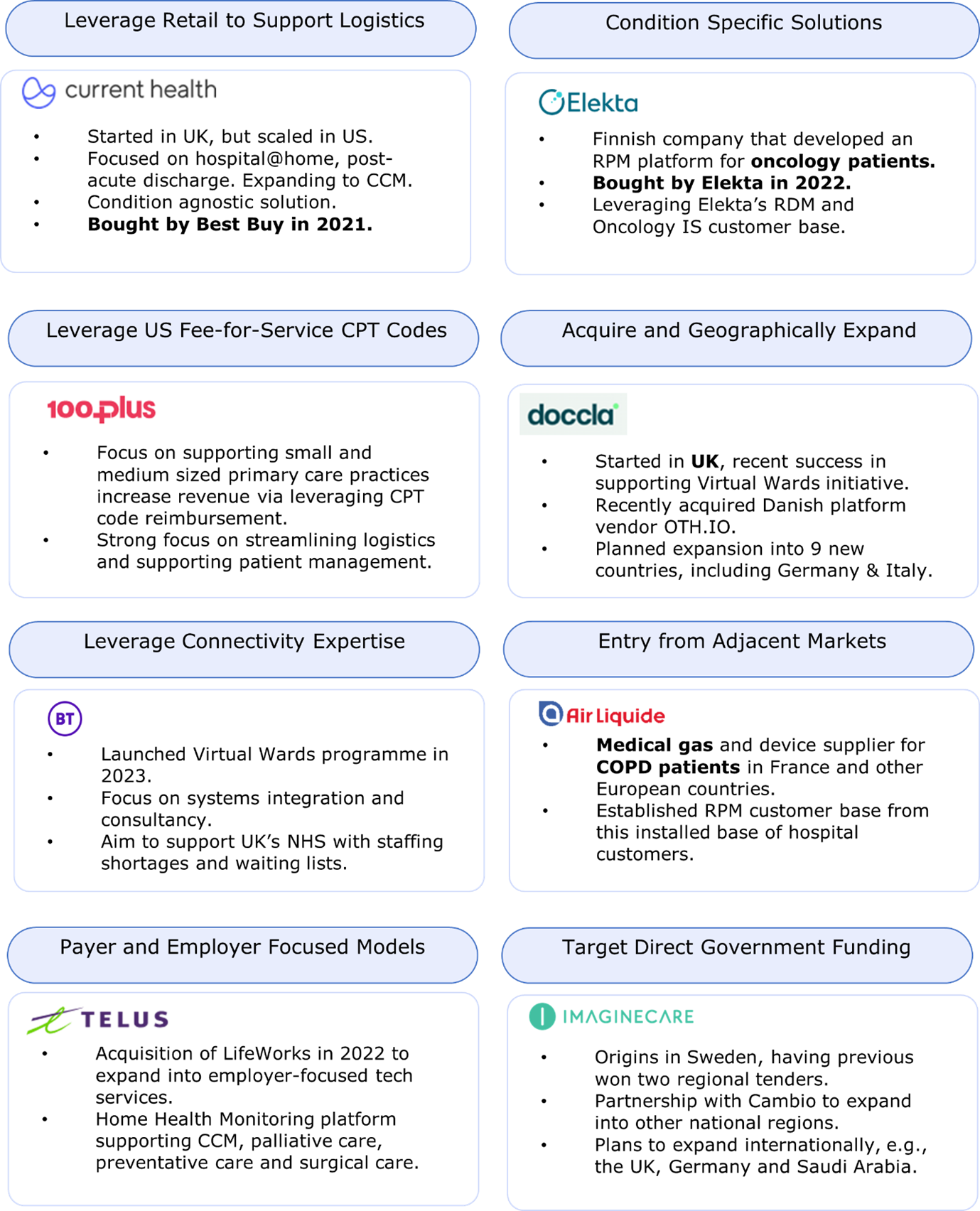

Amidst a highly fragmented global market, the following highlights some of the potential routes to market available to RPM platform vendors:

Moving forward, it is highly likely that we will continue to see further consolidation as vendors look to round out capabilities within their solution offerings.

What Needs to Change?

In the US, by far the largest adopter of RPM programs to date, a number of challenges are still preventing wide-scale adoption. Whilst the current fee-for-service reimbursement structure has been pivotal in enabling providers to offer RPM programs, there are questions around the long-term viability of this approach. From a traditional RPM perspective, whether a point-based condition-specific or condition-agnostic chronic care management solution, the true value of RPM lies in incentivising providers to reduce readmissions and improve clinical outcomes for patients. The current environment, however, sees a number of vendor’s business models heavily reliant on the existing CPT reimbursement codes. In the short term, these codes act as a ceiling to how far RPM can go.

The overarching transition towards value-based care (VBC), both in the US and globally is likely to force a change in approach, particularly as reimbursement rates and requirements continue to be questioned. Though the move to VBC still has a long way to go, it will be essential for the long-term scaling of RPM programmes, particularly to support larger US health systems and Accountable Care Organisations (ACOs), with the adoption of RPM programmes.

Workflow Challenges

One of the major perceived difficulties in RPM adoption is the question of how it will integrate into existing clinical workflows, and who will be responsible for the time and resources to carry out these activities, including patient enrolment, administrative tasks, designing RPM programs and integration into existing healthcare IT infrastructure. EHR’s have traditionally largely focused on historical data, which is a stark contrast to the high levels of continuous data generated from the use of at-home RPM devices. The overwhelming sentiment is that providers simply do not have the resources to manage additional IT interfaces and clinical workflows that may be associated with the introduction of an RPM programme, which has seen the increasing adoption of SMART on FHIR APIs. From a provider’s perspective, the use of such interoperability standards are pivotal in streamlining productivity and efficiency, and allow RPM to provide a tangible benefit in healthcare delivery.

The high levels of staffing shortages have also led to the increasing emergence of vendors such as Optimize Heath and AMC Health offering in-house clinical monitoring services to mitigate some of the issues around workflow changes and resource allocation. Growth in recent years for vendors offering such services has been high and demand for these offerings is unlikely to subside in the medium term,

High Prospects for Hospital-at-Home

Signify Research has extensively covered the Hospital-at-Home market in recent months, particularly in its recently published dedicated Hospital-at-Home – Patient Monitors – World – 2024 Report. Though faced with its own list of challenges, sentiment from vendors and the buzz at HIMSS24 suggests that hospital-at-home is not only here to stay, but will become an increasingly important model of healthcare delivery.

Though there have been recent instances of some US health systems ending their hospital-at-home programmes due to financial restrictions, latest figures state that over 130 health systems and over 300 hospitals have deployed programmes under the Acute Hospital Care at Home Waiver, though absolute numbers remain relatively low at just over 11,000 patients admitted between November 2021 and March 2023. Whilst the waiver is currently set to expire at the end of the year, there is both the expectation and requirement for an extension beyond the current cut-off date.

There remains a number of implementation challenges, however, including the logistics of providing care in homes of those in rural or remote locations, where there may often be greater demand for such services. The use of RPM in particular may also be restricted by limited broadband coverage and capacity in such locations. Similar to traditional RPM programmes, the long-term potential of hospital-at-home in the US is likely to be in the hands of regulators.

Summary of Medium-Term Outlook

Whether or not RPM is able to live up to its true potential is highly dependent on how both vendors and providers wrestle with the implementation and operational challenges of care delivery programs.

With the wide number of potential routes to market, there is no single best strategy for RPM platform vendors. Whilst in the US, the gradual shift towards larger-scale organizations, IDNs and ACOs may enable access to deeper pockets and larger budgets for bigger RPM programmes, private spend in other global markets makes up a much smaller proportion of overall healthcare spend.

New innovative approaches may yet continue to alter market dynamics as gen-AI solutions (e.g., Huma’s partnership with Google Cloud) begin to be utilized to develop solutions for predictive analytics, clinical decision support, patient engagement, workflow efficiency and administrative tasks, whilst the growth of clinical monitoring services continue to be pushed to the forefront of RPM along with the growth of hospital-at-home and the use of RPM for life-sciences and decentralized clinical trials.

Related Research

This is a new Market Report on the global market for Remote Patient Monitoring, published in 2024.

About The Author

Hamir joined Signify in 2022 as a Market Analyst within the Digital Health team, covering EHR/EMR, Telehealth and Value-Based Care. He holds a BSc in Economics having graduated from Loughborough University in 2022.

About the Digital Health Team

Signify Research’s Digital Health team provides market intelligence and detailed insights on numerous digital health markets. Our areas of coverage include electronic medical records, telehealth & virtual care, remote patient monitoring, high-acuity clinical information systems, patient engagement IT, health information exchanges and integrated care & value-based care IT. Our reports provide a data-centric and global outlook of each market with granular country-level insights. Our research process blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net