Written by

11th December 2023 – Cranfield, UK

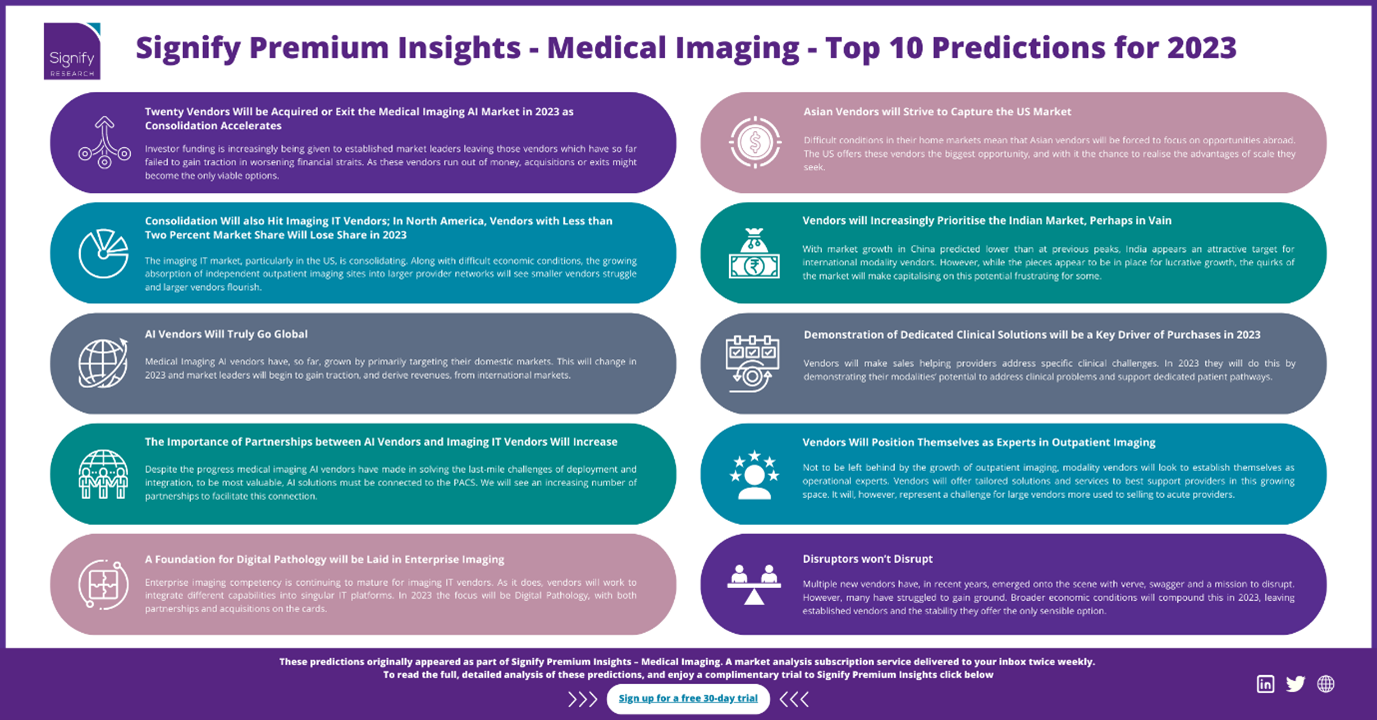

Our team of top analysts have reviewed their beginning-of-year predictions for 2023 and provided a summary of how close our predictions were to manifesting in reality.

To view the Digital Health Top 5 Predicitions, please click here.

To view the Clinical Care Top 5 Predictions, please click here.

Return to Insight Navigation Page

Despite a tumultuous year of changing economic, political, and regulatory macro-influences, big technology lay-offs and the rapid emergence of potentially disruptive technology such as generative AI, most of our predictions held up, with only a few expectations missing the mark, or the timing of actual realisation being slightly off (see our 2024 predictions for more on this).

Below is our summary analysis on the 20 predictions we made across the Healthcare Technology industry, broken into 3 of our main research areas; Medical Imaging, Digital Health and Clinical care. As ever, our expert team are on hand for support on interpretating market trends and supporting clients navigate the ever-changing healthcare technology landscape.

Medical Imaging

Prediction 1: 20 Vendors will be acquired or exit the Medical Imaging AI Market in 2023 as consolidation Accelerates.

Ellie Baker, Market Analyst – “Acquisition and exits within the Medical Imaging AI market have not been as prevalent as anticipated, with less than 10 recorded. Current global headwinds including increased interest rates, the cost of debt and a greater focus on profit margins have accounted for less than favourable conditions for acquisitions to occur.”

“However, with funding runways fizzling out for some vendors, an increase in exits or acquisitions is expected to kick in next year as market consolidation is no doubt inevitable.”

Prediction 2: Consolidation Will also Hit Imaging IT Vendors; In North America, Vendors with Less than Two Percent Market Share Will Lose Shares in 2023.

Amy Thompson, Research Manager – “Similar to consolidation in the AI market, imaging IT was lighter on acquisitions than we predicted. However, there were a number of smaller PACS / RIS vendors that were acquired in 2023. As large replacement cycles come to a close in the US, the trend of consolidation is expected to intensify in the short-term.”

Prediction 3: AI Vendors will Truly Go Global.

Ellie Baker, Market Analyst – “There has been an increase in AI vendors gaining regulatory approvals outside of their domestic markets enabling vendors to expand into additional markets. Since January 2023, 20 companies from EMEA received 23 US-FDA approvals, followed by 12 companies from APAC accounting for a further 27 US-FDA approvals.”

“However, the same cannot be said for vendors looking to target EMEA or APAC. China is still heavily reliant on native vendors, with no vendor outside of China receiving NMPA approval and commercialising their solution within this market. Additionally, with the current regulatory turmoil in Europe as MDD shifts to MDR, vendors have been reluctant to target this market, with only two US-based companies receiving CE mark approval in 2023.”

Prediction 4: The Importance of Partnership between AI Vendors and Imaging IT Vendors Will Increase.

Amy Thompson, Research Manager – “Interest in AI continues to build in imaging IT, however with a high degree of risk still associated to the AI ecosystem – the route of partnership, and importantly, partnerships with AI platforms are preferred by larger imaging IT vendors. In 2023, vendors who were yet to make a defined strategy for AI integration made first steps – with a flurry of new AI platform partnerships announced.”

Prediction 5: A Foundation for Digital Pathology will be Laid in Enterprise Imaging.

Amy Thompson, Research Manager – “The buzz of pathology at RSNA this year solidified the integral focus providers and imaging IT vendors alike are placing on digital pathology and its integration into enterprise imaging strategies.”

“In addition to the drive from those vendors with native pathology capability, the radiology IT market observed seven digital pathology partnerships in 2023, and the Fujifilm / Inspirata acquisition the last week of December 2022.”

Prediction 6: Asian Vendors will Strive to Capture the US Market.

Bhvita Jani – Principal Analyst – “A quick reflection of the RSNA 2023 show floor will tell you all you need to know about the validity of this prediction – Asian vendors were prominent and competing toe-to-toe with leading US and European vendors.”

“However, traction in customer spend and market share has been harder to come by, with no notable evidence in 2023 that the renewed focus on the US is commercially paying off. With lengthening replacement cycles and large, complex managed service deals increasingly common, market traction and momentum will take time. Yet as provider focus shifts to contract consolidation, operational efficiency and “turn-key” service-line offerings, the key question in 2024 is if leading Asian modality vendors have the portfolio and professional services clout to disrupt and win against the market incumbents.”

Prediction 7: Vendors will Increasingly Prioritise the Indian Market, Perhaps in Vain.

Bhvita Jani – Principal Analyst – “The vast opportunity the Indian market offers has intensified with recent domestic breakthroughs in 2023, such as deployment of the first MRI scanner which had been entirely developed and “Made in India”.”

“Aside from domestic investment, there has also been clear focus from international vendors. GE HealthCare, Philips, Siemens Healthineers and FPD manufacturer Varex all decided that strengthening their base in India is a sound opportunity to capitalise on the future potential of the Indian market, with many broadening manufacturing operations in India to diversify production beyond China to achieve a more balanced and diversified manufacturing footprint.”

“Another approach to capitalise on the Indian market, taken by Fujifilm, is implementing a PPP model (public-private partnerships) involving collaborating with government agencies in the health sector. India continues to be perceived as an opportune market for medical imaging component and system suppliers due to the low modality penetration and the government’s commitment to expanding access to healthcare services.”

Prediction 8: Demonstration of Dedicated Clinical Solutions will be a Key Driver of Purchases in 2023.

Bhvita Jani, Principal Analyst – “The strategic focus of medical imaging providers on building comprehensive ecosystems in the fields of cardiology, oncology and neurology is becoming increasingly clear. RSNA 2023 demonstrated the apparent focus of leading CT vendors on coronary CTA and how their latest innovations and solutions are tailored to enable better care pathways within this application. Last year, however, there was heightened focus on low-dose CT product lines and compatibility for lung cancer screening, a trend which was slightly less prominent this year, but a constant throughout 2023.”

“Other examples of dedicated clinical solutions include Shimadzu launching a high-resolution PET scanner for breast and neuro applications, with intended use for the diagnosis of Alzheimer’s disease and reflecting the new surge of funding in the US. GE HealthCare, for example, has also invested heavily in its approach to the Alzheimer’s care pathway and aims to support the entire care continuum from diagnosis to treatment planning, delivery, and monitoring with its range of products and solutions. The company is also involved in the development of an AI screening platform for the early detection of Alzheimer’s disease.”

Prediction 9: Vendors will Position themselves as Experts in Outpatient Imaging.

Steve Holloway – Managing Director – “There is little doubt that outpatient imaging’s growth continued its rapid progress towards playing a leading role in US imaging services. Vendors have been quick to try and capitalise on the uptick, though the market remains fluid.”

“With big consumer brands entering the mix in partnership with imaging centres, large health system groups buying-up and launching outpatient centres, and even modality vendors partnering with providers to offer turn-key diagnostic centres, the direction of travel is clear. However, designing products and services for these markets is arguably the easier task for modality vendors – navigating the evolving myriad of sometimes flaky outpatient commercial channels and where to target for long term gains is much more difficult.”

“Add in growing consumer interest in outpatient imaging (thanks Kim Kardashian) and emerging new business models (direct to consumer add-on fees such as the EBCD component for breast screening from RadNet/DeepHealth), and picking the most successful partnerships and go-to-market investment has never been so difficult.”

Prediction 10: Disruptors won’t Disrupt.

Mustafa Hassan, Senior Market Analyst – “As the economic outlook worsened over the course of 2023, the expected news of cut-backs, lay-offs and missed targets filtered through the “disruptor” pool of newer imaging modality vendors. While it was not all doom and gloom, many new vendors found that healthcare providers’ post-COVID surge in spending and the availability of venture capital were rapidly drying up, leaving many that had not established solid traction in the market with little to show for their endeavours and a growing debt pile.“

“While some of the more prominent brands struggled, others had breakthrough years in 2023, establishing new channels, new funding raises and new partnerships. Given the economic and political risk and volatility expected in 2024, new vendors will have to work harder than ever to survive – yet often during market slow-downs are the most innovative and disruptive companies unearthed. 2023 may have been the beginning of the end for hype and bluster in medical imaging; we expect 2024 to be the start of a few years of survival of the fittest.”

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net