Written by

As the new year begins, Signify Research’s Imogen Fitt shares her top 5 predictions for digital pathology in 2024.

2023 marked several firsts for the digital pathology industry, including:

- The launch of several new CPT codes in the US.

- 4 new radiology partnerships with IMS vendors.

- The announcement/expansion of at least 3 large clinical AI implementations.

In total, the year served to emphasise the increasing adoption and impact of digital pathology in clinical environments, ultimately forecasting a strong outlook for future growth.

Looking ahead, we share below my top 5 predictions for clinical digital pathology in 2024.

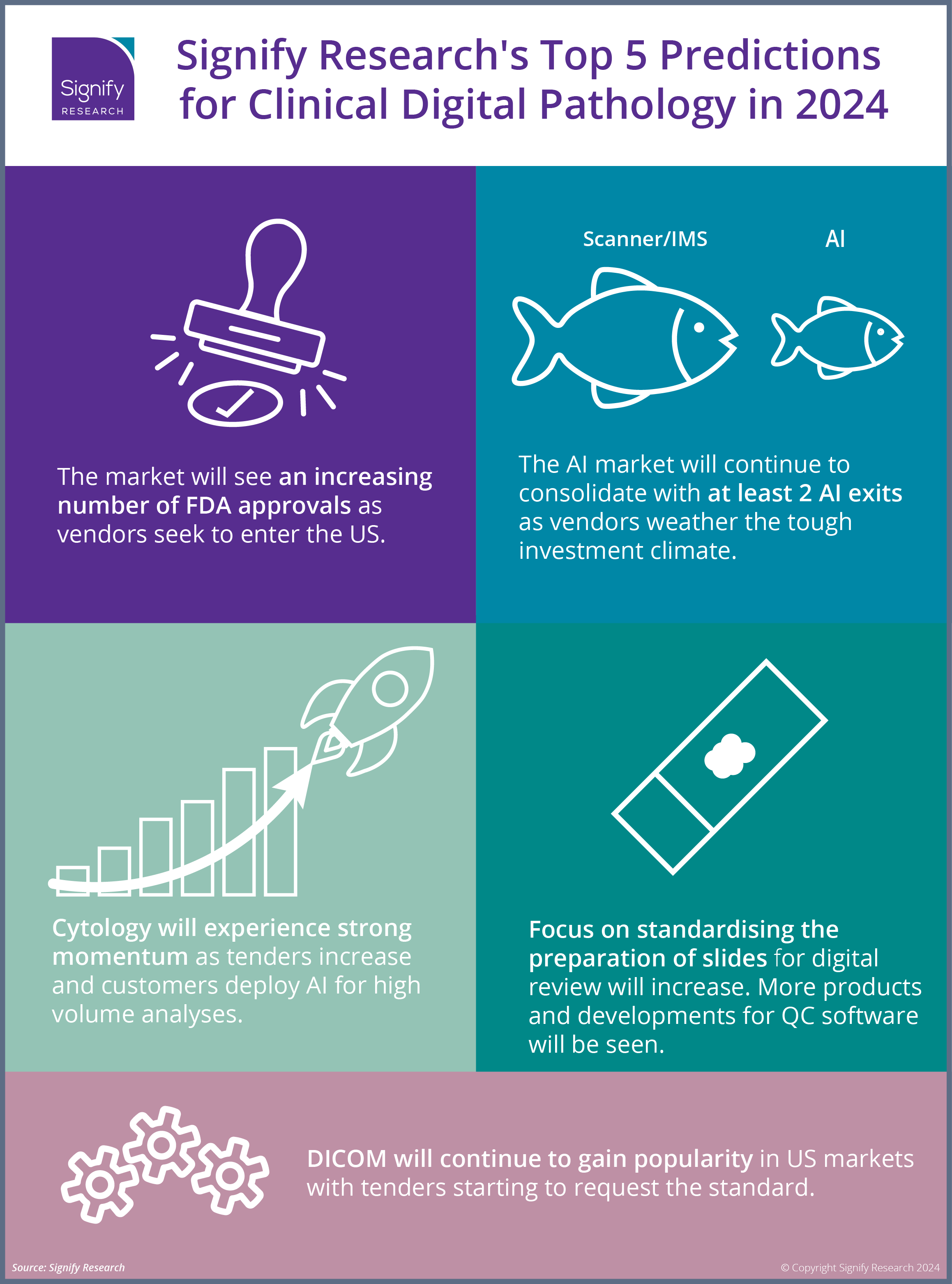

1. The market will see an increasing number of FDA approvals as vendors seek to enter the US clinical market.

The US clinical market offers a significant greenfield opportunity, with many labs yet to digitise. However, due to historical regulatory policies creating a high barrier to entry, there are very few vendors with FDA approval for primary diagnostic use today. We expect more approvals in the short term for scanners, IMS, and AI vendors, which should help increase competitive pressure in this market. More approvals will also drive customer confidence in digitisation and help bolster already impressive growth.

2. The AI market will continue to consolidate with at least 2 AI exits as vendors weather the tough investment climate.

Investment in digital pathology during 2023 was infrequent and mostly reserved for well-established vendors who had already launched products and were now seeking finance to scale commercial operations. 2023 saw some acquisitions early on as opportunistic vendors snapped up IP and expertise from struggling competitors; this trend is expected to continue in 2024 as investment in digital pathology remains difficult to achieve. AI vendors targeting clinical segments are most at risk, however this doesn’t indicate doom and gloom for the overall clinical AI in digital pathology market, which will continue to see promising adoption as labs mature and explore the benefits of augmenting digital imaging workflows with AI.

3. Cytology will experience strong momentum as tenders increase and customers deploy AI for high-volume analyses.

Cytology has historically taken a backseat in favour of anatomic/tissue pathology. However, the discipline generates significantly higher slide volumes per case, thus AI analysis arguably can provide more short-term impact through its ability to triage cases for review. Cytology images experience less variation than tissues, making AI algorithms simpler to train, and utilising AI to triage analyses for clinicians could be a very attractive use case for adopters to help increase efficiency. In addition to this, cytology is increasingly featuring in tenders in some clinical markets, so throughout 2024 we expect to see more news related to this sub-segment.

4. Focus on standardising the preparation of slides for digital review will increase. More products and developments for QC software will be seen.

Anatomic pathology AI is much harder to train due to the wide variation seen in tissue samples; however, this issue is compounded by the fact that slide preparation and scanning can introduce further variations for review. This can significantly alter the sensitivity and specificity of an algorithm, with important implications for clinical use. A number of QC AI solutions were launched in 2023, with impressive uptake seen in the pharmaceutical and CRO segments so far. Throughout 2024, we at Signify expect more attention to be paid towards standardising the pre-scanning process as much as possible, with colour calibration technologies and AI-QC software being increasingly trialled to mitigate this issue.

5. DICOM will continue to gain popularity in the US market, with more tenders starting to request the standard.

DICOM is already popular in Western European markets, owing to the maturity of enterprise imaging (EI) in the region. EI has historically been mostly radiology-focused but is now increasingly impacting pathology digitisation. US maturity is also increasing, with a number of institutions planning to envelope digital pathology soon. DICOM is still relatively new to pathologists in the US, but the industry is making headway in providing more education around both the benefits and considerations of adoption.

Related Research

Digital Pathology Market Intelligence Service – World – 2023

Signify Research’s Market Intelligence Service provides a rolling 12-month coverage of the global Digital Pathology market. The service is composed of four deliverables, as shown below.

INSERT TABLE

The service is designed to enable you to:

- Inform product investment and business strategy

- Evaluate the ever-changing competitive landscape to assess the impact of associations and select potential partners

- Acquire a holistic view of the nuances between different pathology research and clinical markets

- Understand adjacent markets such as enterprise imaging laboratory information systems and the influence these will have on Digital Pathology .

For further questions or samples of the service contents, please contact Imogen Fitt, the report author.

About Imogen Fitt

Imogen joined Signify in 2018 as part of the Healthcare IT team. She holds a 1st class Biomedical Sciences degree from the University of Warwick, where her studies included molecular biology and pharmacology. Since joining the team, Imogen has studied the medical imaging software and hardware markets and is now expanding Signify Research’s Diagnostics and Lifesciences coverage.

About the Diagnostics and Lifesciences Team

The Diagnostics and Lifesciences team provides market intelligence and detailed insights on the multiple healthcare technology markets where the clinical world intersects with the preclinical. Our areas of coverage include digital pathology, laboratory information systems, clinical Real-World Data (cRWD) platforms, oncology information systems, tumour board software, oncology decision support software and radiotherapy IT. Each report provides a data-centric and global outlook of its markets with granular country-level insights. Our research process blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net