Written by

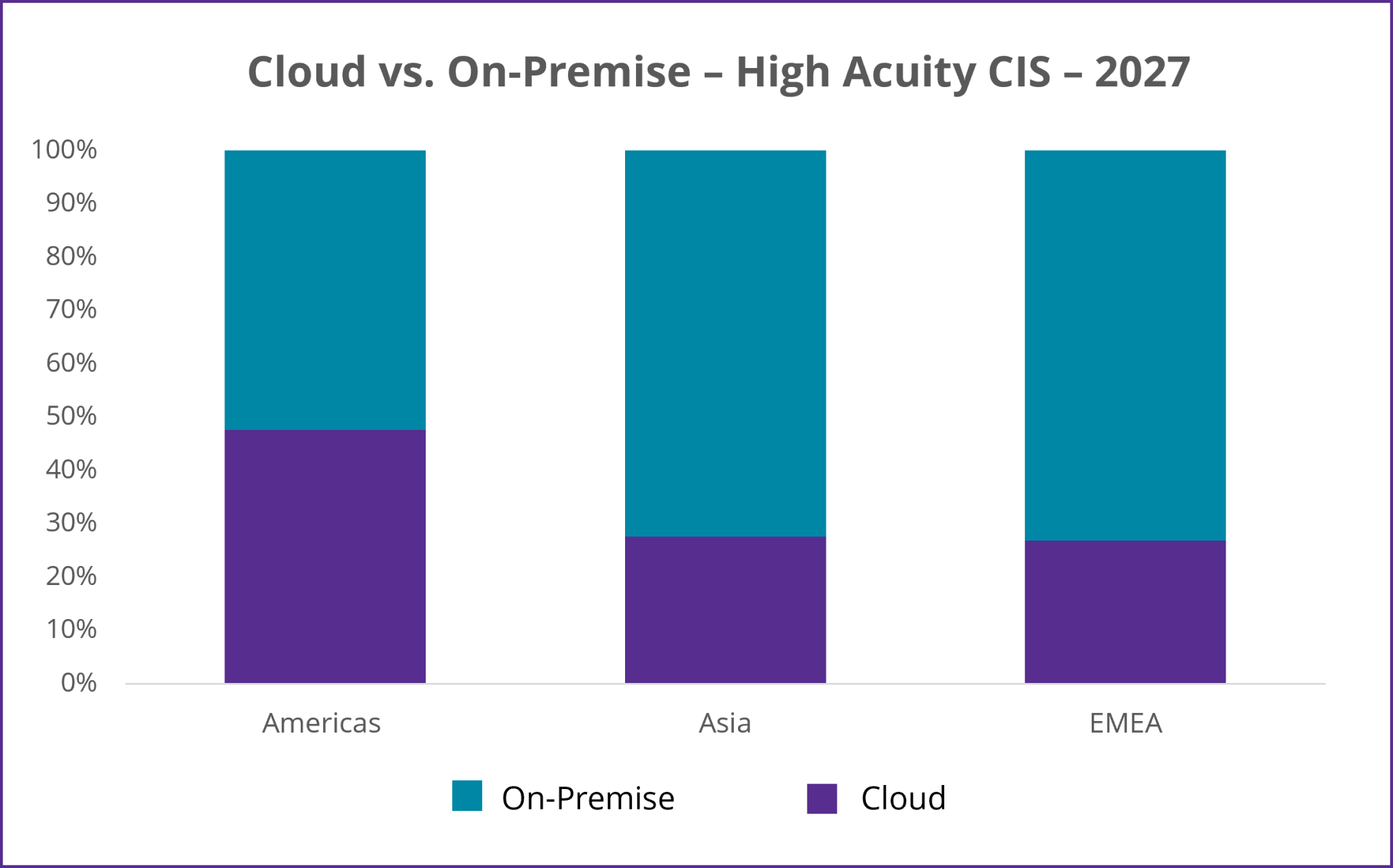

Signify Research’s second iteration of its High-Acuity – CIS market report and data, published earlier this month, projects cloud adoption (including hybrid and fully hosted) to represent almost 40% of the global market revenue in 2027, compared to one-third in 2022.

* The graph demonstrates Signify Research’s forecast of the % of market revenue ($m) for High-Acuity CIS that will be hosted on-premise compared to cloud in 2027. High-Acuity CIS solutions include ICU-IS, NICU-IS, Perinatal IT, OR Manager, AIMS, EDIS and Analytics/AI segments. Cloud includes hybrid and full-hosted solutions.

The Signify View

Globally, vendors are pushing the value of cloud-based hospital systems and their lower-cost maintenance benefits over on-premise solutions. Increasingly providers are starting to see the benefits they offer.

In the US, there is greater momentum towards the use of cloud-based systems, with several cloud providers based in the country allowing patient data to be stored there. The proportion of cloud-based high-acuity CIS systems in the US is higher than elsewhere globally.

As the demands on healthcare facilities increase to serve the ever-increasing patient population, healthcare providers are rethinking the cost model to enable a more sustainable healthcare system. The movement to OpEx purchasing is expected to help maintain the flexibility of IT solutions. In geographies which have a significant private healthcare market, such as the US, the transition to SaaS and monthly payments is happening relatively quickly.

Cloud uptake outside of the US, meanwhile, has been much slower and is projected to remain a smaller proportion of overall High-Acuity CIS revenues, impacting the overall global market.

In many countries, regulatory control restricts the use of US-based cloud providers. There is also hesitancy and fear amongst healthcare providers in relation to sensitive patient data ending up in the wrong hands (e.g. commercial parties). For this reason, private cloud is anticipated to experience a relatively faster adoption, versus public cloud.

Within EMEA, several geographies already have a relatively mature level of healthcare IT and are well placed to ramp up cloud adoption (e.g. Nordics, Benelux). Further, the governments across W. European countries have allocated sizeable funding for healthcare IT and infrastructure initiatives to propel cloud uptake. For example, as part of the German governments’ Hospital Future Act (KHZG) announced in 2020, “Cloud Computing” is one of 11 pillars where the ‚Ǩ4.3bn worth of funding is being allocated. Additionally, two new Italian tenders (one covering EMR and Imaging, the other relating to Telehealth) worth ‚Ǩ1.1bn were announced last month, and discussed in this SPI Digital Health insight. The funding will support ongoing cloud maintenance support and SaaS-based services, which is in line with the government’s cloud-first strategy. Government privacy regulations and patient data policies (e.g. GDPR), however, are significant barriers to cloud adoption, resulting in cautious cloud uptake across the region thus far.

In primarily public healthcare markets, particularly across EMEA, the budgeting mechanism is also inhibiting the transition to a cloud-based SaaS/OpEx model; there remains a strong preference for government funding and upfront capital costs through the CapEx model. This is to primarily ensure that providers do not miss out on funding. Any movement towards OpEx purchasing in the coming years is therefore likely to remain a gradual one.

Cloud Developments by Geography

Benefits and Barriers

Despite progression in many countries to transition from paper-based hospital systems to digital solutions, there are still many barriers to eliminate. The implementation process to install a completely new system can take up to a year (and sometimes longer) with significant progression to remove paper solutions before completely transitioning online. To date, on-premise solutions have largely been the preferred option, where all applications and data are stored and accessed via the health provider’s own network and data centre.

Cloud-based solutions have frequently been pushed as an easier/quicker implementation and cheaper alternative (in terms of total cost of ownership) to on-premise. With less requirement for full-time IT admin resource to maintain their servers, hospitals can instead channel resources towards care quality and patient outcomes.

The reality, however, is that most hospitals have invested heavily in on-premise data storage and server rooms, including hardware and software licences, in the relatively recent past. Despite the clear benefits of public cloud migration, some hospitals are understandably keen to maximise the shelf life of costly IT installations.

Cloud-based AI/Analytics Accelerate

Data analytics and AI tools are evolving at a rapid pace and becoming increasingly useful to healthcare providers in supporting clinical decisions. Growth is being driven by demand for data analytics that support the increasing prevalence of data and devices, particularly within the ICU. It is enabling more informed decision making, improving patient safety and outcomes, easing the burden on nurses, and improving cost-efficiency.

Early-warning scoring, sepsis detection and predictive analytics have been the key areas of focus, to date. Early-warning protocols are commonly used in hospitals to flag patient deterioration using vital signs information. However, in many hospitals this is often a manual process, utilising colour coding of patient status on a white board in the nurse’s station.

Additional use-case examples include alarm management/fatigue tools to reduce unnecessary alarms, and provide more accurate alarm parameters and early warning alerts. This is ultimately better for improving nurse retention and patient outcomes.

A relatively higher proportion of Data Analytics and AI providers (versus traditional EHR/Best-of-Breed vendors targeting HA CIS departments) are cloud-based and provided as a SaaS model. From a functionality standpoint, cloud enables vast amounts of data to be stored and is not limited by storage size. As higher-acuity CIS settings generate such a significant amount of patient data, cloud solutions will enable much greater processing power for data analysis.

As the Analytics/AI segment covered in Signify Research’s High-Acuity CIS report is projected with higher-than-average market revenue growth through to 2027 (24% CAGR), the segment will help to drive the momentum of overall high-acuity CIS cloud adoption, albeit coming from a relatively small base.

High-Acuity CIS to Follow EHRs Footsteps?

As discussed in an SPI Digital Health insight earlier this year, Epic’s November 2022 announcement that hospitals running its EHR would be able to run their EHR workloads on Google Cloud was a pivotal moment.

To date, public cloud providers Google Cloud, Amazon Web Services (AWS) and Microsoft Azure have made the greatest strides within the hospital IT public cloud market. Oracle’s acquisition of Cerner is also expected to boost Oracle’s position in this market over time. As of end-2022, only around 15% of US hospitals had fully migrated to public cloud. But recent EHR hosting agreements between Epic-Google Cloud and Epic-Azure (both in the US), and Dedalus-AWS (in Europe) promise to accelerate migration. AWS hosts Dedalus EHR solutions for more than 50 hospitals in the UK, with more migrations planned this year and in 2024.

EHR market vendors, including the likes of Epic and Dedalus, also have a sizeable share of the High-Acuity CIS market; EHR vendors combined represented just over half of market revenues in 2022. The remaining share consists of “Best-of-Breed” specialist vendors such as Philips, GE HealthCare, PICIS, and Dr√§ger. The pace of cloud adoption in High-Acuity CIS, however, is still lagging the inpatient EHR market development, which is witnessing a relatively quicker pace of transition. This is partly due to the increased level of clinical data and patient sensitivity/privacy within the high-acuity hospital departmental settings.

Best-of-Breed High-Acuity CIS market leader (in revenue terms), Philips, announced a strategic agreement with AWS in April 2023. This was for its HealthSuite Imaging and includes the development of cloud-based generative AI applications that will provide clinical decision support. Whilst this is primarily to support its Imaging business, the vendor has indicated, along with many others, that its overall long-term software strategy lies away from on-premise.

Collaboration and Education is Essential

The challenge for the wider High-Acuity CIS market is ensuring timely collaboration between cloud providers and high-acuity CIS vendors (both EHR and Best-of-Breed). Increasing education targeted towards high-acuity departmental settings and clinicians is another necessity.

The Epic-Google Cloud, Epic-Azure and AWS-Dedalus agreements are recent examples of a collaborative approach in the EHR market. These partnerships promise to accelerate public cloud adoption, reducing costs and improving patient outcomes for hospitals, opening up new markets and revenue pathways for the likes of these vendors.

Public cloud High-Acuity CIS migration is, however, more complex with increased levels of patient data sensitivity and privacy concerns within these higher-acuity departmental settings. It will require several years of heavy investment in education to guide hospital providers based on their needs, and ease cybersecurity concerns, from both a high-acuity CIS departmental and an enterprise level.

Greater vendor collaboration and a change of mindsets is required before cloud adoption moves full steam ahead.

About the Report

The above analysis demonstrates a snapshot of some of the key strategic trends assessed by Signify Research in its High-Acuity Clinical Information Systems – World – 2023 market report. This report is the second iteration, building on the previous edition published in 2021. It provides a data-centric and global outlook of the High-Acuity CIS market by product. These include ICU-IS, NICU-IS, Perinatal IT, OR Manager, AIMS, EDIS and Analytics/AI. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About the Clinical Care Team

The clinical care team provides market intelligence and detailed insights on the clinical care equipment and IT markets. Our areas of coverage include patient monitoring, diagnostic cardiology, infusion pumps, ventilators, anaesthesia and high-acuity IT. Our reports provide a data-centric and global outlook of each market with granular country-level insights. Our research process blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

For further information please contact Arun Gill.

E: Arun.Gill@signifyresearch.net

T: +44 (0) 1234 986 111

www.signifyresearch.net