Written by

- The American Telemedicine Association (ATA) held its annual conference in Chicago last week and with it several significant acquisitions were announced

- On Monday 30th April, American Well announced that it was acquiring acute telehealth hardware and platform vendor Avizia

- Not to be upstaged, on the same day InTouch Health, one of Avizia’s main competitors, announced it had entered into a definitive agreement to acquire telestroke platform specialist Reach Health

Here’s the Signify View on these two announcements

For the last 12 months Signify Research has been providing insight on M&A and strategic partnerships within the telehealth industry. In particular we’ve focused on announcements where a vendor has used an acquisition to expand its portfolio to address the transition of telehealth from small scale pilot projects, focused on a specific need, to enterprise-scale telehealth that is fully integrated across the breadth of a healthcare providers’ services. Recent examples of activity of this kind that we’ve covered include:

- Avizia’s acquisition of Carena – allowing Avizia to expand its offerings beyond platforms and hardware and into physician support services

- Teladoc’s acquisition of Best Doctors – a strategic move that pushed Teladoc’s business up a step, in terms of the levels of acuity it was addressing

- InTouch Health’s acquisitions of TruClinic, C30 Medical Corporation and AcuteCare Telemedicine (ACT) – expanding InTouch Health’s offerings in terms of acuity addressed and into the physician support service market

- American Well and Philips forming a strategic partnership allowing both companies improved access to telehealth markets at acuity levels they had not historically addressed

The latest deals announced at ATA last week are a continuation of this trend, where companies have expanded their portfolios in terms of acuity and product type via acquisition. However, both deals also address another issue that the telehealth platform industry is grappling with: scale.

Portfolio Expansion

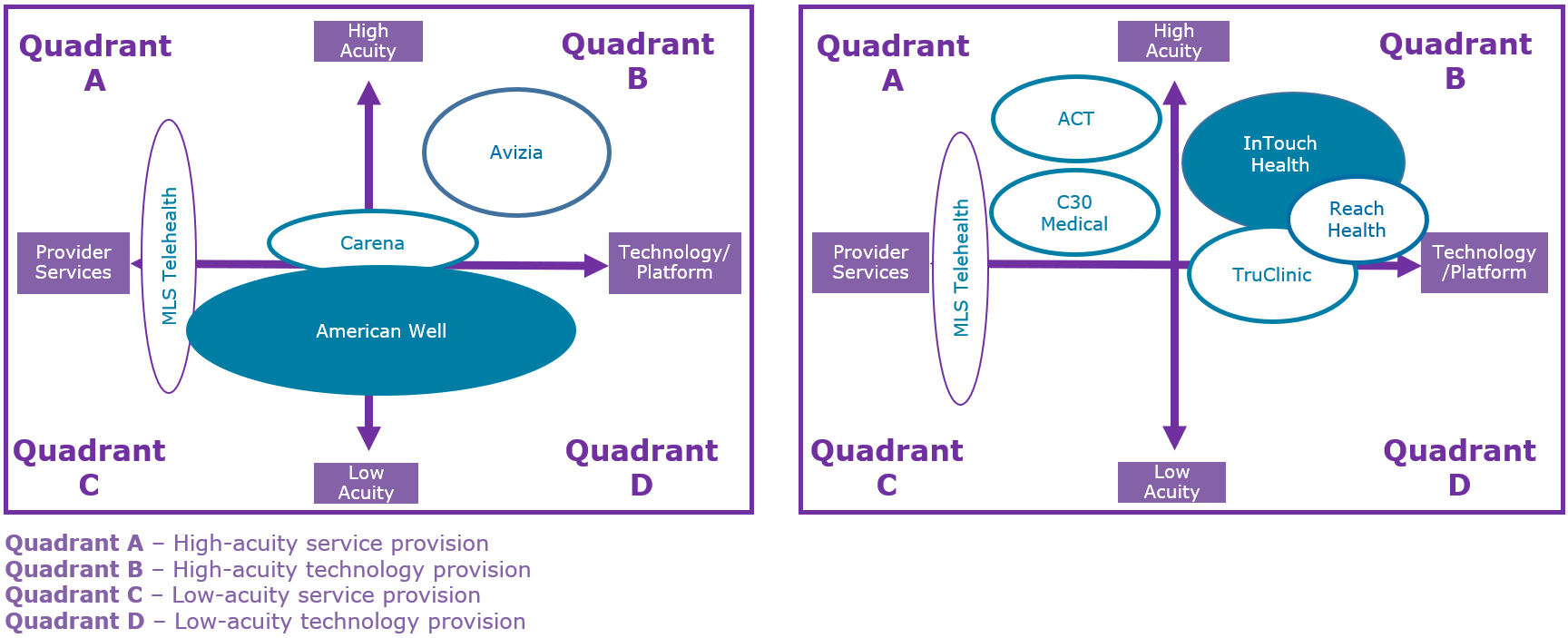

The two diagrams below outline the segments of the telehealth market that American Well, Avizia, InTouch Health and Reach addressed (alongside those of their recent acquisitions and partnerships). The diagrams illustrate the strategy that has been employed by many telehealth vendors over the last 12 months, i.e. to develop a portfolio that addresses a broader range of acuity in terms of both platforms and physician support services.

American Well and InTouch Health Acquisitions and Strategic Relationships

For American Well, the acquisition brings with it several benefits. Avizia (spun out of Cisco in 2014), was a leading hardware vendor to high-acuity telehealth markets. Over recent years Avizia had started to transition its business toward a platform-centric offering; its acquisition of Carena, in 2017, and strategic relationship with MLS Telehealth (also in 2017) had expanded its portfolio beyond high-acuity technology offerings to physician support services and lower-acuity technology offerings (although even with its acquisitions, Avizia still focused largely on the upper half of the above chart).

American Well is a leader in platforms and physician support services for low-acuity markets but has been attempting to shake off its image as a provider of low-cost MD consultations. The strategic alliance with Philips that was announced in 2017 was a step towards this, but the Avizia deal is more significant.

The deal means that American Well is now in direct competition with its strategic partner, Philips, in areas such as tele-ICU and surgical/medical support (also areas of strength for Avizia), suggesting the Philips arrangement may now be more limited in scope. However, the Avizia acquisition puts American Well in a unique position, as the only vendor that has a full enterprise-wide offering in terms of technology and services; this will serve it well as it starts to seriously cast its eye towards international markets.

The InTouch Health deal is not quite as significant in terms of moving InTouch into new acuity markets. The company had started expanding out of its high-acuity technology provider niche into lower-acuity markets and the physician support market during 2017. However, the Reach Health acquisition doesn’t expand the company’s offering into the lower acuity sector to any great extent. Reach Health also addressed the same high-acuity platform market, initially focusing on neurology but in more recent years expanding its offering to other clinical applications. However, the deal is important in terms the general trend towards consolidation within the high-acuity platform market and in terms of the issue mentioned earlier: scale.

Scale

The telehealth market (platforms, hardware and services) is forecast to grow from under $3B in 2017 to more than $7B in 2022 (Source: Acute, Community and Home Telehealth – World – 2018), with platforms projected to increase market share significantly. Today, the platform supplier base is extremely fragmented and served typically by small, local vendors that have historically specialised in one or two use-cases/application areas. As market need moves to towards higher demand for enterprise-scale solutions, consolidation is to be expected, with vendors that have the breadth of portfolio and the scale of resources to meet the demand winning a greater share of the market.

Reach Health is perhaps a prime example of a vendor that would have struggled to adapt during this transition. Its 2017 revenues are estimated to have been less than $10M; whilst it had extensively developed its platform to address the transition to enterprise-scale telehealth, it did not have the same level of resources (e.g. implementation services, advisory services and physician support services) as companies such as Philips, InTouch Health, American Well and Teladoc, that will be needed to meet future demand.

The issue of scale is also vital for larger vendors. Both acquiring companies in this insight had telehealth businesses that are estimated to have still been less than $100M in 2017. This is a relatively low for two of the leading vendors in a $3B market. To succeed in the medium term in addressing the broader demands of enterprise-scale telehealth, market leaders will also need to scale their business more broadly (partly through M&A). No doubt one of the key reasons InTouch Health made this acquisition, and also a reason as to why this won’t be the last major acquisition we see within the telehealth platform market.

Where Next?

Consolidation of telehealth platform vendors has been intense over the last 12 months. However, apart from Philips, the market is still largely dominated by start-ups (Teladoc being one of the few platform vendors to have had an IPO).

However, US EHR vendors are starting to turn their attention to the telehealth platform market. During 2017 Allscripts announced that it was working with Vidyo to integrate video consultations into its FollowMyHealth patient engagement offering; Vidyo has also recently announced it was working with Epic to develop telehealth solutions for stroke services in rural areas, eClinicalWorks also launched “Televisits” as part of its Healow PHM solution in June 2017 and at HIMSS this year we saw Avizia announce it had partnered with athenahealth to offer the AviziaOne telehealth platform within the athenahealth Marketplace.

These partnerships are key for ensuring that telehealth is integrated seamlessly into standard clinician workflows as telehealth moves from pilot/single-setting deployment to enterprise-scale deployment. But will it stop at partnerships? Or are we likely to see an EHR vendor make a significant telehealth acquisition?

Population Health Management had similar dynamics just a few years ago, with the market dominated by start-ups such as Wellcentive, dbMotion, Phytel, Explorys, Jardogs, PureWellness and Humedica. Whereas now the large EHR vendors and Health IT vendors have acquired these companies and the PHM market is dominated by companies such as Cerner, Allscripts, Epic, Optum, Philips and IBM.

While Telehealth does not have the same legislative drivers as PHM, the move to enterprise-scale telehealth, the fact that telehealth is increasingly used as a tool in other clinical processes administrated by EHR systems and the increasing use of telehealth as a core component of a patient engagement strategy mean that it would not be a surprise to see one of the leading EHR vendors make a significant telehealth acquisition during 2018.

About the Report

The trends analysed in this insight are also discussed in Signify Research’s just published market report “Acute, Community and Home Telehealth – 2018 Edition“. This report presents the market for telehealth platforms, hardware and services and will include projections and market sizings for more than 20 countries across a range of care settings and acuity levels.

The report is available as a stand-alone product, but it is also a component of Signify Research’s “Population Health Management and Telehealth Service“. This is a year-round service that provides ongoing data, insights, and analysis on the global population heath management and telehealth markets. The service includes four market reports delivered over a 12-month period, regular updates of key market metrics, competitive environment and market share analysis by product type and region and quarterly analyst briefings to each subscriber firm.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

To find out more:

E: Alex.Green@signifyresearch.net , T: +44 (0) 1234 436 150

www.signifyresearch.net