Written by

Written by Arun Gill, Cranfield, UK, 11th October 2021 – Two key deals, involving four of the UK and Oceania’s teleradiology providers, were announced in early 2021. In February, the UK and Ireland’s market leader Medica Group partnered with Australian teleradiology provider Integral Diagnostics to launch a 50-50 joint venture called MedX. This was followed four months later with the news that Vital Healthcare Group, through its UK subsidiary Vital Radiology Services, announced a partnership with Australia’s largest diagnostic imaging operator, I-MED Radiology Network. These vendors are set to benefit from synergies delivered by their partnerships, but will these unions also make them a more compelling teleradiology option for the NHS?

Vendor Impact

- For Medica and Integral Diagnostics, the MedX joint-venture provides access to a group of dual-qualified radiologists able to operate in Oceania and the UK/Ireland, and will support both companies’ acute, out-of-hours reporting services.

- There is also potential for MedX, which is registered in Australia, to bid directly for teleradiology reporting contracts in Oceania using its combined network of reporters, and in the longer-term offer services beyond Oceania and the UK/Ireland.

- Vital has a global footprint spanning Asia and EMEA, although most of its reading service volume is performed for the Indian market and its UK operation is still in its infancy. With NHS demand for teleradiology services ramping up in 2021, Vital’s ability to leverage I-MED’s scale and expertise, along with the commencement of a new overnight out of hours reporting service based in the UK, will strengthen its ambition to become a leading provider to the UK’s NHS.

Market Impact

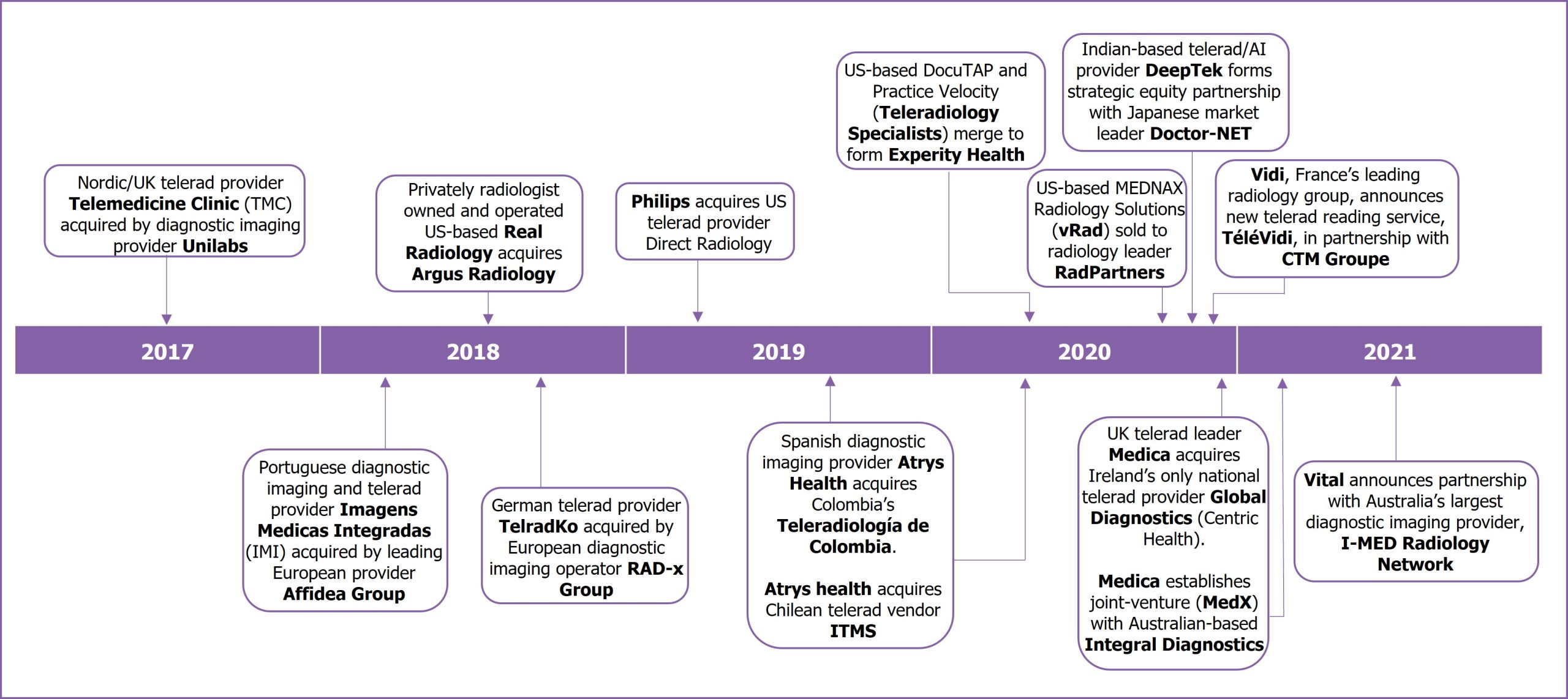

- These deals reinforce a trend of increased vendor collaborations, partnerships and M&A activity that has taken place in recent years involving outpatient imaging/radiology groups and teleradiology providers.

- The trend of consolidation is likely to accelerate further. This trend is driven by the fragmented nature of the diagnostic imaging and teleradiology market which limits the opportunities for smaller vendors to scale, and is due to vendors’ financial difficulties resulting from the pandemic.

- With healthcare providers under pressure to fulfil the unprecedented backlog of postponed diagnostic imaging procedures as a result of the pandemic, strategic partnerships involving teleradiology providers will ultimately enable them to offer greater support to healthcare providers.

Strategic Partnerships Accelerate

The highly fragmented nature of the diagnostic imaging and teleradiology competitive landscape has resulted in an accelerating trend towards consolidation, through joint-ventures and M&A activity involving private equity firms and larger diagnostic imaging groups, as highlighted in the below graphic. However, since the beginning of the global pandemic, vendor activity has risen considerably, and whilst the trend of consolidation through M&A activity has shown no indication of slowing down, several examples of strategic partnerships have also emerged, most recently involving UK and Oceania-based vendors.

Pandemic Deepens Radiologist Shortages

Whilst radiologist shortages are ubiquitous globally, in Oceania and especially the UK these shortages are particularly acute; there are an estimated seven radiologists per 100,000 people in the UK, versus the European average of 13 radiologists per 100,000.

The UK’s shortages are fundamentally due to the NHS lacking the in-house capacity to read the rising quantity of diagnostic images. In April 2021, the UK Royal College of Radiologists indicated that the radiologist workforce has a shortfall of 33% (minimum 1,939 consultants) required for pre-COVID-19 levels of demand for diagnostic images. Without further investment in consultant training, and better staff retention/recruitment, the shortfall will reach 44% (minimum 3,613 consultants) by 2025.

With over 5m patients waiting for routine operations and procedures in England alone, and with this figure set to almost treble in 2022 according to the Institute for Fiscal Studies, it has led to the government announcing GBP 6.4bn (USD 8.7bn) in emergency funding for the UK to help the NHS deal with the backlog.

The deficit means that healthcare providers are becoming increasingly reliant on outsourcing their diagnostic imaging workload. It also goes some way to explaining why, at 10% and 5% respectively of overall diagnostic imaging procedures, the UK and Oceania had the first and fourth highest rates of teleradiology penetration of all major countries and sub-regions globally in 2020. Despite this, however, both markets are projected to achieve double-digit CAGR in teleradiology IT and reading service revenues through to 2025.

Teleradiology’s Role in Tackling the Backlog

Medica and Vital are two of the five specialist teleradiology service providers on the NHS Teleradiology Reporting Services framework agreement, along with 4Ways Healthcare and Telemedicine Clinic (Unilabs). The final vendor on the framework is Everlight Radiology; another provider with operations in both the UK and Oceania, where it is the market leader for teleradiology reading services.

In November 2019 Vital began to provide teleradiology reads for a major NHS trust, however the volume came to a sudden halt in early Q1 2020 due to the postponement of non-urgent, elective daytime procedures during the pandemic, resulting in a substantially lower requirement for its teleradiology services. Similarly, Medica’s reliance on reporting for the NHS led to a 50% fall in demand for its NightHawk reporting, and a 90% drop in elective procedure reading volumes during April 2020 versus pre-pandemic levels. Demand for its overnight NightHawk business remained robust with revenues up by 4% versus 2019, however its elective procedure reading business suffered throughout 2020 with a 49% decline in revenues. This contributed towards the UK/Ireland representing the most severely impacted geography across Western Europe in terms of volume decline, and one of the worst affected teleradiology markets globally.

Teleradiology is a relatively small part of the overall I-MED business; it performs c. 5 million patient procedures annually, although emergency and after-hours teleradiology reporting from its “I-TeleRAD” group represents around 10% of this. Similarly, teleradiology reading services only represents a small proportion of Integral Diagnostics’ business. During 2020, Oceania experienced a relatively lower impact from COVID-19, in part due to lockdown measures and the closing of Australia and New Zealand’s borders to international visitors.

Whilst these partnerships provide mutual benefits to all parties, including giving the vendors the opportunity for international expansion, they are likely to be of greater significance to the UK/Ireland, particularly as it is facing an unprecedented backlog of diagnostic imaging procedures waiting to be performed. Through greater sharing of resources (e.g. teleradiologist reporters), higher reading volume capacity, and collaboration on the development of new technologies (e.g. AI), these partnerships will lead to greater operational efficiency and maximize the return on a vendor’s radiologist workforce; one of their most significant overheads. This will ultimately lead to Medica and Vital being better equipped to support the UK’s NHS in tackling the backlog.

The word ‘unprecedented’ has regularly been used to describe the conditions resulting from the global pandemic. But, for the NHS this word represents the scale of the challenge it faces. While partnerships alone will not be able to solve all of the problems faced by the health service, the fact that Medica and Vital have so readily engaged shows they are motivated to arm themselves as best they can and tackle these challenges head on.

Signify Research Teleradiology Market Coverage

The above analysis is a summary of data and commentary from Signify Research’s Teleradiology – World – 2021 market report. This report builds on the previous edition published in 2020 and provides an up-to-date assessment of the current status for diagnostic imaging procedures by modality, and the teleradiology reading services and IT market. It explores the impact of COVID-19, specifically, in 20 core countries and sub-regions, and looks at when the market will begin to increase back to and beyond pre-pandemic levels. Forecasts are provided to 2025 for the market for teleradiology reading services (reading volumes, revenues and revenue per read), teleradiology IT and the competitive environment (from a reading service provider and IT vendor perspective) in each of the 20 countries and sub-regions mentioned above.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.