Written by

How do Companies Differentiate in a Saturated Marketplace?

The general radiography market is feeling the pressure for a number of reasons:

- The influx of new companies bringing low-cost FPD products to the market, predominantly Chinese companies, which is enabling manufactures of general radiography systems to lower their prices.

- Pressure exerted from regional companies who are expanding into the international markets, particularly those producing competitively priced, low-end x-ray rooms.

- Healthcare systems across the world are under pressure to do “more for less” for the end user. The motto “price is king” has never been more accurate. The general radiography market is seeing a transformation as healthcare changes to value-based-care, with radiology converting from profit centre to cost centre.

Across the market we are seeing system prices fall by mid-single digit percentage annually. So, with a nearly-saturated digital radiography market and declining product prices; what are manufacturers doing to maintain their margins?

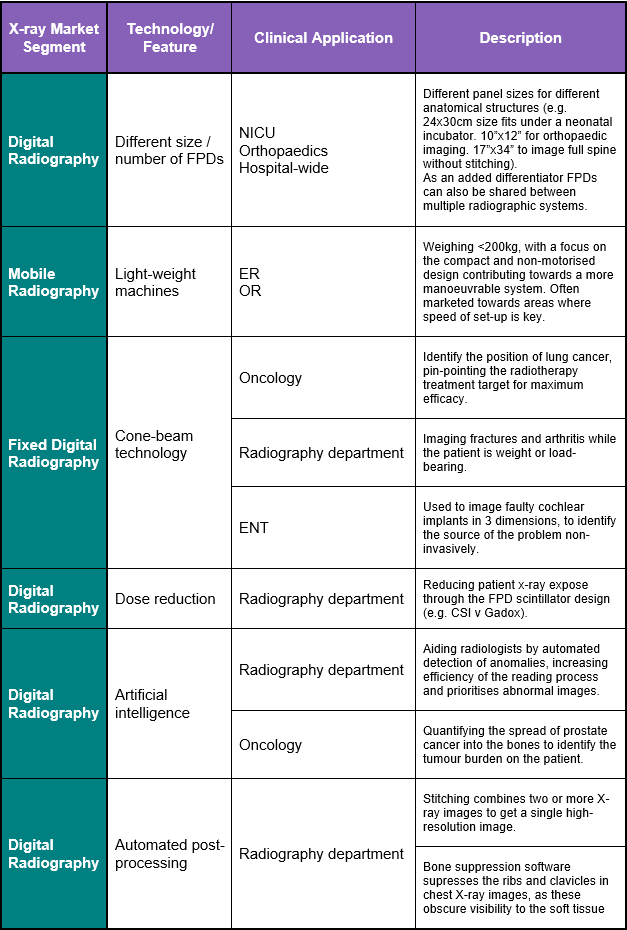

To challenge commoditisation, it seems the answer for many companies is further diversification by offering products developed for specific clinical applications.

The variety of FPD offerings is not new to the market, giving it little appeal as an option for system manufactures to further diversify their product offering. The same can be said for the introduction of light-weight mobile radiography systems – there are both global x-ray vendors and regional players already competing in this area. Cone-beam, on the other hand, could be an area of further diversification within the general radiography market. A handful of vendors currently have cone-beam technology in their diagnostic x-ray product portfolio, and it is also used in some angiography and ENT imaging products too. Dose reduction is already addressed to a certain extent, with end-users becoming increasingly aware of the issue of maximising dose-reduction for the patient. The market already offers a certain amount of choice for this (CsI versus Gadox detectors), but an increased focus on x-ray dosage could broaden the opportunities for vendors to further diversify their product ranges.

However, the area with the most potential seems to be imaging software, particularly features that optimise workflow. Post-processing of images, as well as storage and sharing of those images is an important area of development across all medical imaging platforms. The post-processing features currently associated with premium systems will gradually migrate down to high-end and mid-range systems. For example, Samsung are offering image stitching on both their ceiling mounted and u-arm floor type systems. As new software technologies are developed and introduced, this migration will see a broader range of systems that include post-processing features, thereby increasing the diversity of product offerings.

Analysis of the operational cost benefits and the clinical capabilities of these advanced solutions need to be quantified. It is not enough to simply add on the technology to maintain a high price-point, the cost of the processing software must be justified. This will help vendors to compete against the lower-cost manufacturers and maintain their profit margins in this highly competitive market.