Written by

Cranfield, UK, 22nd February 2024 – The Infusion market has seen various swings in competitive dynamics in recent years. Product recalls, company acquisitions, new product launches, component supply issues and the uptick in demand seen following the COVID-19 pandemic have all had their impact on the market environment. This insight provides a deeper dive into the evolution of the infusion market and subsequent impact on share of the leading players.

Signify Research has been assessing the market developments within the Infusion Pumps market in the last 3 years and has aggregated its market share analysis into an infographic. Please click below to request the infographic and learn how the impact of product recalls and launches have affected vendor market share.

The Good

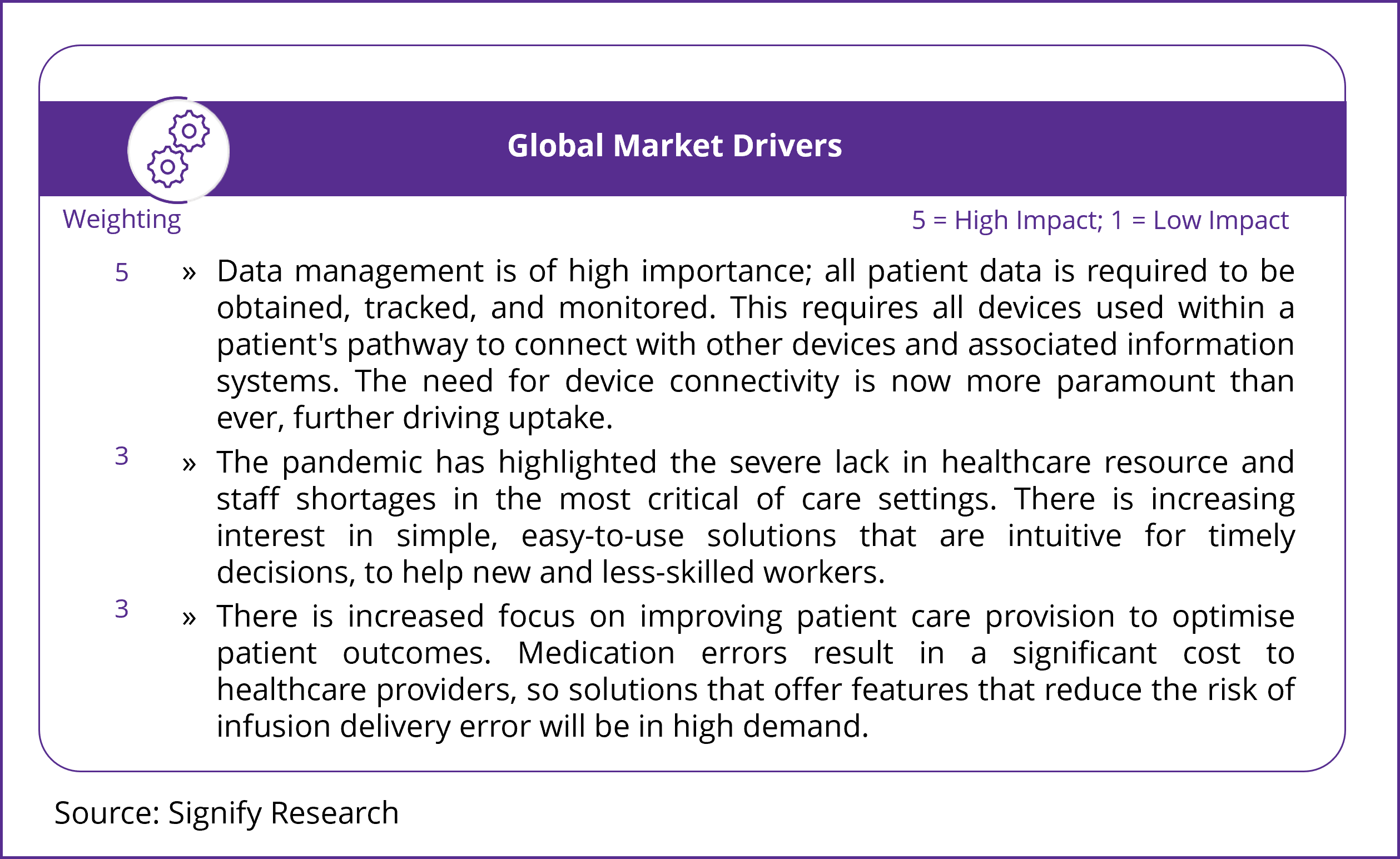

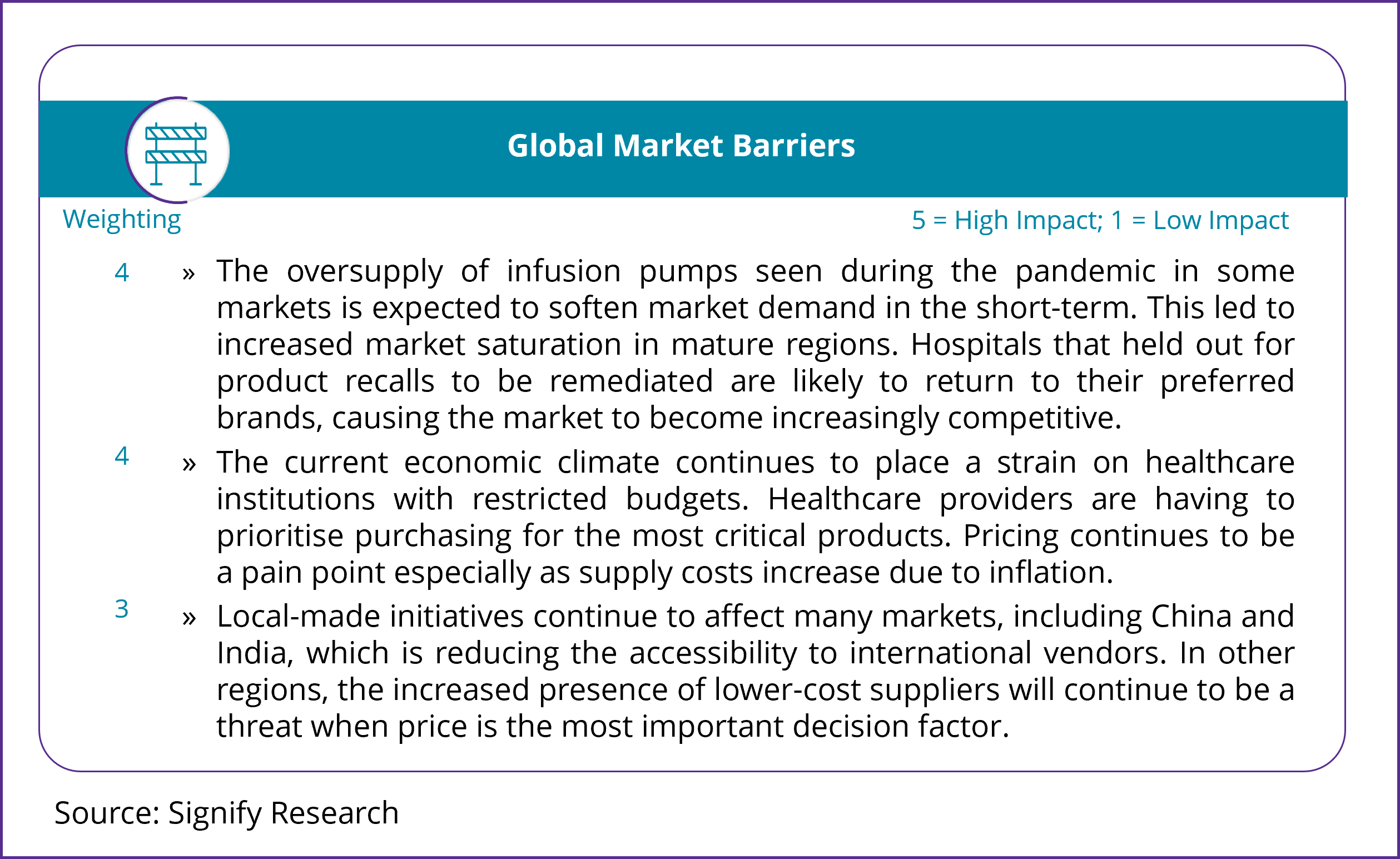

The infusion pump market is projected to see steady growth of 4.2% CAGR in the next five years. However, the strong demand seen during the pandemic has softened the market in the short-term, as some countries extend product replacement cycles. The surgical backlog is still very prominent in many countries and tackling the long waitlists will remain a focus for many healthcare providers. However, they need to balance this with increasing costs due to high inflation. There is growing interest in infusion solutions that offer intuitive features such as simple dashboards, colour-coding and smart alarming, that ultimately help to reduce patient risk from medication errors. The need for newer digital solutions that improve patient safety and clinical efficiency is at an all-time high. Vendors who can offer a comprehensive platform and an intuitive software solution that can meet the increasing demands of the healthcare workforce will win in what will be an increasingly competitive environment.

The Bad

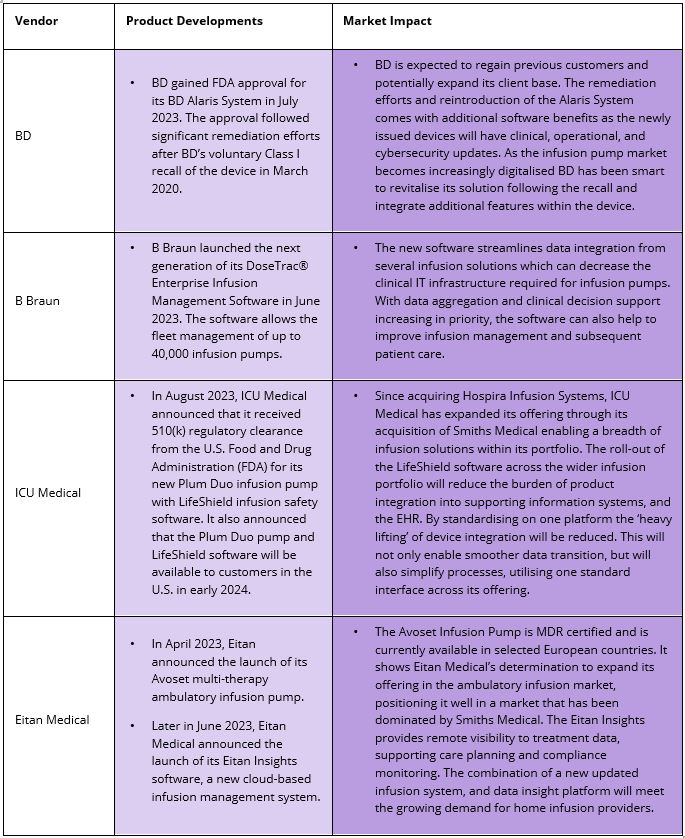

The infusion market has been plagued by several recalls in recent years, with some of the larger international brands affected. Many of the recalls are related to infusion software. With the growing use of infusion software, vendors are focusing heavily on improving the safety of their products. BD released its updated Alaris System in 2023, which included additional software benefits, such as clinical, operational, and cybersecurity updates. ICU Medical also recently launched its new Duo Pump also in 2023, with LifeShield infusion safety software. ICU Medical hopes the new solution will further cement the company as a leading vendor in the market.

Since the pandemic, several vendors have faced component supply issues that affected their ability to manufacture their products. Supply chains began to return to normal in 2023 and the affected vendors have increased production, enabling them to regain market share. However, as inflation rose in 2022 it affected global economies and vendors faced significant push-back on price. An uptick in average selling prices was seen in 2022, and prices rose further in 2023; however, price erosion is projected to return from 2024, as the market becomes increasingly competitive and purchasers show greater price sensitivity.

The Not so Ugly Future

Despite the dip seen in 2021, global revenues for infusion pumps are projected to remain above pre-pandemic levels through to 2027. The need to ensure patient data continuity to help improve clinical decisions is maintaining demand for solutions that can connect with wider information systems. This is also driving purchasing decisions toward digital solutions that can interop with other medical devices in addition to the electronic medical record. The lack of ICU capacity during the pandemic flagged major inefficiencies in healthcare systems globally, and healthcare providers had to rethink their provision of care. The ICU department will be an initial focus in both developed and emerging regions, with demand for solutions that optimise patient care. Solutions that can integrate with other clinical devices will be necessary to ensure patient data is optimised to improve clinical decisions. In response to the changes in market demand, several vendors have revamped their offering with newer advanced solutions catered toward clinical efficiency and workflow. In its Infusion Pumps – 2023 report, Signify Research recently assessed the new product launches and their market impact, including:

Related Research

Signify Research is due to publish its Infusion Pump – World – 2023 report. The report builds on our 2022 edition of the research and provides a data-centric and global outlook of the market. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors to provide a balanced and objective view of the market.

About Kelly Patrick

Kelly joined Signify Research in 2020 as a Principal Analyst. She has over 15 years’ experience covering a range of healthcare technology research at IHS Markit/Omdia. Kelly’s core focus has been on the clinical care sector, including patient monitoring, diagnostic cardiology, respiratory care, and infusion and associated IT solutions. Kelly holds a BSc degree with honours in Pharmacology from the University of Leeds. In her spare time, Kelly has a passion for running and outings with her husband and three children.

About the Clinical Care Team

The clinical care team provides market intelligence and detailed insights on the clinical care equipment and IT markets. Our areas of coverage include patient monitoring, diagnostic cardiology, infusion pumps, ventilators, anaesthesia devices, and high-acuity IT. Our reports provide a data-centric and global outlook of each market with granular country-level insights. Our research process blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net