Written by

Cranfield, UK, 16th April 2024 – In recent months, the US Department of Health and Human Services (HHS) made several announcements promoting the development of health information exchanges (HIE).

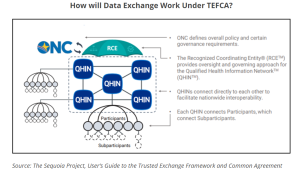

The first was to officially unveil the vendors that can immediately begin exchanging data under the Trusted Exchange Framework and Common Agreement (TEFCA), a nationwide interoperability framework. The vendors, officially designated as the first cohort of Qualified Health Information Networks (QHINs) in December 2023 were eHealth Exchange, Epic Nexus (subsidiary of Epic Systems), Health Gorilla, KONZA, and MedAllies. CommonWell Health Alliance and Kno2 received QHIN status in February 2024.

Secondly, the final ruling of HTI-1 (Health Data, Technology, and Interoperability: Certification Program Updates, Algorithm Transparency, and Information Sharing) was announced. This includes advancements related to interoperability, transparency and greater support for access and exchange of health information.

Lastly, the Centers for Medicare & Medicaid Services (CMS) Interoperability and Prior Authorization Final Rule, declared in January 2024, also aims to improve electronic HIE and prior authorization processes.

The Signify View

As analysed in this recent SPI Digital Health Insight, the QHIN concept and its various implications is the result of legislative measures in the US, chiefly the 21st Century Cures Act. This act specifically called for the establishment of a TEFCA whereby, through a network of federally-designated QHINs, healthcare organisations could easily connect and exchange health information securely across the US.

Back in 2019, the non-profit Sequoia Project was selected by the Office of the National Coordinator for Health Information Technology (ONC) as the Recognised Coordinating Entity (RCE) to support TEFCA’s implementation. It had been accepting applications for the first candidate QHINs since 2022, and has now officially designated the first cohort of QHINs. Surescripts and eClinicalWorks announced their QHIN intentions last year, and more organization are anticipated to come on board.

QHINs to Eventually Replace HINs?

At its core, the legislation supporting the creation of QHINs aims to break down the information silos that persist US healthcare systems. The 2009 Health Information Technology for Economic and Clinical Health (HITECH) & Meaningful Use Act intended to address this problem by financially incentivising providers to rapidly implement (non-standardised) EHRs. But the more successful EHR vendors realised that it would be better (for them) if their systems were unable to ‘talk’ to other EHR platforms, so providers would be obliged to buy their EHR and supplemental IT. This created a siloed system dominated by a select few players.

eHealth Exchange, CommonWell, and Carequality are the three large national networks/frameworks which combined have access to healthcare records from over 90% of the population (>320m patients). Carequality and eHealth Exchange are federated networks. Meanwhile Carequality provides HIE in a decentralized manner; each entity connected within the network is responsible for its own patient matching and record location. They have been described as the HIEs of HIEs, but although there is some overlap between them, information exchange between them is anything but smooth.

A major advantage of the new QHINs versus the HINs, however, is that a member organisation of one QHIN will automatically be plugged into all five of the newly qualified TEFCA vendors, which covers the entire care system. Each QHIN connects participants and sub participants. The national HINs stipulate that, unless an HIE specifically opts out, it will automatically be part of a QHIN.

The expectation is for the existing HINs (eHealth Exchange and CommonWell) to fully transition to TEFCA (QHINs) over the next three to five years, replacing the existing requirement for Carequality’s HIN framework.

There are currently six authorized Exchange Purposes under the TEFCA agreement: Treatment, Public Health, Payment, Government Benefits Determinations, Health Care Operations, and Individual Access Services. Additional Exchange Purposes are likely to be added over time.

Waiting Game

While the newly designated QHINs signal a new era of information sharing, it will be some time before they begin to deliver real benefits. It is not mandatory for an organisation to join a QHIN and those that are already partnering with the incumbent HINs will need compelling reasons to switch to another QHIN.

QHINs will be effective only when they have a critical mass of partners with a critical mass of data to be shared. Essentially, the more users a network has, the better information sharing will be. In May 2023, Epic announced the first cohort of 20 health systems joining its QHIN, including major health systems such as Mayo Clinic and Mount Sinai. eHealth Exchange revealed in August that 12 US healthcare organisations would be the initial participants in its QHIN, including larger tier-1 and tier-2 players. Health Gorilla announced in October that 17 US organizations had committed to joining its QHIN, although its partner list predominantly included tier-2 and tier-3 vendors.

A member of one QHIN automatically confers connectivity to other QHINs. But given that organisations are free to choose which QHIN to partner with, familiarity will play a huge role in members’ decision making. For example, most health systems in the US use Epic’s EHRs and therefore already have deep connections to Carequality. Epic will be hoping that the majority of the 2,000 hospitals and 600,000 clinicians nationally using Epic’s interoperability tools will participate. As of December 2023, 84 health systems representing 498 hospitals and 11,711 clinics had opted in.

In the case of eHealth Exchange, organisations that are already partners will by default become partners in the new QHIN unless they opt out, and this will therefore limit migration. In February 2024, eHealth Exchange launched a programme to incentivise public health data sharing. According to eHealth Exchange, the first five HIEs to sign up by end-April 2024 will be exempt from annual fees for three years. These HIEs will be obliged to exchange clinical data for a nominated use case via eHealth Exchange or TEFCA.

This incentive programme comes as a spokesman for the Office of the National Coordinator (ONC) for Health Information Technology recently stated that, as the agency that oversees TEFCA, the onus was on it to promote TEFCA’s advantages. Currently, TEFCA membership is voluntary.

When deciding which QHIN to partner with, a potential differentiator is the storage of data; data from the Health Gorilla and Konza QHINs is centralised, whereas the other five QHINs have a decentralised model. In these, the preference is for data not to be stored, and instead pass through from one point to another, largely due to security/trust reasons. Smaller players lacking the IT infrastructure, for example, may be more inclined to partner with Health Gorilla/KONZA for data curation purposes. Larger players, however, that have invested heavily in a sophisticated enterprise Master Patient Index (MPI) and Record Locator service (RLS), will be more inclined to opt for a de-centralised QHIN partner.

Eliminating Barriers

Another significant element of the Cures Act helping to eliminate HIE barriers is the anti-information blocking element. In September 2023, the policy was reinforced with the introduction of penalties of $1M per violation for any interference with access to, exchange and use of electronic health information (unless the information is not private, secure or invisible). Two months later, the HSS released a proposed rule to compliment the above penalties, with disincentives for healthcare providers found guilty of information blocking. This would impact reimbursement, scoring, and participation, respectively, under three Centers for Medicare & Medicaid Services (CMS) programs; the Medicare Promoting Interoperability Program (for hospitals), the Promoting Interoperability performance category of the Merit-based Incentive Payment System (MIPS, for ambulatory providers), and the Medicare Shared Savings Program (for Accountable Care Organisations – ACOs).

The HTI-1 rule, initially proposed in April 2023 and finalised in December, includes further revisions to information blocking definitions and adds a new exception for TEFCA.

Also of note within the ruling is the new regulatory requirement for healthcare related AI and algorithms to be transparent, safe, and help eliminate existing health disparities without creating new ones. US Core Data for Interoperability (USCDI) Version 3 has been unveiled as the new baseline standard within the ONC Health IT Certification Program. Lastly, developers of certified health IT will be required to report certain interoperability metrics as part of their participation in the Certification Program.

Further, the Centers for Medicare & Medicaid Services (CMS) Interoperability and Prior Authorization Final Rule requirements for payer-to-payer API-based information sharing, announced in January 2024, also aims to improve HIE and prior authorization processes. To date, +99% of data exchange has facilitated treatment purposes only, with minimal data electronically exchanged for non-treatment “purpose of use”, such as payment, research, etc. By 2027, the ruling has the potential to drastically increase the amount of data flowing electronically and increase trust across the healthcare industry. Whilst the ruling does not currently apply to TEFCA, Signify Research understands that QHINs are keen for the CMS to include TEFCA, and ultimately better support the aim of streamlining prior authorisation process by 2027.

Pushback Anticipated

Despite the unprecedented opportunities for information exchange being promoted by TEFCA, the move to QHINs has some high-profile critics. Former ONC National Coordinator Don Rucker suggested that TEFCA is built on outdated data exchange technology that will prevent the initiative from being useful. Despite the need to overcome such obstacles, Signify Research predicts that, over time, HINs will eventually convert fully to QHINs, offering incentives such as FHIR at QHIN level to eventually persuade enough stakeholders to move to QHIN.

There are also concerns from healthcare providers relating to several proposed HTI-1 compliance deadlines required to be met by the end of 2024. Less than half of healthcare providers are currently in a position to comply with the interoperability rules set in the Cures Act. To comply with FHIR standards, vendors will need to allocate substantial resources to their solutions. In 2024, some will inevitably fail.

The Medical Group Management Association (MGMA) has pushed back on the information blocking disincentives, suggesting that noncompliant providers require greater technical support to protect privacy and security if they are to ensure interoperability. Expect similar from hospitals and clinician groups this year on plans to enforce these data blocking rules in such aggressive timescales. With Medicare reimbursement struggling to keep up with inflation and providers’ operational costs, it could ultimately discourage participation in value-based care programs.

Conclusion

TEFCA will take time to progress and it remains to be seen how effectively QHINs will drive HIE developments. But ultimately these announcements in recent months are an important step in driving national baseline standards for clinical data sharing and improving access to health information, including for non-treatment purposes. As more organisations come on board, TEFCA has the potential to truly mark a new era of interoperability and health data exchange, supporting the national interoperability frameworks’ aim of enhancing clinical decision making, improving patient outcomes and lowering healthcare provider costs.

Related Research

Health Information Exchange – World – 2024

The above analysis is a summary of some of the trends assessed by Signify Research in its upcoming Health Information Exchange – World – 2024 market report. It provides a data-centric and global outlook of the HIE market by implementation type (i.e. National, State-wide, System-wide, Hospital-specific) and data architecture models (i.e. Centralised, De-centralised/Federated, Hybrid). The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Arun Gill

Arun joined Signify Research in 2019 as part of the Digital Health team focusing on EHR/EMR, integrated care technology and telehealth. He brings with him 10 years’ experience as a Senior Market Analyst covering the consumer tech and imaging industry with Futuresource Consulting and NetGrowth Consultants.

About the Digital Health Team

Signify Research’s Digital Health team provides market intelligence and detailed insights on numerous digital health markets. Our areas of coverage include electronic medical records, telehealth & virtual care, remote patient monitoring, high-acuity clinical information systems, patient engagement IT, health information exchanges and integrated care & value-based care IT. Our reports provide a data-centric and global outlook of each market with granular country-level insights. Our research process blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net