Written by

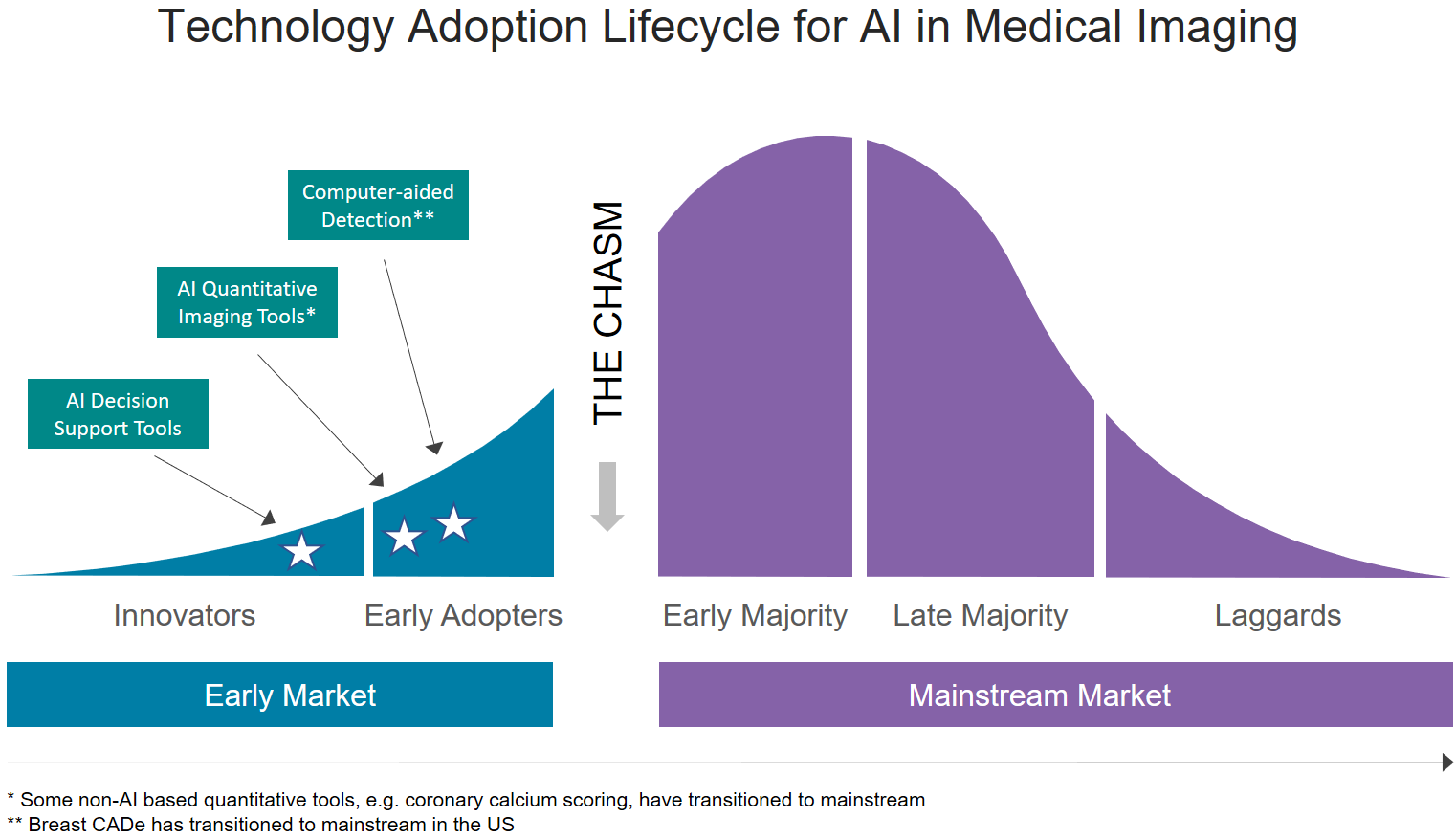

In his seminal book “Crossing the Chasm”, Geoffrey A. Moore described the challenges of bringing disruptive technologies to market and the all-important transition from selling products to innovators and early adopters, to selling to the mass market. Moore’s book builds on the diffusion of innovations theory from Everett Rogers and highlights how the expectations and requirements of early adopters are notably different to the early majority, the group of customers that start to buy the new technology in larger quantities. As the first wave of deep learning solutions for medical imaging enter the market, vendors are vying to win innovator and early adopter customers. But will their go-to-market strategies enable them to penetrate the mass market, or will they fall into the chasm?

From Innovators and Early Adopters to the Early Majority

Vendors first need to identify the innovators, or technology enthusiasts, who are willing to act as alpha and beta test sites and who are willing to provide data to train AI models. Likely targets are key opinion leaders at the larger academic hospitals. These customers are unlikely to represent a significant revenue stream, but they are the gatekeepers to the next group of customers, the early adopters.

The early adopters, or visionaries, are motivated by change and want to be the first to implement change in their industry, to gain a competitive edge. They are prepared to champion new technology and will accept the limitations and glitches often associated with early generation products. The early adopters for medical imaging AI are likely to be found at academic hospitals and the larger hospital groups. Teleradiology companies looking for ways to differentiate their offering and to improve their efficiency are another potential source. The experiences of these early adopter customers will provide vendors with invaluable feedback to refine their solutions, so they are ready for the mass market. Moreover, these customers act as cross-pollinators in the industry and help to raise awareness and to build credibility for new vendors and their solutions.

Whist success with innovators and early adopters is pivotal for crossing the chasm, vendors must ensure they do not stretch themselves too thinly. These customers tend to be needy and time consuming, often requiring high levels of product customisation, assistance with system integration and technical support. Start-up companies in particular need to be careful not to take on too many early adopter customers or risk being pulled in many directions, soaking-up precious resource. This is challenging and somewhat contradictory, since these customers are a welcome revenue stream for a new business, but the transition to the mainstream market needs to be carefully managed, or companies may find themselves at the bottom of the chasm.

By contrast, the early majority, or pragmatists, tend to be followers and are more risk averse. They want proven and reliable solutions from known vendors with strong customer support. User interfaces must be refined, and any complex features simplified. Vendors also need to adapt their marketing messages for early majority customers and position themselves as reliable, easy to do business with and solution providers, rather than technology innovators and visionaries. Case-studies can be a useful tool.

The Whole Product Concept

The early majority customers expect total solutions for a given business or clinical problem, rather than discrete products and technologies. These solutions must seamlessly integrate into their existing infrastructure. When considering AI in medical imaging, a deep learning algorithm on its own is not the total solution, merely a component. Whilst the innovators and early adopters may be prepared to buy AI tools from multiple vendors and integrate them into their existing solutions, the mainstream market will require end-to-end AI-powered solutions, with proven productivity gains.

For some early majority customers, this may take the form of a suite of algorithms hosted on a dedicated AI platform that integrates with their imaging IT system. As most AI vendors currently only offer a single product, or at best a handful of AI tools, the platform may need to be augmented by products from partner companies, in order to have maximum appeal to the mainstream market. For other customers, and most likely for the bulk of the mainstream market, they will expect AI to be a fully integrated feature of their imaging IT system, rather than a standalone product/platform. Over time, it’s likely that some of the AI tools that today command a high price, will become common utility features of imaging IT systems.

Both cases highlight the pivotal importance of AI start-ups forming partnerships, both with other AI specialists and, most importantly, with the leading imaging IT and modality vendors. Early adopters may be satisfied with a loose, API-level integration between an AI platform and their imaging IT system, but mainstream customers will be more comfortable with a tightly integrated solution that combines image storage, management and viewing, alongside AI-powered analysis tools, in a single environment. With a fully integrated solution, the results from AI tools can be accessed via the diagnostic imaging viewer for an enhanced user experience, with the ability to annotate and reject/approve the results from within the imaging IT platform. Moreover, a tight integration will allow full access to the diagnostic worklist, to discover scheduled studies and retrieve related priors. Moreover, radiologists will increasingly expect to see non-imaging information present alongside the scan, requiring integration with other health IT systems, such as EHRs.

The whole product concept is a critical success factor in crossing the chasm and in taking innovative technologies mainstream. Vendors with innovative, end-to-end workflow solutions will likely have the best chances of success.

The Tenpin Bowling Analogy

According to Moore, one of the fundamental principles for crossing the chasm is to target a specific niche market as an initial point of attack and to focus all resources on achieving a dominant leadership position in that segment. The target niche should be selected by considering the potential market size, accessibility and competitor intensity. Selecting the best niche is another critical factor in crossing the chasm and Moore describes a “bowling pin” strategy, where targeting a given market segment will help to “knock over” related segments, leading to market expansion. By selecting the right target market and having the best “angle of attack”, companies can scale faster.

Vendors must identify the best target segment to pursue the mainstream market and should not pursue too many segments at once, or they will likely dilute their focus and reduce their chances of success. Ideally, customers in the target segment will have similar needs as customers in adjacent segments.

For many of the medical imaging AI start-ups, their choice of target market seems to have been based on the availability of training data, rather than rigorous market segmentation analysis. Many are pursuing either the lung or breast imaging markets, which is a risky strategy as it’s harder to cross the chasm to the mainstream market by starting in a crowded segment. That said, lung and breast are both high volume segments of the medical imaging market, so the potential rewards are greater. Companies who target these segments must ensure they have truly differentiated offerings, as those who have me-too products will almost certainly fall into the chasm. Examples of differentiation include:

- Target a specific imaging modality, e.g. breast MRI, or develop solutions for a multi-modality customer environment.

- Target a specific geographic market that is currently under-served.

- Target a specific user group, e.g. community hospitals, private imaging centres, teleradiology companies, etc.

- Develop an innovative workflow solution.

- Introduce an innovative pricing strategy.

Vendors must also consider the effects of the bowling pin strategy and their next move once they are established in their initial target market. For example, developing a suite of tools for a specific clinical speciality, e.g. cardiology or pulmonology, may be a more efficient strategy than developing a tool for one speciality and then targeting an unrelated speciality. It is also important to consider that not all applications for AI in medical imaging will cross the chasm at the same time. Applications with a proven return on investment, coupled with improved clinical outcomes, will likely be the first. In today’s cost-conscious healthcare environment, customers need a compelling reason to buy new technologies, particularly from new vendors.

Crossing the Chasm Checklist

- Carefully select your target market. Can you truly differentiate and clearly articulate why your solutions is better than the competition? Will the target market enable you to penetrate adjacencies?

- Focus on one target market at a time and carefully manage the number of early adopter customers. Don’t over-stretch your resources.

- Adapt your go-to-market strategy and marketing communications as you transition through the technology adoption lifecycle. What works for one group of customers may not work for the next.

- Ensure your technology roadmap leads to a “whole product”. Develop partnerships and ecosystems that will enable you to develop total solutions to meet your customers’ needs.

Related Market Report

“Machine Learning in Medical Imaging – 2018 Edition” provides a data-centric and global outlook on the current and projected uptake of machine learning in medical imaging. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK.

More Information

To find out more:

E: simon.harris@signifyresearch.net

T: +44 (0) 1234 436 150

www.signifyresearch.net