Written by

11th January 2022 – Written by Kelly Patrick- With most governments moving toward ‘healthcare for all’ there is immense pressure on healthcare providers to ensure a high level of care is offered to a greater patient population. Healthcare providers are now being targeted to achieve specific measures with reimbursement affected if healthcare provision is poor. This is increasing demand for solutions that advance patient care and clinical outcomes, by improving workflow and clinical efficiency. Due to the significant costs associated with anaesthesia care, the return on investment is of highest priority. Mature countries have already transitioned to assessing the total cost of ownership, however, there was little consideration in more developing regions. The Coronavirus pandemic affected healthcare budgets in many countries and has pushed providers to reassess the overall cost of anaesthesia care. The importance of evaluating upfront costs, in addition to the longer-term financial impact is now higher than ever.

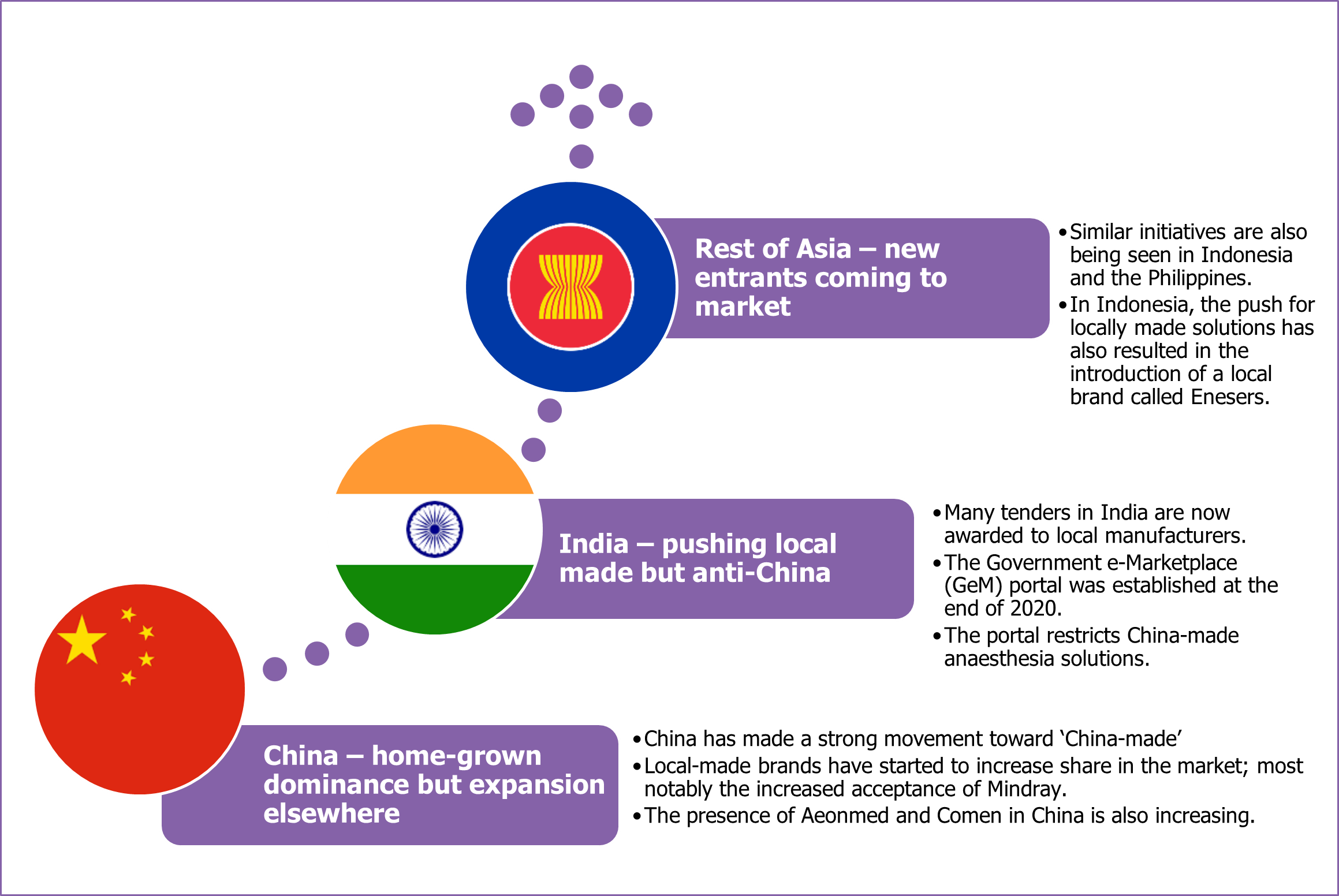

The governments in emerging countries such as China, India and other Asian countries are now starting to prioritise purchasing from local vendors, to not only reduce costs of healthcare equipment purchases, but also to help further strengthen their own economies. For several years, these countries have been reliant on medical devices imported from international vendors, especially for anaesthesia solutions.

Figure 1 Trends in ‘Local Made’ Purchasing in Asia

China – home-grown dominance but expansion elsewhere

China has made a strong movement toward ‚ÄòChina-made’ with four provinces now stating that all medical solutions need to be made in China where possible. Attitude toward international brands is changing; traditionally Western international brands were favoured in higher tier hospitals as they were considered the highest quality and of greater cost benefit. Through industrial policy for medical technology, local-made brands have started to increase share in the market; most notably the acceptance of Mindray has increased significantly in recent years. Mindray’s presence is expected to further strengthen with the launch of the premium (A9) and high-end (A8) solutions (A8) late last year, which they claim have had significant uptake in China. The movement to local brands has resulted in an uplift in the number of vendors present in the Asia region in addition to existing vendors expanding their product offerings. The presence of Aeonmed and Comen in China is increasing, and this is subsequently supporting the development and expansion of their solutions, assisting their capability to launch more solutions globally.

India – pushing local-made but anti-China

Many tenders in India give preference to local manufacturers Initiatives to support local manufacturing were further accelerated by the COVID-19 pandemic, with India seeing much higher rates of COVID-19 patients than many other emerging countries. The Government eMarketplace (GeM) portal was established at the end of 2020, enabling healthcare providers to purchase medical devices including anaesthesia solutions at a competitive price. Currently the portal restricts China-made solutions, and subsequently will affect the presence of vendors whose products are manufactured in the country.

Rest of Asia – new entrants coming to market

Similar initiatives are also being seen in Indonesia and the Philippines. In Indonesia, the push for locally made solutions has resulted in the introduction of a local brand called Enesers. The government in Indonesia introduced regulations that encouraged the use of domestically manufactured solutions. Enesers manufactures a range of medical devices, including anaesthesia solutions.

Impact on international vendors

With many of the faster growing economies attempting to inject finances into their domestic market, international vendors are taking heed of the changes that are coming. The pandemic highlighted the risk that many countries had if they did not have their own domestic supply of medical solutions, and as such investment into local brands is expected to continue. This is creating uncertainty for international vendors and is subsequently reducing their ability to supply across the healthcare market, decreasing opportunities in public-funded institutions.

Some international manufacturers have established local manufacturing plants to supply at least some of the components that are included in the anaesthesia equipment to try and help meet minimal local manufacturing requirements. Vendors are also advancing partnerships with university teaching hospitals to develop research programs utilising their solutions. It is expected that international vendors will also look to partner with local manufacturers, or possibly acquire the solutions, to maintain their presence within the region. Despite this, the acceptance for local brands will still be higher.

Impact on global market

On the flip side, several Asian manufacturers have started to drive their product offerings globally by acquiring smaller international vendors or working closely with domestic distributors. Mindray has grown its share in recent years in many of the developing regions including Eastern Europe, ASEAN, and Latin America. Beijing Aeonmed has also invested further into the anaesthesia devices market and is following Mindray’s footsteps to provide a more complete offering of solutions across the clinical care markets. Its recent acquisition of Heyer Medical has enabled it to gain more traction in international markets, and enable access to Heyer’s solutions in emerging regions, helping to strengthen its position. As a result, Beijing Aeonmed was ranked fifth globally in the anaesthesia market in 2020.

Closing remarks

There is a lot of uncertainty in the anaesthesia market, especially in the emerging regions where growth is often faster. International vendors are assessing ways in which they can remain competitive and will be adjusting strategies accordingly. Above all, price competition is expected to be intensified, devaluing the market overall in many countries.

About the Report

The recently published report Anaesthesia Devices Report – 2021 provides a data-centric and global outlook of the market. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK. To find out more: enquiries@signifyresearch.net, T: +44 (0) 1234 436 150, www.signifyresearch.net

More Information

To find out more:

E: enquiries@signifyresearch.net,

T: +44 (0) 1234 436 150