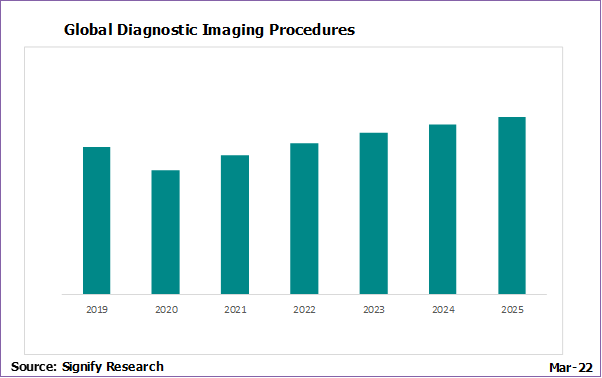

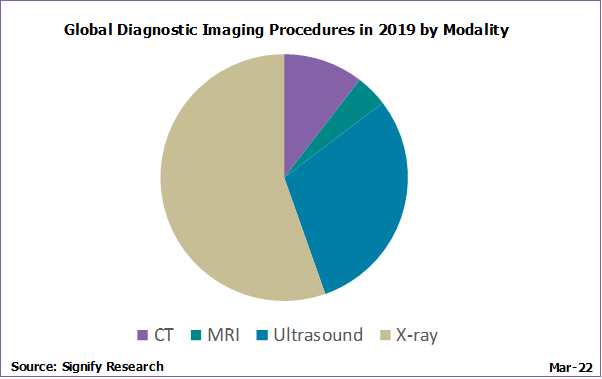

In the years prior to the Covid-19 pandemic, the worldwide accessibility and usage of medical imaging has made marginal but marked gains. This is due to both the increased investment in healthcare and the advances in technology that improve image acquisiton speed and/or image quality. According to the Lancet in October 2021, 47% of the world now has access to diagnostic imaging. Signify Research estimates that in 2019 over 4.9 billion diagnostic imaging procedures were undertaken. Though over 50% of these images were performed by the X-ray modality, there was increasing global use of ultrasound imaging and to a lesser extent CT and MR imaging.

National lockdowns curtailed non-urgent procedures in all countries at some point during the Covid pandemic, as healthcare workflows were often drastically revised to ensure that resources could be focused on Covid patients and that sufficient protective measures, including cleaning, PPE and social distancing, were emplaced for other types of healthcare provision to protect patients and healthcare professionals alike. These changes substantially lowered diagnostic imaging procedure volumes in 2020, with a global decrease of almost 16% to just under 4.2 billion. The MRI modality was most heavily impacted, due to a number of factors. These factors include: (1) MRI’s limited role in assessing Covid patients, (2) – the postponement or decreased demand for some MSK imaging, (3) that confined MRI rooms required greater infection control efforts, and (4) installations of new MRI systems were postponed.

The anticipated 2021 recovery in diagnostic imaging procedure volumes was diminished by the emergence and spread of Covid-19 variants. However, we estimate that diagnostic imaging procedure volumes will recover to just above 2019 levels in 2022 and 2023.

From 2019 to 2025, the proportional breakdown of diagnostic imaging procedures across the imaging modalities will remain broadly similar, with relative slight increases in the percentages of ultrasound, CT and MR procedures, and a relative decrease in the percentage of X-ray procedures.

Beyond the global trends, more in-depth analysis of the individual country data reveals some interesting trends.

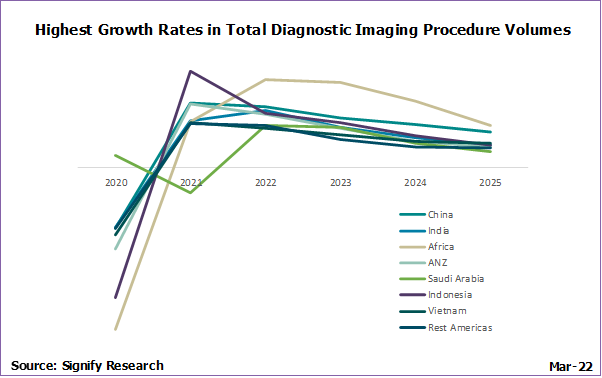

Growth Rates by Country

When considering growth rates in diagnostic imaging procedure volumes over the 2019 to 2025 time period at a country level, the top eight geographies offered no surprises. Areas within Asia Pacific and Latin America, including China and Vietnam, already had undergone major efforts to expand the provision of healthcare prior to Covid. For other areas, such as India and Africa, their large but under-served populations meant that small increases in imaging capabilities will have a large impact on the growth rates for the number of diagnostic imaging procedures carried out. The inclusion of ANZ (Australia, New Zealand and surrounding islands) and Saudi Arabia in the highest growth rates were more unexpected, but attributable both to the success of their early efforts to contain Covid and to the installation of updated imaging equipment.

Body Parts

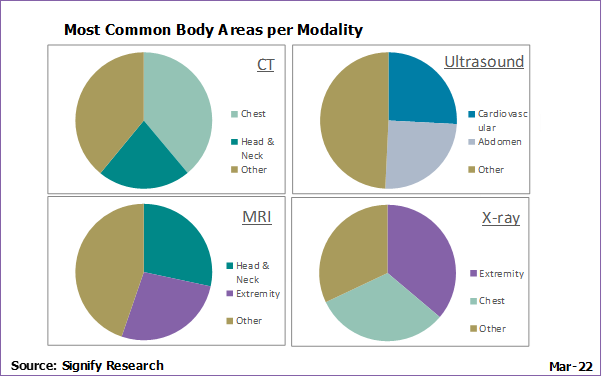

For the CT modality, the body parts imaged most commonly in 2021 were the chest and head & neck. The chest use is aligned with diagnosing and monitoring lung cancer and respiratory conditions (including COPD, pneumonia, and TB), and additional use in trauma. CT of the head & neck is associated with multiple conditions, including stroke, cancer, trauma, aneurysm, neurodegenerative diseases, and structural malformations.

The MRI modality provides the clearest details of soft tissues due to the enhanced image quality provided, and thus is used predominantly for neurological, spine and extremity imaging.

Due to its accessibility and real-time visualisation, ultrasound is the preferred modality for non-invasive assessment of the abdominal organs and structures and for studies of moving body parts such as the heart and foetus.

X-ray is both the fastest and the most globally accessible modality, and has broad usage for a diverse range of clinical applications. As such, it may be used as a first line investigation of any potential medical issue or injury. For extremities, X-rays can quickly investigate fractures and other bone injuries. For the chest, X-rays can quickly assess lung function as well as chronic lung conditions such as emphysema and cystic fibrosis. These two body areas (chest and extremities) accounted for over two-thirds of the diagnostic X-rays conducted in 2021.

Though very important for healthcare management, breast, pelvis and hip imaging are performed for more specific purposes, and do not fall within the top two body areas for any given diagnostic imaging modality.

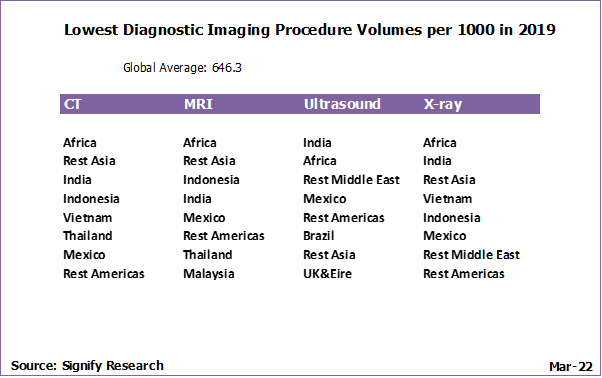

Most Under-Penetrated Countries per Modality

Though in 2019 the global average of diagnostic imaging procedure volumes was 646.3 per 1000 population, certain geographical areas had significantly lower average procedure volumes.

For CT and MR imaging, the countries that fell in the lowest average procedure volumes have limited resources to purchase, install and utilise advanced imaging equipment, and therefore offer limited potential for notable increased equipment sales.

The same cannot be said for the ultrasound and X-ray modalities, where the devices have relatively low average selling prices in comparison to other modalities. They can be installed in the most basic medical facilities, and they do not require advanced training to use. As a result, countries such as India and Mexico, and regions such as the Rest of Asia, Rest of Middle East, and Rest of (Latin) Americas, present a clear opportunity for increased equipment sales.

Future outlook

Following recovery from Covid suppression of healthcare provision, diagnostic imaging procedure volumes should see robust growth to 2025 to just under 6.0 billion scans as a result of the increased investment in imaging to tackle Covid, the resultant patient backlog in most well resourced countries, increased device capabilities and the continuing democratisation of imaging.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK. To find out more: enquiries@signifyresearch.net, T: +44 (0) 1234 436 150, www.signifyresearch.net

More Information

To find out more:

E: enquiries@signifyresearch.net,

T: +44 (0) 1234 436 150