Written by

Cranfield, UK, February 23rd 2022; Written by Bhvita Jani and Graham Cooke: The medical flat panel detector (FPD) market experienced a 4% increase in unit sales in 2020 reaching a market size of just under 70,000 units. However, the market revenues declined by almost 10%, equating to a market size of $2.1 billion USD. Market fluctuations echoed those seen in the X-ray modality markets, with static FPDs used primarily in fixed digital radiography (DR) rooms and mobile DR experiencing 10% year-on-year growth. Growth was driven by healthcare providers globally buying mobile X-ray systems for diagnosis of pneumonia as an indicator of COVID-19. Conversely, the market for dynamic panels, often used for fluoroscopy, surgical and interventional procedures, saw a sharp decline with units falling by 18% from 2019 to 2020 as elective surgeries were postponed or cancelled.

Signify Research predicts the medical FPD market to reach 85,000 units by 2025. However, as average selling prices are expected to continue to fall, market revenues are predicted to decline.

In 2021, market dynamics shifted with demand for static panels used in mobile radiography declining, as the surplus demand in 2020 had been met during the initial waves of the pandemic. However, as elective procedures returned in 2021, demand for dynamic panels for mobile C-arm and interventional applications subsequently increased. In 2021, unit sales of dynamic panel increased by just under 15%, almost returning to pre-pandemic levels.

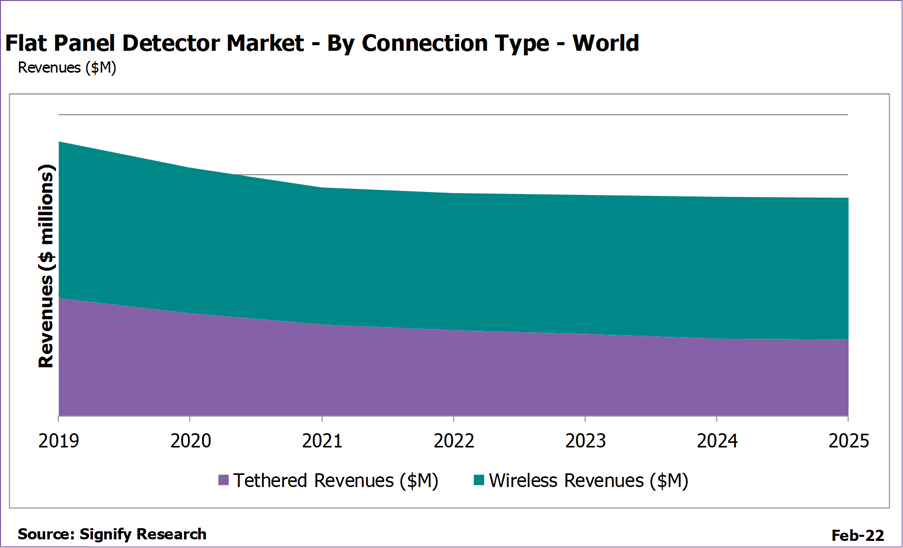

Wireless flat panel technology is increasingly adopted globally

Demand for wireless technology is continuing to increase in applications such as fixed and mobile radiography, especially in developed markets where benefits such as increased workflow capabilities are widely recognised. In 2020, wireless detectors accounted for 53% of all FPD unit sales. By 2025, this is forecast to grow to 61%. Physical parameters such as detector weight, extended battery life, and liquid damage protection also play a role in the purchasing process, although these factors are typically a lower priority than image quality and dose reduction. Purchasers are also paying attention to the pixel resolution and detective quantum efficiency (DQE). Manufacturers of FPDs are developing thicker scintillator layers and increasing the DQE level possible with their detectors.

Suppliers of FPDs are developing new products that have reduced scatter, lower noise, higher resolution and require lower dose exposure, a key consideration for healthcare providers and increasingly for patients as well. A combination of these features can reduce the need for retakes and increases clinical precision, enabling imaging departments to perform more efficiently.

Another key consideration when purchasing FPDs is the reliability and durability of the panel. Providers are demanding more robust, reliable panels, with a greater return on investment before replacement is required. As a result of this, providers are requesting service contracts or extended warranties to support increasing the lifespan of the detectors.

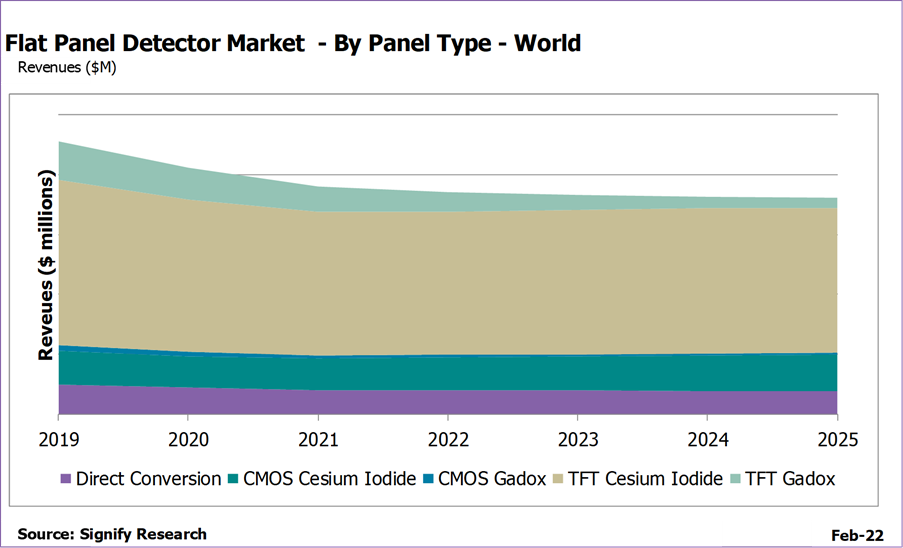

Demand for Gadox continues to decrease

Cesium iodide is the gold standard for medical imaging FPDs, but limited demand for gadolinium oxysulfide (Gadox) panels remains. Cesium iodide panels are more sensitive and produce higher quality images than Gadox equivalents, but come with a higher associated cost. The focus on reducing radiation dose in Western Europe and North America is limiting demand for Gadox panels. However, they continue to be sold in some price sensitive markets across Latin America, . Demand for Gadox detectors is forecast to decrease throughout the forecast to 2025. As the prices of cesium iodide panels become more affordable, these panels are becoming more accessible to a wider range of customers. In addition, as the dose optimisation benefits of cesium iodide FPDs are further acknowleded in emerging countries, this will drive adoption of this panel type. Demand for Gadox panels will be maintained beyond the forecast period by smaller clinics and independent medical imaging facilities where cost is the primary consideration,

Competitive Analysis

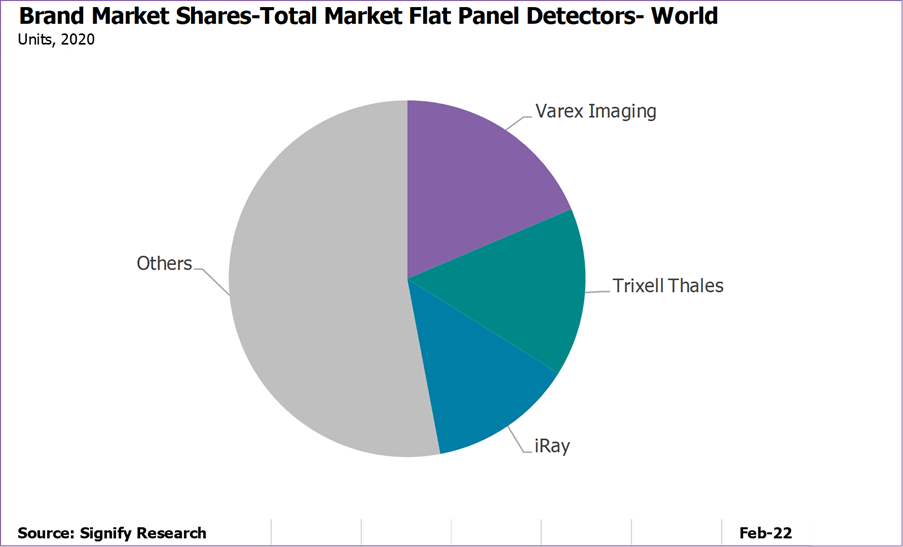

The medical flat panel detector market remains a highly fragmented and competitive sector, with 15 vendors having at least a 2% market share each. Varex leads with 18%, followed by Trixell Thales in second position and iRay in third position completing the top three.

Chinese FPD vendors gained market share in 2020, due to increased production and surplus inventory to supply to mobile X-ray system manufacturers. As a result, companies such as iRay, Careray and PZ Technology increased their market share in 2020.

Chinese FPD companies continue to drive an aggressive price war, forcing international FPD vendors to re-evaluate supply chains and open production facilities in lower cost countries such as China.

In the coming years, a key opportunity for vendors with cost-efficient FPDs is expected to be developing markets, such as Latin America, Africa and parts of Asia. With many of the countries in these regions having large installed bases of analogue or computed radiography systems, there will be ongoing digitalisation as the affordability of digital X-ray systems continues to increase.

Future outlook

As the low-end FPD market continues to become saturated and the price ware continues, with newer Asian FPD vendors increasing market presence globally, margins for FPD vendors are increasingly at stake. After years of double-digit price erosion, medical FPD prices are forecast to stabalise with only single-digit price annual declines forecast through to 2025. As a result, FPD vendors are progressively investing in research and development to upgrade their product lines to showcase latest hardware innovation and establish a niche. Such developments include IGZO, flexible detectors, photon counting and addition of AEC chambers on the detectors themselves. Target markets for these higher-end FPD products include developed countries and high-end hospitals where clinical precision is still paramount.