Written by

11th March 2021 – Written by Kelly Patrick – As the calm starts to set in as the COVID-19 pandemic subsides, the focus will resume on lessons learnt. It was clear that many of the most mature healthcare markets were not prepared for the pandemic. Mass purchasing of critical care devices happened after hospitals were put under extreme capacity pressure from significant rise in patients suffering from COVID-19 symptoms.

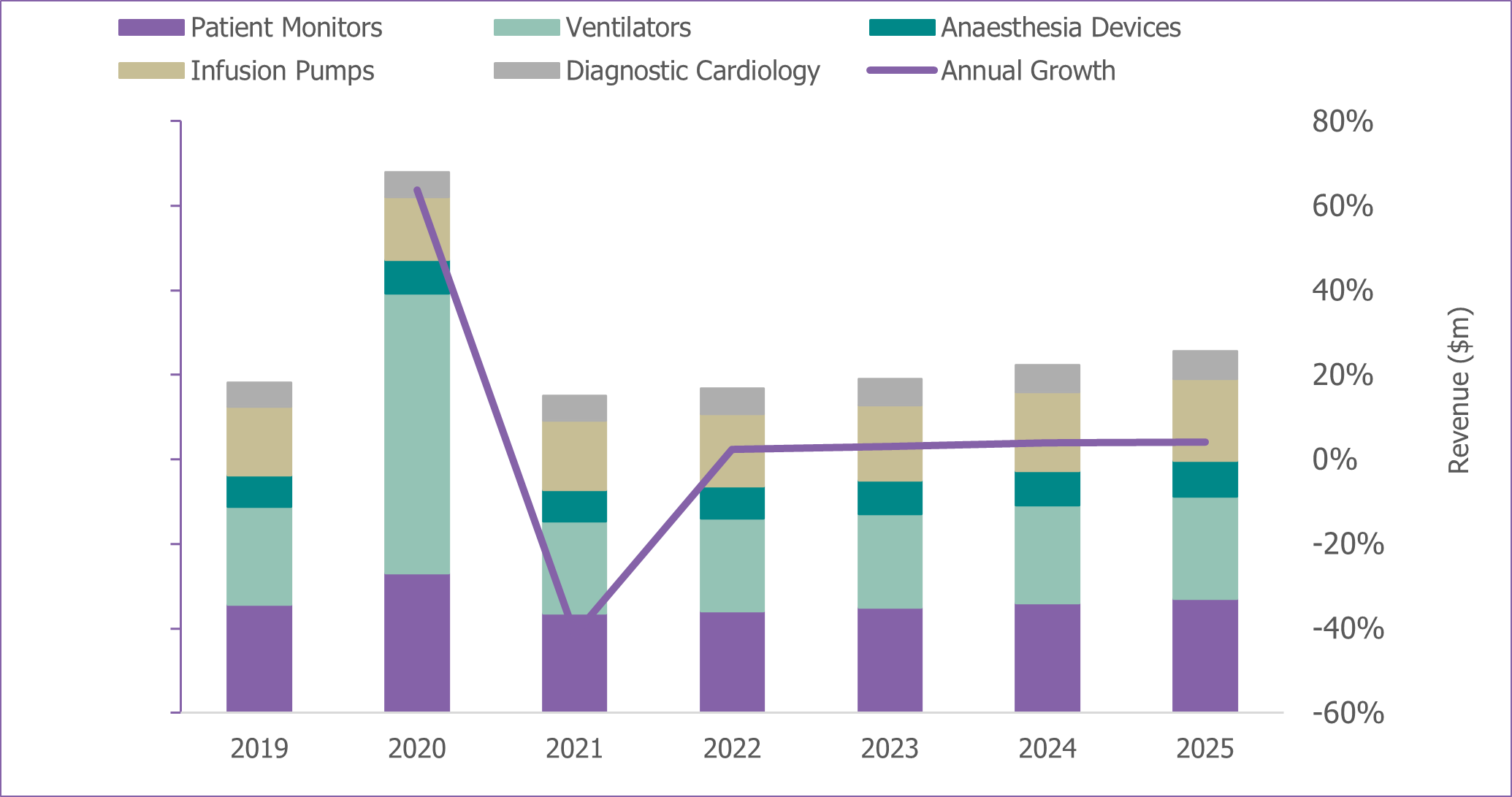

Healthcare budgets were enhanced in many regions, supplemented by Government stimulus packages to help to combat issues faced by a lack of healthcare provisions. Subsequent demand for ventilators and patient monitors to help care for the uplift in patients increased exponentially. Signify Research estimated that the global ventilator market grew to $8.5 billion in 2020, an uplift of 187% from 2019. Similarly, the patient monitor market grew by 28% with revenues increasing to $4.2 billion.

The demand for other clinical care devices in 2020 was mixed. As hospital visits were limited to essential treatment only, many elective procedures were cancelled. This resulted in delayed purchasing for many other devices to the latter part of 2020. Anaesthesia devices saw some uplift in early 2020 in countries where ventilator supply was restricted, with temporary off-label usage for ventilation for ICU patients. With fewer surgeries occurring in 2020, global demand for infusion pumps declined, despite the temporary uplift in demand for treatment of COVID-19 patients.

According to the report’s author, Signify Research analyst Kelly Patrick, “The interest in typically saturated markets has been revitalised, with purchasers reassessing the solutions they have available. This has created opportunity for manufacturers that can offer innovative and cost-effective solutions, including patient monitoring. Healthcare providers have learnt the necessity of continuous monitoring of patients during their care pathway. The pandemic further highlighted the fact that patient information is required to guide patient care. By enabling continuous access to key patient parameters and by ensuring up-to-date patient status is recorded, the level of care provided is expected to increase.”

The patient monitoring market is largely saturated; however, the COVID-19 pandemic has resulted in increased demand for monitoring solutions at all levels of acuity. With reignited interest, manufacturers are continuing to push solutions that share the burden of the cost of increased care provision. Monitoring-as-a-service is starting to become very real, with a fixed price per patient for monitoring provision. Leading patient monitor manufacturer, Philips, is spearheading the movement toward an OPEX (operating expenditure) purchase model. This helps to ensure healthcare providers are kept up-to-date with the most advanced equipment, to improve workflow and enable the best level of care, progressing them toward value-based care. With budgets likely to be more considered moving forward, the pandemic has generated more interest in solutions that can provide the best return on investment.

While the movement to OPEX purchasing holds great promise, it is still in the innovator and early adopter phase and there are several barriers that need to be overcome before it becomes mainstream:

- The financial process remains challenging; healthcare providers need guidance to support the transition from CAPEX (capital expenditure) to OPEX purchasing models. Similarly, manufacturers also need to adapt their own finance systems to be able to facilitate the service model.

- Brand standardisation has been a key trend in the clinical care market, with purchasers choosing one brand for their complete fleet of solutions. All the major vendors will need to support this type of service model to enable appropriate brand choice moving forward.

- Vendors will need to ensure relevant cost analysis is provided to prove the return on investment through a service-based model. This poses a greater risk to the manufacturer if the concept is not proven.

- Each country has different purchasing models, each having their own country-specific standardisation. It will take time and significant resource to roll out the service globally. This will also limit smaller players that don’t have the necessary infrastructure and resources to support this.

Patrick concluded “If the monitoring market successfully transitions to a monitoring-as-a-service model, other markets are likely to follow. Value-based care is becoming a prominent global trend, with providers focusing on health outcomes and cost efficiency. New purchasing models are likely to be well received in the healthcare industry with a greater focus on risk-sharing, to enable the highest level of care provision at the best return on investment”.

About the Report

“Market Impact Report – Clinical Care Devices Report – 2021” provides a data-centric and global outlook on the impact of COVID-19 on the major clinical care devices. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK. To find out more: enquiries@signifyresearch.net, T: +44 (0) 1234 436 150, www.signifyresearch.net

More Information

To find out more:

E: enquiries@signifyresearch.net,

T: +44 (0) 1234 436 150