Sirona Medical Announces Launch of Sirona’s RadOS Platform at RSNA 2021 Annual Meeting

Dr Sanjay M Parekh

Published: December 6, 2021 In The News

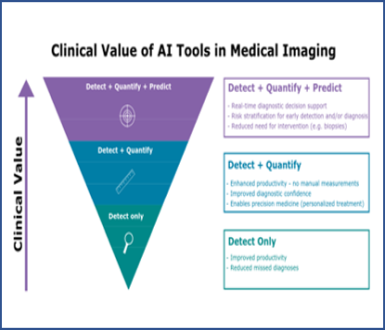

November 30th 2021 – Sirona Medical, a software company founded on a deep understanding of both the practice and business of radiology, today announced the launch of its cloud-native radiology operating system (RadOS) at the Annual Meeting for Radiological Society of North America (RSNA). The unified Workspace platform was developed based on the principle that technology, and AI in particular, should augment the intelligence of the physician. Through the unification of radiology’s core IT software components the worklist, viewer, reporter, and AI onto a single platform, radiologist workflow is simplified, resulting in a better user experience and work product.

You may also like