Written by

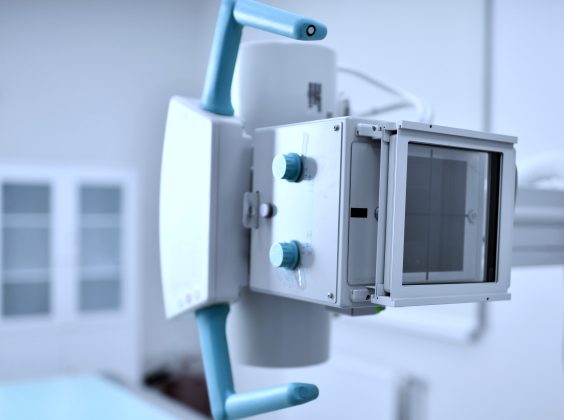

This Market Intelligence Service provides rolling 12-month coverage of the global X-ray market and includes 4 reports :

- Medical Flat Panel Detectors

- General Radiography and Fluoroscopy

- Interventional and Surgical X-ray

- Breast Imaging

This service gives you with unlimited access to our X-ray reports and provides:

- Accurate market sizing and forecasting, empowering you with data driven decision making.

- Detailed market insight and analysis covering key trends, growth drivers, challenges, and opportunities helping you in strategic planning.

- Regional analysis helping you understand market potentials and develop regional strategies.

- Overview of the latest technologies, including disruptive innovations, new partnerships and product launches, providing you with competitive edge.

This Market Intelligence Service provides rolling 12-month coverage of the global X-ray

market. It includes the following reports:

- Flat Panel Detector Market

- General Radiography & Fluoroscopy Market

- Interventional and Surgical X-ray Market

- Breast Imaging Market

Report Deliverable Overviews for the 2024 subscription are:

1. Flat Panel Detector

Report presenting market dynamics, estimates, forecasts and analysis of major drivers for the flat panel detector supply market. Product splits include the flat panel detector market by size, application, image type, connection type, market segment, panel type and panel supply.

2. Interventional and Surgical X-ray

Report presenting market dynamics, estimates, forecasts, competitive analysis and major drivers for the Interventional and Surgical X-ray market. Products included in this report are image intensifier mobile C-arm, 2D mobile C-arm, 3D mobile C-arm and O-arm, Hybrid operating rooms, General vascular angiography, Oncology / Body, Neurology, Interventional gastro, General coronary, Structural heart lab and Electrophysiology. The report also analyses the mobile C-arm market and hybrid operating room market by clinical application at a regional level. The Mobile C-arm FPD market and the interventional X-ray market is further split by pricing segments and suspension or configuration type.

3. General Radiography & Fluoroscopy

Report presenting market dynamics, estimates, forecasts, competitive analysis and major drivers for the General Radiography and Fluoroscopy market. Products included in this report are fixed digital radiography, mobile radiography, analogue, computed radiography, retrofit, remote image intensifier fluoroscopy, classical image intensifier fluoroscopy, remote FPD fluoroscopy and classical FPD fluoroscopy. Fixed and mobile digital radiography is also split into further pricing segments. The total market in each country is also split by sales channel, and customer type.

4. Breast Imaging

Report presenting market dynamics, estimates, forecasts, competitive analysis, and major drivers for the Breast Imaging market. Products included in this report are Full field digital mammography (FFDM), Digital breast tomosynthesis (DBT) upgraded and new systems, Conventional ultrasound, Automated breast ultrasound (ABUS) and Breast AI.

Service Overview

Market

- Identify market opportunity and product mix segment

- Observation on the drivers behind market growth or contraction

- Sales analysis by product type and region for up to 36 countries

Competition

- Market share estimates for the leading vendors by product and by region

- Analysis of vendor strategy and market

- performance

- Detailed product matrix for major vendor portfolios

Technology

- Analysis of the product mix by technology and system value for each country

- Impact of system features on product demand

- Identify trends in product development

Strategy

- Analysis and insights to support your strategy planning

- Our opinion on the future direction of the market

- Direct access to the Analyst for an expert opinion

This service will help you to:

- Identify market growth opportunities, regional trends and market segments based on in-depth quantitative and qualitative analysis

- Benchmark market share against competitors to inform marketing strategies and evaluate ways to strengthen market position

- Gain competitive advantage by identifying emerging players and innovative technologies with the potential to disrupt the market

- Get direct access to our team of expert medical imaging analysts to address pressing questions from stakeholders in your organization