Written by

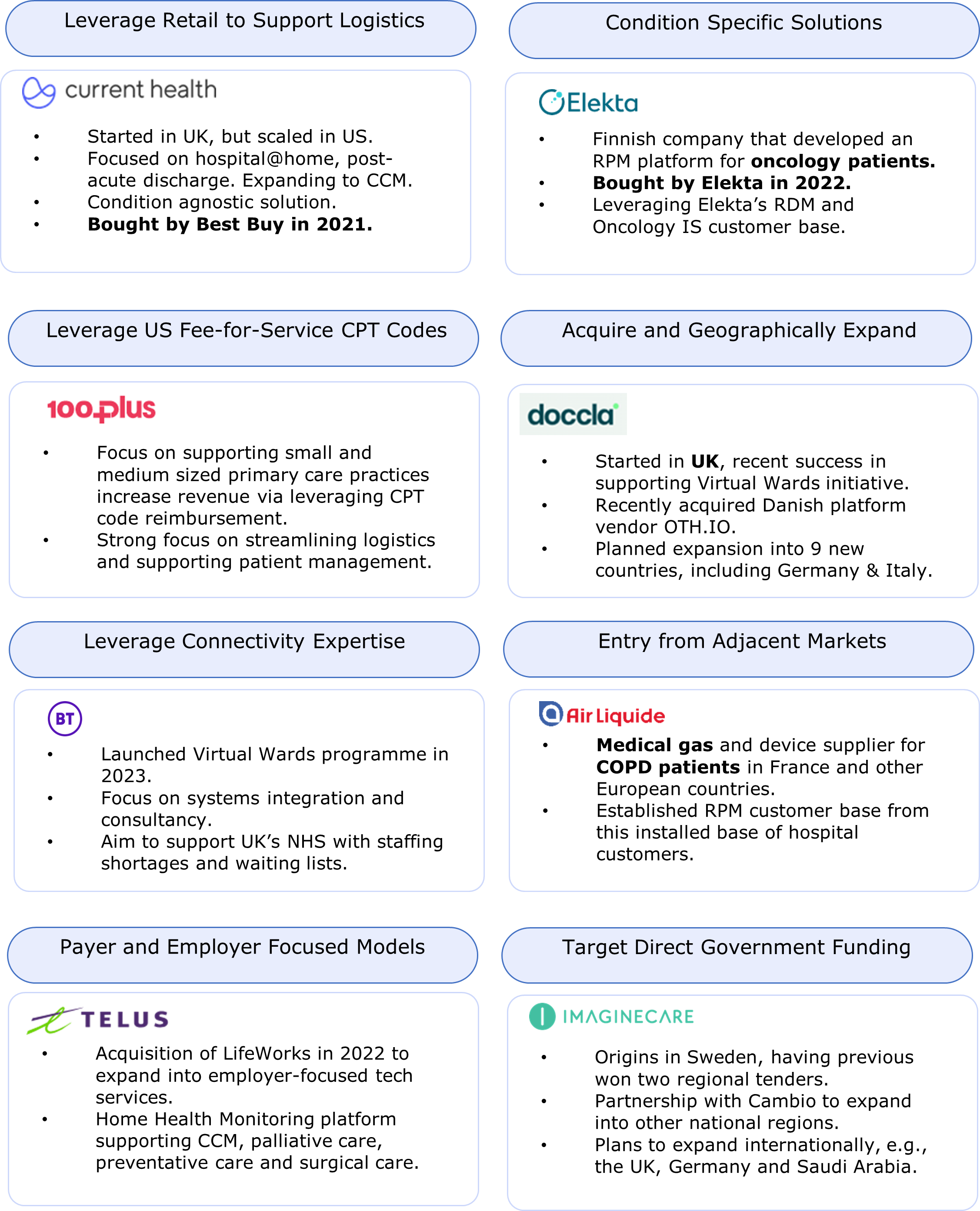

The global Remote Patient Monitoring (RPM) market is characterized by its fragmented nature, both in international and regional terms. Distinct characteristics emerging from various healthcare system structures have contributed to the development of an RPM ecosystem of platform vendors comprising broad variations in origin and strategy. This has impacted both how vendors commercialise their products and scale their business. The diagram below highlights some of the approaches adopted by platform vendors:

1. Leverage Retail to Support Logistics

2023 has seen RPM vendor Validic acquire Trapollo, a subsidiary of the telecoms and automotive retail conglomerate Cox Enterprises, with the deal enabling Validic to benefit from Trapollo’s Internet of Things (IoT) and logistics positioning to ‚Äòround out’ its core capabilities. Having initially been successful with its ‚Äòbring your own device (BYOD)’ programmes aimed at large-scale RPM programmes for chronic condition patients with low-moderate risk of hospital admission, Validic experienced less success with selling higher-acuity solutions, with the Trapollo acquisition aimed towards delving into the area. Best Buy’s acquisition of UK hospital-at-home vendor Current Health is a key example of leveraging retail to support logistics, with Current Health supported by the former’s substantial distribution footprint, along with its inhouse installation and technical support teams. This infrastructure can be used to both scale up activities and also support its hospital-at-home services.

2. Condition Specific Solutions

Traditionally, many vendors in the RPM space have been focused on disease-specific solutions, often with their own proprietary platforms. These solutions have often been targeted towards higher-acuity conditions, which have a smaller total addressable market. An example of this is Elekta Kaiku’s specialist oncology RPM solution, primarily used in radiotherapy.

Trends in the wider RPM market have meant that demand for solutions has typically shifted towards multiple-disease, or disease-agnostic platforms, in which healthcare providers can address patients across suffering from different diseases or comorbidities, particularly as chronic care management has become prevalent within RPM technology. This currently makes up the majority of the active RPM vendors, and as a result, has a higher level of competition.

Glooko’s initially diabetes-focused platform exemplifies this trend as it has expanded its scope towards monitoring diabetes-related comorbidities. Huma’s MDR Class IIb and FDA 510(k) approved platform is an example of a disease-agnostic platform which has had success.

3. Leverage US Fee-for-Service CPT Codes

Many vendors in the US are supported by, and have aligned business strategies to, the RPM CPT reimbursement codes introduced by the CMS in 2019. This has been compounded by the additional expectation of reimbursement programs stemming from COVID-19 being made permanent, such as the Acute Hospital at Home Waiver which is currently extended to the end of 2024. Whilst this is aimed at the hospital-at-home segment, many US based RPM vendors, such as 100.Plus (subsidiary of Connect America) have used the CPT code reimbursement to increase revenue streams, with a particular focus on small-to-medium sized primary care practices in an ambulatory setting.

Expansion into larger health systems has been a successful recent route to market for RPM vendors. Logistics and solution implementation challenges meant that smaller independent practices had initially been able to adopt and implement RPM programmes more rapidly than larger health systems. Some companies such as Glooko and Optimize.Health have seen a shift in focus towards these larger health systems and Accountable Care Organisations (ACOs) as the RPM market continues to mature. Traditionally, it has been the continuous monitoring nature of RPM which has posed challenges for ACOs when setting up programmes, particularly in terms of onboarding and training staff to manage the new workflows associated with RPM solutions. Successful expansion into this target market would enable vendors to partner and win contracts with healthcare providers with budgets for larger scale implementations.

Optimize.Health has prioritised the managed services component of its business in order to access this market, in which it claims to have quadrupled in size over the past year, evidenced by its inclusion on the Inc. 5000 list of the fastest growing private companies in the US. It utilizes its own clinical workforce operating remotely or from its clinical operation centre in Dallas, for staff augmentation and supporting patient management, alleviating some of the challenges a practice may face, such as developing expertise and a scalable RPM programme. Ultimately, the move towards remote monitoring and clinical surveillance services may prove to be a successful strategy for growth as nursing and clinical staffing shortages remains an increasing difficulty faced by providers globally.

4. Acquire and Geographically Expand

The ‚Äòland and expand’ strategy is one which has been relatively prominent in the RPM market over the last couple of years, most recently seen by UK hospital-at-home provider Doccla, with its recent acquisition of Danish RPM platform vendor OTH.IO, with a subsequent expansion into nine additional countries. The aim for Doccla is to replicate its UK model in European markets. Signify Research has discussed this acquisition in detail in this recent SPI: As Doccla Goes Global, OTH Deal is a Marriage of Convenience. Huma is another example of a UK based RPM vendor which has had success in expansion to Germany, the Middle East and the USA.

The acquisition and expansion strategy has seen a range of avenues of approach from RPM vendors. Philips acquired BioTelemetry (BioTel) in 2021 for $2.8B with the aim to expand its own RPM capabilities, by introducing BioTel’s chronic disease management capabilities of BioTel Care to its comprehensive Virtual Care Management Platform. The platform has enabled Philip’s to align itself with the goal of reducing costs and burden on staff, a factor with ever-growing importance of Value-Based Care (VBC) models, and opportunities with hospital VBC contracts and other fee-for-service reimbursement codes.

5. Leverage Connectivity Expertise

Leveraging logistics and telecommunications expertise may prove to be a shrewd approach in scaling for RPM vendors, with this strategy being seen internationally, such as BT’s involvement in the UK through its virtual wards programme. Through this, it is supporting the NHS via partnerships with healthcare technology companies in providing devices to monitor chronic conditions and deliver AI-backed software to enable clinicians to perform digital rounds. Vodafone (UK) and KPN (Netherlands) are other examples of telecoms organisations looking to tackle the healthcare market.

6. Entry from Adjacent Markets

Industrial gases and services provider Air Liquide’s activity within RPM represents a unique approach in addressing the market, with solutions developed to address respiratory conditions such as COPD, whilst also supporting the management of diabetes, CHF and Parkinson’s disease. This approach has seen vendors predominantly operating in an adjacent market where they leverage their expertise in that market to then provide solutions for RPM. Air Liquide provides a clinical team alongside a digital platform, carries out patient triage and provides general assistance. Its large scale provides a significant opportunity to expand its RPM business, e.g., the approximate 1.4m home-based healthcare patients it supports which are not currently on its RPM platform. It has also expanded its focus towards more complex, acute and post-acute patients in Spain. However, it may need to seek M&A or partnerships to enter North American markets, such as its partnership with Cloud DX in Canada. A similar approach in seeking M&A or partnerships with another specialist RPM vendor may also support its expansion in managing other diseases to offer a more comprehensive solution.

7. Payer and Employer Focused Models

Payer-focused (insurance companies, government-funded, or self-funded/employer-sponsored) and employer-focused business models have also been used by vendors and services providers do drive RPM business. One such example is Canadian digital solution provider, Telus Health, which has had particular success since it acquired LifeWorks in 2022. LifeWorks is an employer-focused digital primary care and preventative health/wellness company. Prior to the acquisition, Telus was already providing RPM solutions to healthcare providers via its Home Health Monitoring business, which supports patients with chronic conditions such as CHF, COPD, diabetes and hypertension. However, the acquisition of LifeWorks with its strength in employer-focused health and well-being services has provided a new target customer base for Telus’ wider RPM portfolio.

8. Target Direct Government Funding

Single-payer systems dominated by government-owned providers such as the UK and the Nordics have faced a misalignment of incentives in relation to RPM deployment. The way that RPM is funded in these markets can result in the entity that benefits from the RPM solution being different to the entity paying for it. For example, a community provider may put in place and pay for an RPM program that results in fewer hospital admissions. However, it’s the local hospital that benefits in terms of reduced demand on its budgets.

In instances such as these, companies have seen success through national tenders supporting the implementation of RPM solutions with health systems. Through the NHS, a £150M framework was announced in March this year to develop RPM initiatives across England, with £36M of the funding allocated to remote clinical monitoring solutions to expand Virtual Wards across the country. Vendors such as Doccla, Docobo and Huma have seen success in this space. DACH is another market which is being driven by national-scale initiatives, such as the Digital Healthcare and Nursing Care Modernisation Act 2021 and the Hospital Futures Act (KHZG) in Germany assigning €4.3b for digital health innovation.

Closing Thoughts

There is no single best strategy in terms of route to market for RPM vendors. While shifting priorities towards larger-scale organizations and ACOs may be the best approach for RPM platform providers with large operations in the US, this may not be applicable in other markets where private spend makes up a much smaller proportion of overall healthcare spend, such as Germany. New innovative approaches may yet continue to alter market dynamics as gen-AI solutions (e.g., Huma’s recent partnership with Google Cloud) begin to be utilized to develop solutions for predictive analytics, clinical decision support, patient engagement, workflow efficiency and administrative tasks.

Related Research

Signify Research’s upcoming report “Remote Patient Monitoring – World – 2023” will build on their 2022-edition and will provide a data-centric and global outlook of the market. The report will blend primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Hamir Harbham

Hamir joined Signify Research in 2022 as a Market Analyst within the Digital Health team. He holds a BSc in Economics having graduated from Loughborough University in 2022.

About the Digital Health Team

Signify Research’s Digital Health team provides market intelligence and detailed insights on numerous digital health markets. Our areas of coverage include electronic medical records, telehealth & virtual care, remote patient monitoring, high-acuity clinical information systems, patient engagement IT, health information exchanges and integrated care & value-based care IT. Our reports provide a data-centric and global outlook of each market with granular country-level insights. Our research process blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.‚ÄØ‚ÄØ‚ÄØ‚ÄØ

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net