Written by

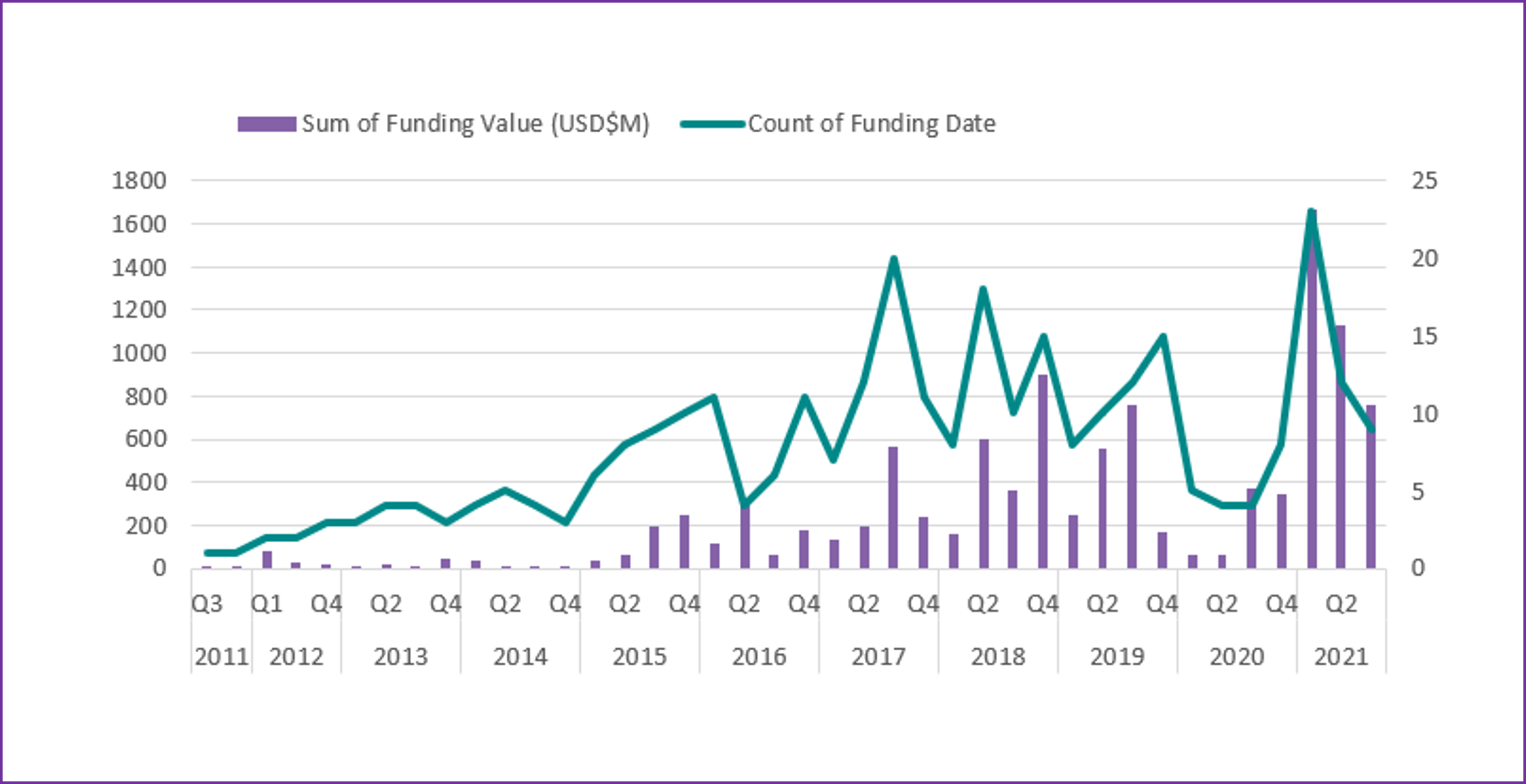

12th August 2021 – The market for AI in drug development and clinical trials has seen renewed interest in recent months, with total funding in the industry now reaching $10.7Bn.

Following a slower period in 2019 and 2020 on account of market uncertainty and the COVID-19 global pandemic, the industry has seen an uptick in interest and capital funding for both emerging and late-stage vendors, who often cite oversubscribed rounds; $3.6Bn of this sum was raised in the first few quarters of 2021 alone.

Table 1: Sum of funding vs the number of public rounds announced. Please note, data shown for Q32021 is shown to date.

This new funding wave is mostly concentrated around novel drug design companies who offer a high-risk high-reward potential, signalling a shift in the market as several announced partnerships between pharmaceutical giants begin to reach the five-year mark and see tangible results.

Whilst no novel AI-designed drugs have yet been FDA-cleared, the recent pandemic has highlighted the need for a more efficient and dynamic healthcare industry, with many start-ups benefiting from raising their profiles by participating in COVID-19 research projects. The culture of co-operation has certainly made strides in overcoming barriers that previously held the market back, including promoting and sharing an abundance of data that was previously sequestered by its owners.

Freshly launched start-ups who are emerging from stealth mode will now have to enter a market full of well-funded first-generation vendors. At Signify Research we expect to see an increasing number of acquisitions emerge as these well-funded start-ups look to diversify their portfolios and capitalise on the presence of existing solutions. This will enable acquiring companies to both create more beneficial partnerships with existing pharmaceutical companies, whilst improving the quality of internal development pipelines.

As these internal pipelines grow, an increasing portion of the market will also pivot towards becoming pharmaceutical “giants” in their own right. We expect an increasing number of IPOs to emerge as vendors look to raise the capital required to fund clinical trials.

As these AI companies begin their own clinical trials, several drug design companies will evolve into end-to-end companies also targeting the clinical trials market. By either acquiring or developing their own solutions aimed at shortening the clinical trial timeline, vendors will thus be able to maximise the efficiency involved in such as a lengthy process and hopefully shorten the route to market.

Signify Research has analysed the investment landscape and categorised the industry into Information Engines, Drug Design, Clinical Trials and End-to-End Solutions.

This work forms a part of the wider research conducted for our AI in Drug Development and Clinical Trials world market report. The report enables interested parties to answer key questions surrounding the market such as:

- Who is currently generating revenue using AI in Drug Development?

- How will adoption of AI solutions across the drug development lifecycle unfold?

- Which sales models have proven to be the most successful?

- How will ‘Big Pharma’ and ‘Big Tech’ corporations respond to and incorporate developments?

- Where is growth projected to be strongest in the next 5 years?

If you have any questions about the associated data or would like to know more about Signify Research’s services in this area, please email Imogen.Fitt@signifyresearch.net.