Written by

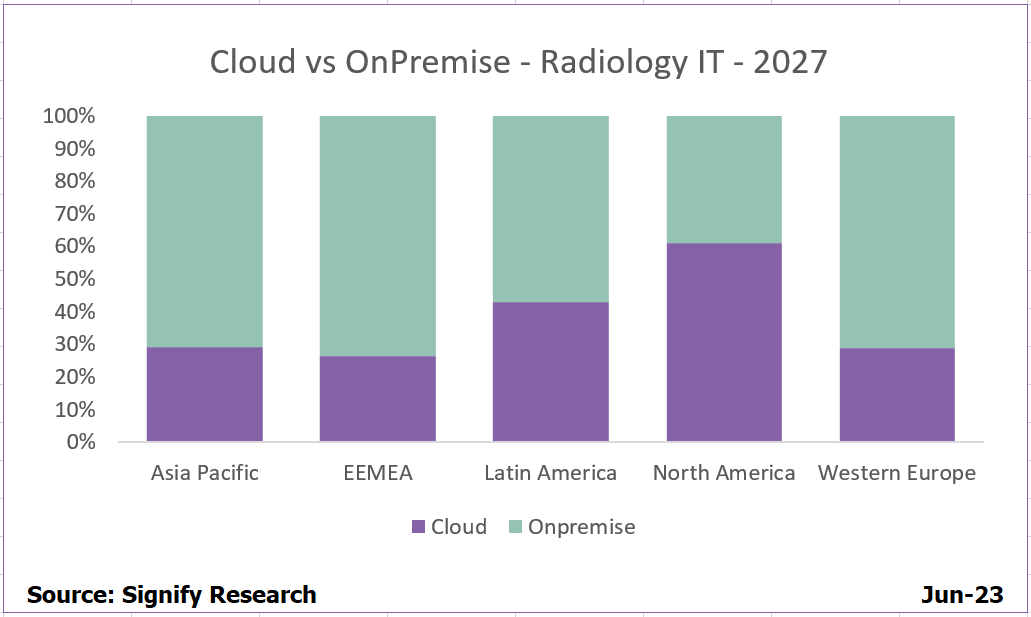

Cranfield, UK, 27th June 2023 – Cloud adoption remains inevitable, with Signify Research’s latest market data, published in May 2023, forecasting that cloud adoption (including hybrid and fully hosted) will represent 43% of the global radiology IT market revenue in 2027, compared to 25% in 2022.

*The graph demonstrates Signify Research’s forecast of the % of market revenue ($m) for radiology IT that will be hosted on-premise compared to cloud in 2027. In this instance, cloud includes hybrid and full-hosted solutions. Radiology IT includes standalone PACS, RIS, VNA, universal viewer and image exchange as well as enterprise radiology.

Deployment of radiology IT on public cloud today is predominantly confined to the academic and outpatient market; although deals are beginning to filter through into IDNs and the larger hospital market, these currently stand as the exception as opposed to the majority. The tipping point in the market is yet to occur for public cloud adoption, with several significant barriers still present.

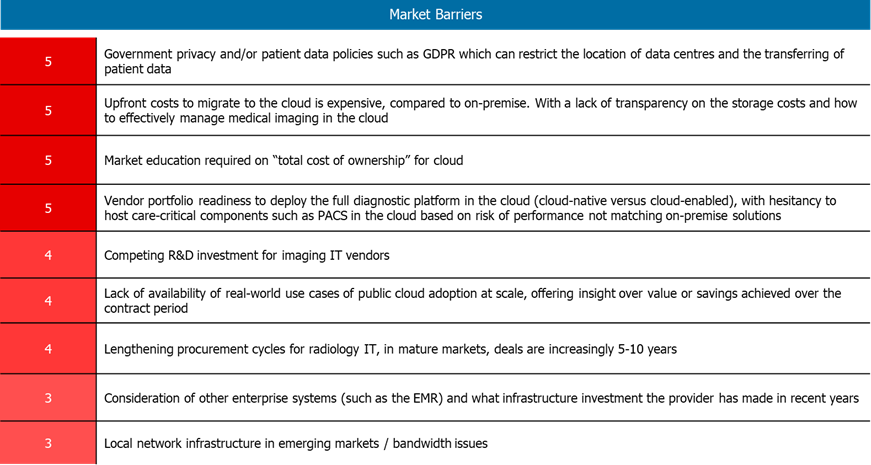

The table below highlights the main challenges facing the market and within this insight, we will delve into the role of technology vendors in overcoming these obstacles and how collaboration across the vendor ecosystem can help propel cloud adoption, not only in radiology, but across medical imaging.

Transparency Required for Cloud Costs

One of the fundamental challenges vendors are faced with when discussing the opportunity of public cloud is price, whether expensive up-front investment or the unknowns and limited transparency on data storage and associated egress and ingress charges.

With the reinvigoration of public cloud discussion post-pandemic, there has been increased effort to improve market understanding around terminology used, cost and overall benefits of cloud deployment. However, due to the complexity of medical imaging and the dynamic needs of a hospital, the answers surrounding cost aren’t straightforward. Unlike other sectors, there is unpredictability to patient care, and applying a universal rule for storage management and when images should transfer from hot to cold storage is ineffective and if incorrectly managed, a costly endeavour.

To minimise unnecessarily high costs, technology vendors have begun working closely with imaging IT vendors to delve into existing systems and practices, as well as often working with a prospective hospital to map image management processes to help select the optimum services to meet their needs. While this helps overcome concerns at an individual provider level, the impact needs to be scalable. Technology vendors need to establish intelligent storage services that can adapt based on the requirements of the radiologist without compromising performance or producing a high monthly bill. Not an easy undertaking, but one that once configured will not only support adoption in radiology but lays a solid foundation as providers explore enterprise imaging and seek to bring additional specialities onto the cloud such as surgical, point of care ultrasound and pathology.

Additionally, technology, service providers and software vendors have done a relatively poor job of supporting healthcare providers to understand the longer-term benefits and ROI of the transition to cloud deployment. While the more obvious (reduction of full-time administration staff resources for example, reduced investment in on-premise hardware etc.) are increasingly discussed, there are many more nuanced benefits to cloud deployment from an IT, operational and care perspective. Rarely are these factored into discussions or longer-term benefits explored in decision-making.

Collaboration with Imaging IT Vendors

The responsibility to create a cost-effective cloud solution for the medical imaging market is not for the technology vendors to bear alone, with imaging IT vendors applications also having an influence on the cost of cloud.

Although a like-for-like comparison for the price of a cloud deployment versus on-premise would lead to the impression that cloud is more expensive, the comparison isn’t straightforward. The encapsulation of infrastructure, energy and staffing costs, the cloud services available, alongside the outsourced risk for managing the platform and the cyber security are all typically included within the price of public cloud, many of which are excluded from the on-premise data centre cost. The challenge in recent years has been the deployment of imaging IT technology stacks that weren’t built for the public cloud, i.e. vendors “lift and shifting” legacy platforms into the cloud, thus making the utilisation of cloud more expensive than it had to be.

The last 12 months has witnessed a rapid growth in the number of partnerships announced between imaging IT vendors and hyperscalers, a necessary step to help drive innovation. Imaging IT vendors can thus leverage cloud services as well as hyperscalers expertise to support in the rearchitecting of platforms whilst managing additional R&D priorities such as enterprise imaging and AI orchestration.

Driving Organisational Change

Although imaging IT platforms require ongoing investment from vendors to continue rearchitecting, the current availability of the VNA and viewer is sufficient short-term, with the majority of the market having cloud-native solutions. The fundamental role for vendors to propel adoption short-term, aligns to driving organisational change. Adoption of cloud; transitioning to operational business models, the changing role of IT, the alternative value proposition, all turns traditional procurement and organisational processes on its head.

Shifting a paradigm that is deeply entrenched within the market is no easy undertaking and a responsibility all vendors within the ecosystem have to take on. Collaboration will be key. The growing number of partnerships between hyperscalers and cloud service vendors with imaging IT vendors, alongside the increased webinars, articles, and sessions at industry conferences to support market education is a welcomed first step. However, market education must go further. Each customers exploration into cloud is different, with significant support required from both the imaging IT and technology vendors to understand internal processes, strategies and budgets, to then start the providers journey to the cloud. Thus, adaptive and context-specific support for providers is essential, as opposed to broad marketing and limited detail.

The next few years will be crucial, as first adopters come to renew cloud deployments and vendors have the opportunity to present the real-world use case of adopting cloud solutions for medical imaging. Once providers have evidence of the value and benefits achieved from their peers, and the fear of not wanting to be the guineapig for public cloud passes, the dominos for cloud adoption will begin to fall.

Technology Vendors Next Steps

Short-term, to help drive market adoption, technology vendors are anticipated to continue developing partnerships with imaging IT vendors, not only within the North American radiology IT market, but European and Asia Pacific markets.

Although the adoption of cloud has started with radiology, having partners and a strategy to overcome storage, security and cost concerns across the broader enterprise will be the true differentiator for technology vendors. With many technology vendors evaluating partners outside of radiology, whether that’s other enterprise specialisms such as cardiology or pathology, as well as AI and advanced visualisation IT, laying a foundational deployment framework and supporting the drive towards multi-ology enterprise imaging will be a critical factor for success.

The question is, which technology vendors can innovate and overcome the existing barriers in the market, to capitalise on the future momentum of cloud adoption.

Related Research

Imaging IT Market Intelligence Service – 2023

The Imaging IT Market Intelligence Service – 2023 is an annual subscription inclusive of five deliverables. The reports provides full coverage of the global informatics ecosystem and is comprised of detailed global market data and forecasts, alongside qualitative analysis to evaluate key strategic questions.

The five deliverables included in the 2023/2024 subscription are:

- Imaging IT – Core Data Update and Full Report – May 2023

- Imaging IT – Market Opportunities for Enterprise Imaging – September 2023

- Imaging IT – Core Data Update and 2H Refresh – October 2023

- Imaging IT – RSNA Show Report – December 2023

- Imaging IT – HIMSS/ECR Show Report – March/April 2024

About Amy Thompson

Amy joined Signify Research in 2020 as part of the Healthcare IT team, focusing on Imaging and Clinical IT. Prior to that, she brings four years’ experience as a Research Analyst; supporting business strategy and market sizing.

About the Medical Imaging / Imaging IT Team

Signify Research’s imaging IT service provides expert market intelligence and detailed insights across radiology IT, cardiology IT, and advanced visualisation IT, alongside operational workflow & business intelligence tools. Combining primary data collection and in-depth discussions with industry stakeholders, our thorough research approach yields credible quantitative and qualitative analysis, helping our customers make critical business decisions with confidence. Throughout the course of 2023/24, the imaging IT team will be further assessing developments in the market through its’ Imaging IT Market Intelligence Service.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net