Written by

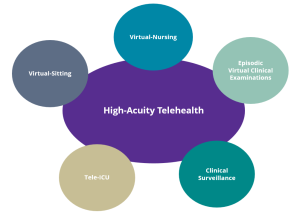

Cranfield, UK, 6th March 2024 – The digital health market was inundated with several announcements off the back of the ViVE 2024 conference last month. As it pertains to high-acuity telehealth, many announcements over the last year have related to the growing uptake of virtual nursing and virtual sitting technologies, along with the introduction of Gen-AI capabilities within telehealth applications. Whilst one of the leading vendors in these segments, AvaSure’s recent product launch had a focus on more traditional inpatient telehealth applications.

AvaSure unveiled the launch of its Episodic Virtual Care Solution at ViVE 2024, with the latest addition to the vendor’s Intelligent Virtual Care Platform including two-way video capabilities with group calling to include multiple parties, polite entry and web-based access. The company claims the solutions allow caregivers to seamlessly launch virtual patient visits from an Epic EHR, without disrupting existing workflows.

The Signify View

Recent trends within the market amidst health system and provider requirements have seen vendors opting to expand solution bases towards an enterprise-scale telehealth approach, stemming from the need to mitigate staffing capacity constraints. The general direction of movement has been from vendors operating within the tele-ICU or episodic virtual clinical examination segments towards the provision of virtual nursing and virtual sitting platforms, which typically require similar audio-visual monitoring platforms and hardware (portable wireless carts, wall-mounted units etc.). AvaSure’s solution expansion, however, has moved in the opposite direction and highlights the flexibility of transitioning familiar solutions for new application settings.

Historically, endpoint solutions have been departmental, siloed point-focused products (hardware-centric). However, enterprise-scale solutions with a focus on platform-centric, software-based and configurable workflows have become increasingly prominent as solution requirements mean vendors must cater to individual health system needs.

Oracle Partnership

Also announced during the conference was the decision to partner with Oracle Cloud Infrastructure (OCI) to power AvaSure’s AI-enabled virtual care platform, as the company aims to scale the use of AI for its flagship TeleSitter solution. The platform allows virtual safety attendants to monitor up to 16 patients at a single time, a stark contrast to traditional in-person, one-to-one models of sitters to monitor at-risk patients. AI deployment is being scaled to utilize algorithms to detect adverse patient behaviour and provide staff monitoring, with notifications to augment patient care processes and enable earlier interventions. The use of OCI is stated to layer several AI algorithms on top of falls and elopement prevention, and as new models are developed for self-harm, rounding, and workplace violence, virtual care teams can be trained on the addition of new alerts and notifications.

The potential of false positives or false negatives have remained a risk with continuous monitoring solutions, however AvaSure’s AI solutions are marketed as augmenting care processes for essential in-person staff to ensure any alerts to staff are validated. Long-term technological developments may ultimately resolve issues of this nature, but for the time being, its focus is to ensure the delivery of reliable AI models to prevent any additional burdens for care providers.

Recent Success

AvaSure’s announcements at ViVE 2024 highlights the large levels of success it has experienced in recent years and is likely to further consolidate its position within the high-acuity telehealth space. Its customer base had surpassed the 1,000 mark by the end of 2022, and is now currently greater than 1,100. These are predominantly health systems within the US and Canada, many of which will now be able to plan their deployment of the new AvaSure Episodic solution.

The launch of the new system is a clear example of the ‘land and expand’ strategy, whereby vendors have an opportunity to cross-sell and upsell with an expansion in not only the number of facilities within a particular health system, but also the number of applications. Historically, other vendors such as Access Telecare have also benefitted from similar strategies, having grown from 1.38 services per facility in 2015 to 1.90 in 2020. This, combined with the increasing requirement of enterprise-scale solutions, has been a significant driver of growth for vendors such as AvaSure, particularly amidst an evolving healthcare system, which has seen individual hospitals, or hospital chains acquired by IDNs and ACOs looking to homogenize care delivery platforms.

HIMSS Anticipation

With the annual HIMSS Global Health Conference and Exhibition commencing next week, it will be interesting to see whether there will be similar announcements as that of AvaSure and Caregility’s recent launch of its new AI-Enhanced Telehealth Systems. Since last year’s HIMSS gathering in Chicago, the intensity of macro-economic challenges such as high levels of inflation have somewhat eased, however issues such as chronic staff shortages remain ever present. Signify Research discusses some of its top predictions for the conference in this recent SPI. AvaSure’s launch of its episodic virtual care solution is an example of how some of these predictions, such as the expansion of the Virtual Hospital movement, are already coming to fruition.

Related Research

Telehealth – High-Acuity – World – 2023

Signify Research’s report “Telehealth – High Acuity – World – 2023” builds on its 2022-edition and provides a data-centric and global outlook of the market. The report blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About The Author

Hamir joined Signify Research in 2022 as a Market Analyst within the Digital Health team. He holds a BSc in Economics having graduated from Loughborough University in 2022.

About the Digital Health Team

Signify Research’s Digital Health team provides market intelligence and detailed insights on numerous digital health markets. Our areas of coverage include electronic medical records, telehealth & virtual care, remote patient monitoring, high-acuity clinical information systems, patient engagement IT, health information exchanges and integrated care & value-based care IT. Our reports provide a data-centric and global outlook of each market with granular country-level insights. Our research process blends primary data collected from in-depth interviews with healthcare professionals and technology vendors, to provide a balanced and objective view of the market.

About Signify Research

Signify Research provides healthtech market intelligence powered by data that you can trust. We blend insights collected from in-depth interviews with technology vendors and healthcare professionals with sales data reported to us by leading vendors to provide a complete and balanced view of the market trends. Our coverage areas are Medical Imaging, Clinical Care, Digital Health, Diagnostic and Lifesciences and Healthcare IT.

Clients worldwide rely on direct access to our expert Analysts for their opinions on the latest market trends and developments. Our market analysis reports and subscriptions provide data-driven insights which business leaders use to guide strategic decisions. We also offer custom research services for clients who need information that can’t be obtained from our off-the-shelf research products or who require market intelligence tailored to their specific needs.

More Information

To find out more:

E: enquiries@signifyresearch.net

T: +44 (0) 1234 986111

www.signifyresearch.net