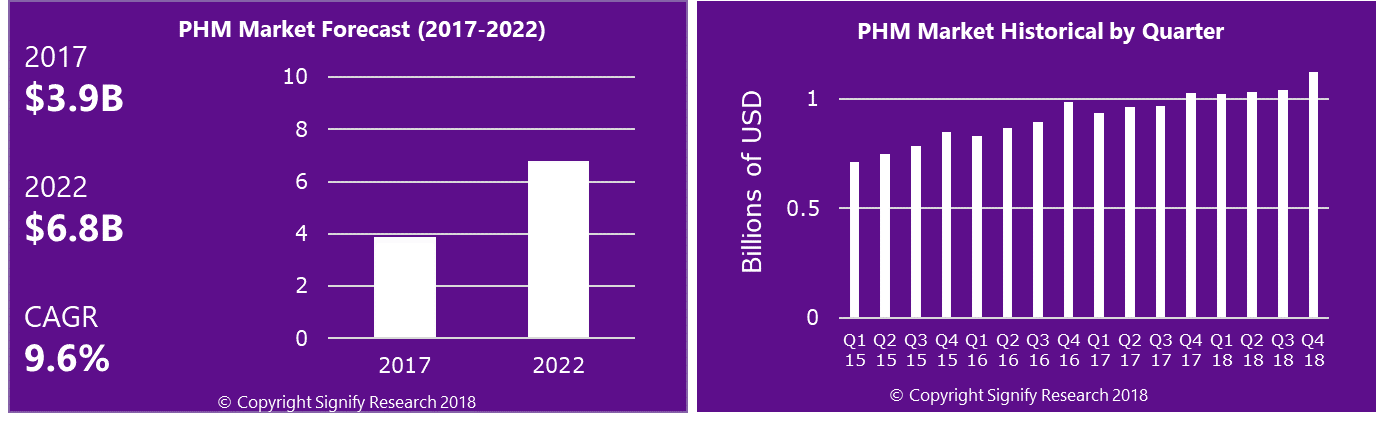

Data from Signify Research’s just-published interim report on the North American Population Health Management (PHM) market shows that growth in 2018 is forecast at 8%. This is down from 9% in 2017 and down significantly on historic double-digit growth rates seen prior to the Trump administration coming to power.

2018 has proved to be another challenging year for the North American PHM market, with growth limited to single digits for the second year running. There has been a growing sense of pessimism around PHM market development as a challenging 2017 market has continued into 2018. The market is now forecast to grow to $6.8B by 2022, at a CAGR of 9.6%.

Highlights

- North American Population Health Management (PHM) market estimated to reach $6.8B by 2022, growing at a CAGR of <10%.

- Q1 2018 saw the market grow by 8.9% YoY, in line with Signify Research forecasts.

Growth in Q2 2018 was limited to 7% YoY, lower than expected and in line with the Signify Research downside forecast, with early indications into Q3 2018 suggesting this will follow suit. - YoY growth for 2018 is now expected to fall short of 2016 and 2017 levels.

A market continuing to slow

The slowdown in growth can largely been attributed to two main factors:

- Concerns around CMS pushing ACOs to take on downside risk

- Falling revenue per life managemed as lower acuity populations are brought onto PHM platforms

The CMS Medicare Shared Savings Program (MSSP) is being reformed, reducing the time an ACO can spend on the first track (bearing only upside risk), from six years to two years. This has affected 82% of Medicare ACOs (~460), with the majority now having to decide whether to shift towards two-sided risk by mid-2019.

The ACOs that choose to move onto two-sided risk contracts are forecast to accelerate their procurement of PHM solutions. However, those who choose to leave the MSSP initiative all together, are forecast to be slower at adopting new systems and procuring mature digital health solutions. The uncertainty around this decision-making process has meant that some ACOs have delayed purchasing PHM solutions in 2018, leading to the slower than expected growth. For a deep-dive into this topic, including the impact for major vendors, please follow this link.

Average vendor revenue per life managed on PHM platforms has been falling in recent years as the market starts to scale and as providers look to manage lower acuity lives, where the short-term financial saving are somewhat less. This pressure has continued during 2018; however, there are signs that as providers take on an expanding range of PHM modules and services from vendors, an upturn in expected in the near future. These two factors, alongside the threats relating to ACA reform seen when the Trump administration came to power in 2017, have resulted in a certain level of market uncertainty which has had a tangible impact on vendor revenues.

Opportunities & Emerging Market Trends for 2019

The market is expected to see somewhat of a bounce-back in 2019, although still falling short of historical rates seen pre-2017. Several factors will help drive this including:

• Legislative uncertainty easing post-US mid-term elections as the Democrats take back control of the House of Representatives.

‚Ä¢ Wider healthcare IT spending trends driving a ‚Äòrip and replace’ market for EHR, RCM and ERP systems through the consolidation of smaller practices into larger hospital networks and IDNs.

‚Ä¢ The push from CMS to meet quality targets continues to drive growth in ‚ÄòReporting and Optimisation’ PHM functionality.

The right direction and market leaders

Several companies have continued to gain share and grow at a faster rate than the market average during H1 2018. Some have achieved this through organic growth (e.g. Evolent) and others through a combination of organic growth and acquisitions (e.g. Allscripts, Medecision).

Optum is estimated to have remained the clear market leader for H1 2018, but second position is particularly tight with Cerner, Allscripts, IBM and Evolent all managing similarly sized PHM businesses. IBM has historically been the second largest PHM vendor in North America since its acquisition of Truven Health. However, 2018 has seen this position challenged as it has struggled to grow its PHM business whilst competitors have chipped away at its market share.

Time for PHM to deliver on its long-term goals

After years of hype and long-term business strategies pegged on the ability to upsell innovative PHM solutions, a lacklustre performance in both 2017 and 2018 is increasingly putting pressure on vendors’ top-line revenues in their ‚Äòemerging’ segments.

One area we’ll be watching closely in 2019 is the success of the CVS-Aetna acquisition. Aetna has wound down its activity in the PHM market through its spin-off of Medicity to Health Catalyst. While there are numerous examples of payer/ PHM businesses looking to drive cost-savings to reduce insurance premiums, it will be worth watching whether a payer/ pharmacy tie up could drive savings beyond all the efforts from CMS and the VBC movement, and the potential ramifications of that.

Signify Research PHM Market Intelligence Service

Signify Research has launched its PHM Market Intelligence Service 2019 to meet the requirements of those working within the fast-moving global PHM market. This service provides a yearly stream of PHM intelligence to that provides meaningful insight for marketing and strategy teams that supports informed decisions. Click here for more details.

About Signify Research

Signify Research is an independent supplier of market intelligence and consultancy to the global healthcare technology industry. Our major coverage areas are Healthcare IT, Medical Imaging and Digital Health. Our clients include technology vendors, healthcare providers and payers, management consultants and investors. Signify Research is headquartered in Cranfield, UK. To find out more: enquiries@signifyresearch.net, T: +44 (0) 1234 436 150, www.signifyresearch.net

More Information

To find out more:

E: enquiries@signifyresearch.net,

T: +44 (0) 1234 436 150

www.signifyresearch.net